Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview please help.me to solve thate I will sure put like Q2: Solar Designs has the following information regarding two of its assets

Old MathJax webview

please help.me to solve thate I will sure put like

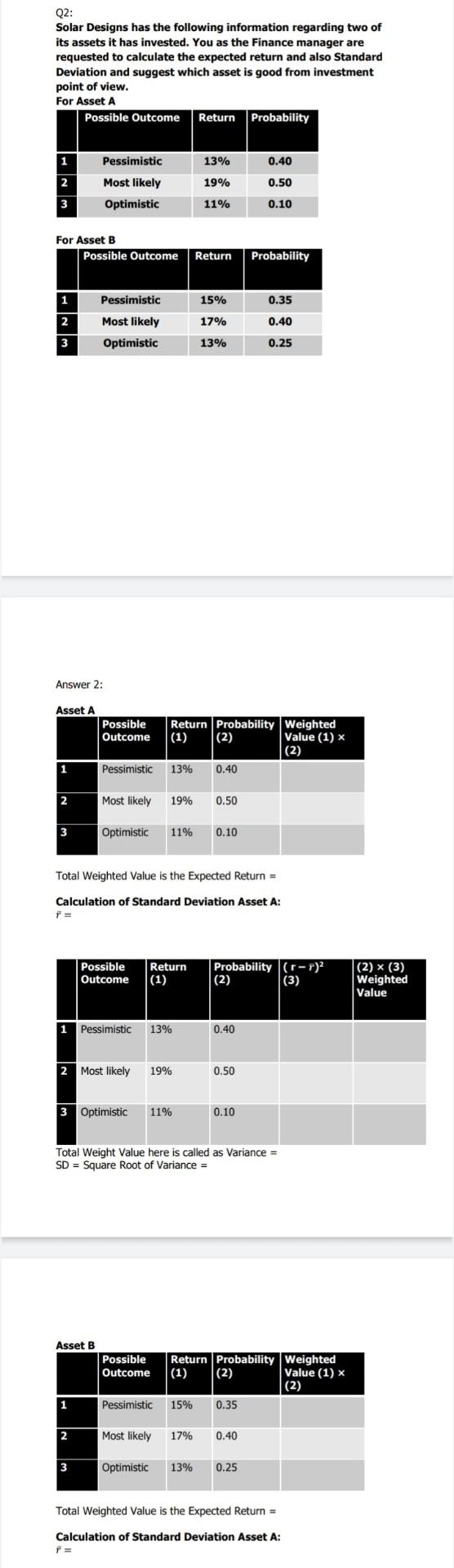

Q2: Solar Designs has the following information regarding two of its assets it has invested. You as the Finance manager are requested to calculate the expected return and also Standard Deviation and suggest which asset is good from investment point of view. For Asset A Possible Outcome Return Probability 1 13% 0.40 2 Pessimistic Most likely Optimistic 19% 0.50 3 11% 0.10 For Asset B Possible Outcome Return Probability 1 Pessimistic 15% 0.35 2 Most likely 17% 0.40 3 Optimistic 13% 0.25 Answer 2: Asset A Possible Outcome Return Probability Weighted (1) (2) Value (1) X (2) 13% 0.40 1 Pessimistic 2 Most likely 19% 0.50 3 Optimistic 11% 0.10 Total Weighted Value is the Expected Return = Calculation of Standard Deviation Asset A: Possible Outcome Return (1) Probability (r-r)2 (2) (3) (2) (3) Weighted Value 1 Pessimistic 13% 0.40 2 Most likely 19% 0.50 3 Optimistic 11% 0.10 Total Weight Value here is called as Variance = SD = Square Root of Variance = Asset B Possible Outcome Return Probability Weighted (1) (2) Value (1) X (2) 15% 0.35 1 Pessimistic 2 Most likely 17% 0.40 3 Optimistic 13% 0.25 Total Weighted Value is the Expected Return = Calculation of Standard Deviation Asset A: =Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started