Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview please answer this question Determine whether the income described below is subject to final withholding tax on passive income, basic tax or

Old MathJax webview

please answer this question

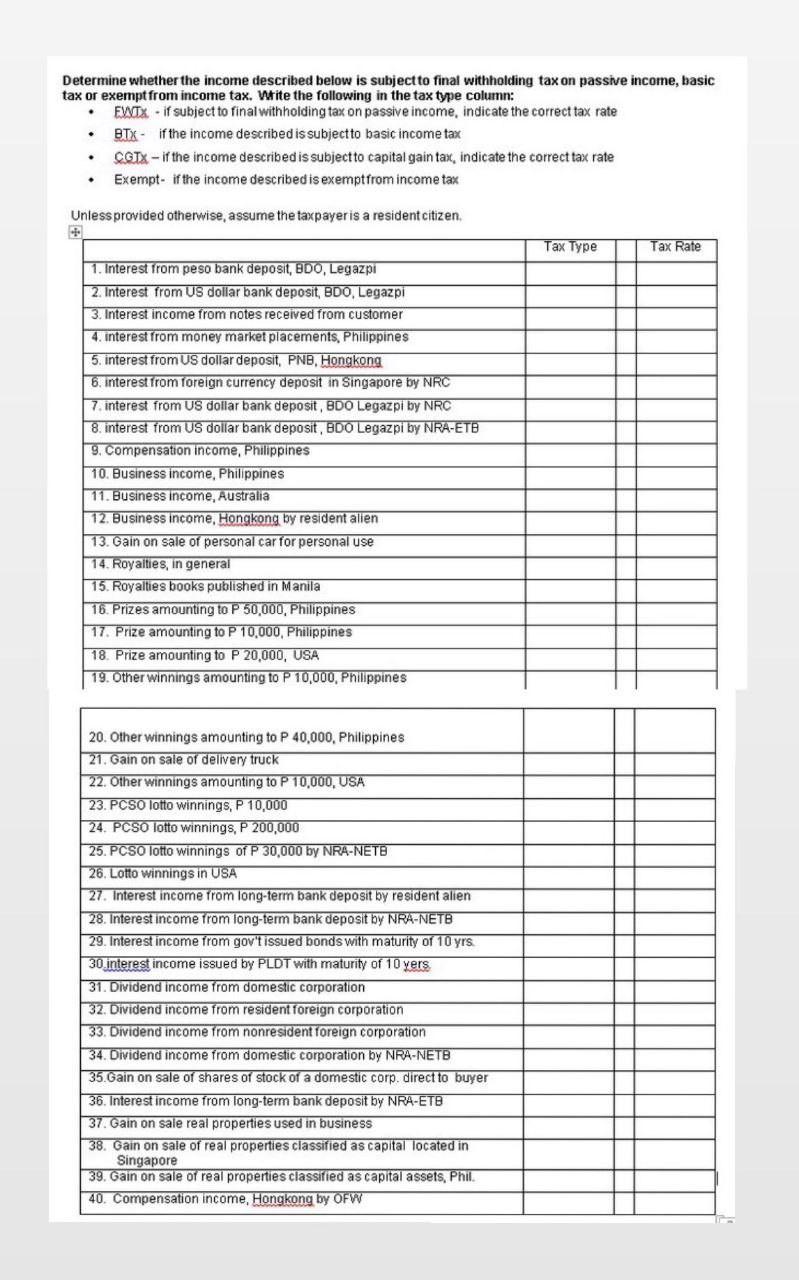

Determine whether the income described below is subject to final withholding tax on passive income, basic tax or exempt from income tax. Wite the following in the tax type column: EWTX - if subject to final withholding tax on passive income, indicate the correct tax rate BTX - if the income described is subject to basic income tax CGTX - if the income described is subject to capital gain tax, indicate the correct tax rate Exempt- if the income described is exemptfrom income tax . . Unless provided otherwise, assume the taxpayeris a resident citizen Tax Type Tax Rate 1. Interest from peso bank deposit, BDO, Legazpi 2. Interest from US dollar bank deposit, BDO, Legazpi 3. Interest income from notes received from customer 4. interest from money market placements, Philippines 5. interest from US dollar deposit, PNB, Hongkong 6. interest from foreign currency deposit in Singapore by NRC 7. interest from US dollar bank deposit, BDO Legazpi by NRC 8. interest from US dollar bank deposit, BDO Legazpi by NRA-ETB 9. Compensation income, Philippines 10. Business income, Philippines 11. Business income, Australia 12. Business income, Hongkong by resident alien 13. Gain on sale of personal car for personal use 14. Royalties, in general 15. Royalties books published in Manila 16. Prizes amounting to P50,000, Philippines 17. Prize amounting to P10,000, Philippines 18. Prize amounting to P 20,000, USA 19. Other winnings amounting to P10,000, Philippines 20. Other winnings amounting to P 40,000, Philippines 21. Gain on sale of delivery truck 22. Other winnings amounting to P 10.000, USA 23. PCSO lotto winnings, P 10,000 24. PCSO Lotto winnings, P 200.000 25. PCSO lotto winnings of P 30,000 by NRA-NETB 26. Lotto Winnings in USA 27. Interest income from long-term bank deposit by resident alien 28. Interest income from long-term bank deposit by NRA-NETB 29. Interest income from gov't issued bonds with maturity of 10 yr 30.interest income issued by PLDT with maturity of 10 yers 31. Dividend income from domestic corporation 32. Dividend income from resident foreign corporation 33. Dividend income from nonresident foreign corporation 34. Dividend income from domestic corporation by NRA-NETB 35. Gain on sale of shares of stock of a domestic corp. direct to buyer 36. Interest income from long-term bank deposit by NRA-ETB 37. Gain on sale real properties used in business 38. Gain on sale of real properties classified as capital located in Singapore 39. Gain on sale of real properties classified as capital assets, Phil 40. Compensation income, Hongkong by OFWStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started