Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview please Fast Work should be done in groups of two or three. Similar submissions will both get a mark of zero. The

Old MathJax webview

please Fast

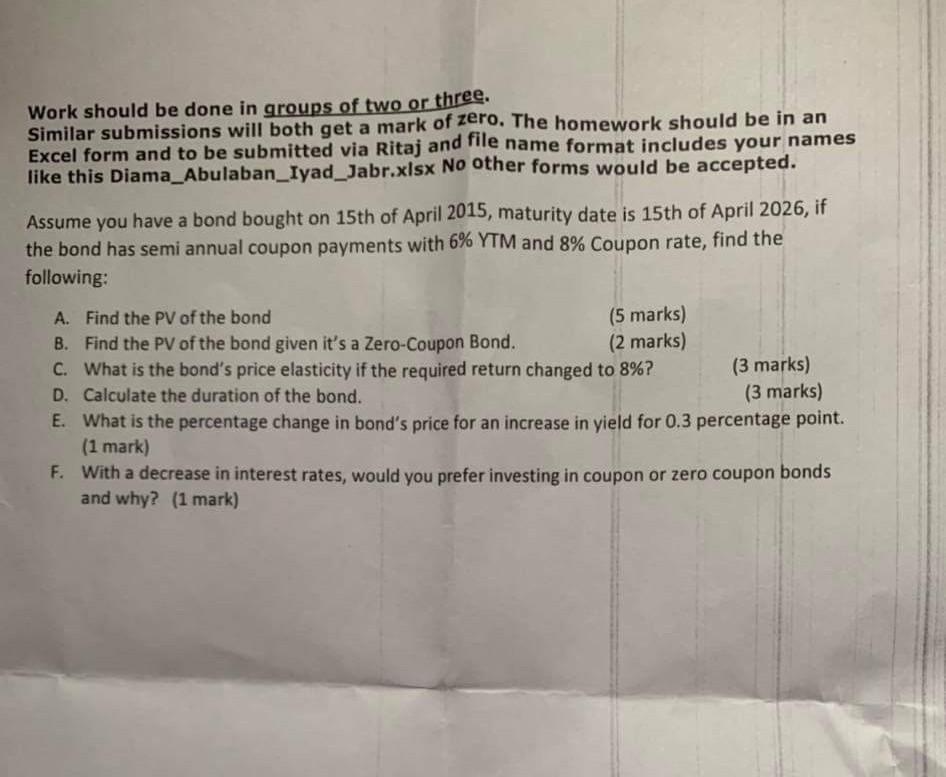

Work should be done in groups of two or three. Similar submissions will both get a mark of zero. The homework should be in an Excel form and to be submitted via Ritaj and file name format includes your names like this Diama_Abulaban_Iyad_Jabr.xlsx No other forms would be accepted. Assume you have a bond bought on 15th of April 2015, maturity date is 15th of April 2026, if the bond has semi annual coupon payments with 6% YTM and 8% Coupon rate, find the following: A. Find the PV of the bond (5 marks) B. Find the PV of the bond given it's a Zero-Coupon Bond. (2 marks) C. What is the bond's price elasticity if the required return changed to 8%? (3 marks) D. Calculate the duration of the bond. (3 marks) E. What is the percentage change in bond's price for an increase in yield for 0.3 percentage point. (1 mark) F. With a decrease in interest rates, would you prefer investing in coupon or zero coupon bonds and why? (1 mark)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started