Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview please solve 4,5,15 please it's a request please step by step please i will give you a thumbs up please do it

Old MathJax webview

please solve 4,5,15 please it's a request please step by step please i will give you a thumbs up please do it please...

pls solve 4,5 please it's a request please step by step please I will give you a thumbs up please do it please... it will really help me information is all ready here in questions

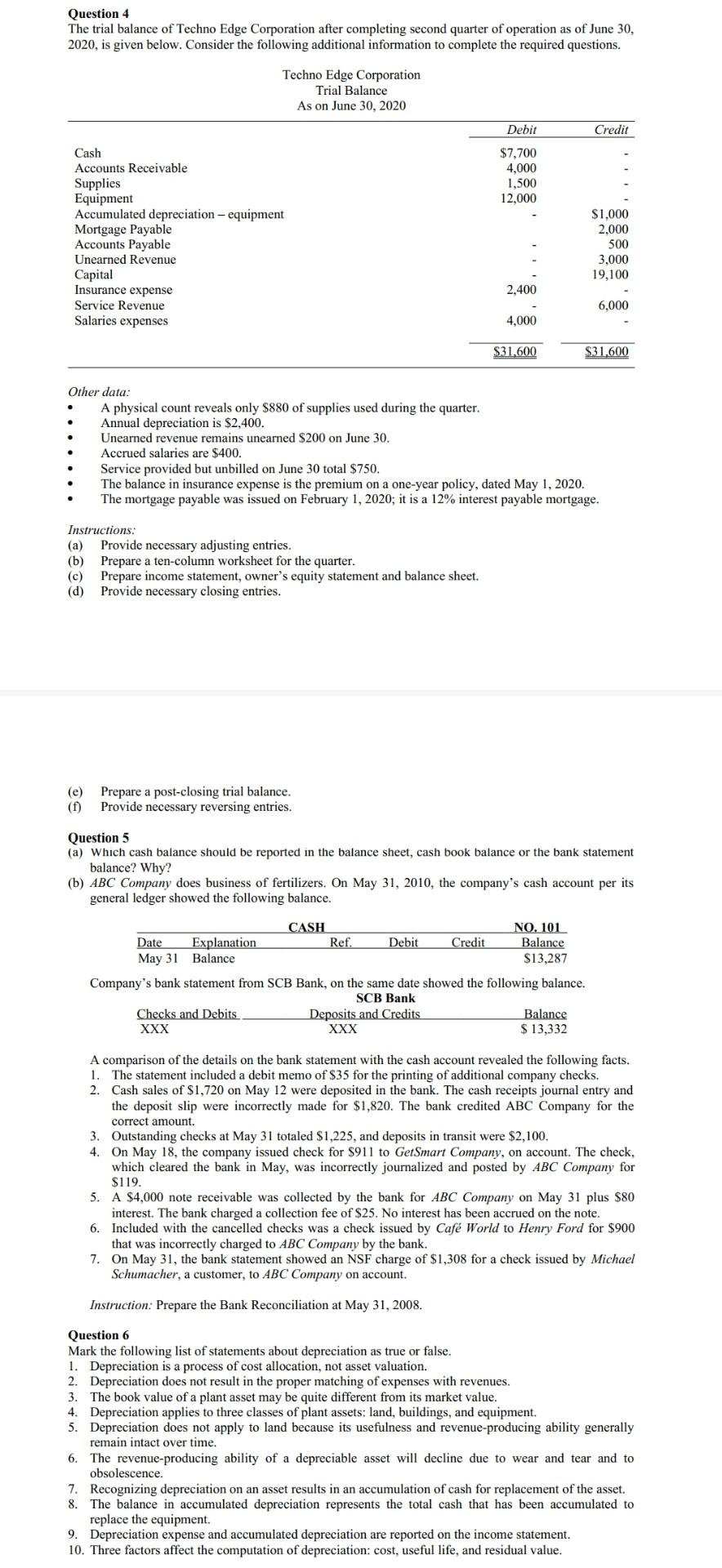

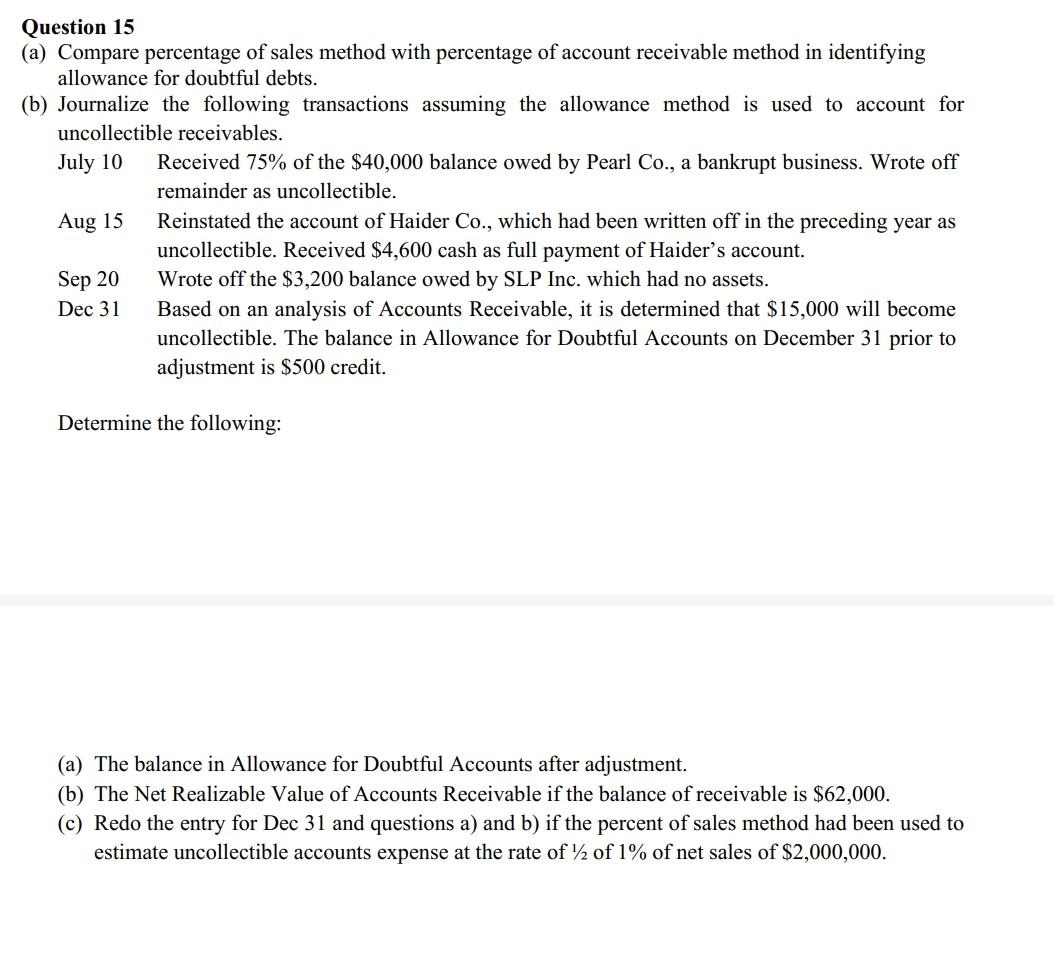

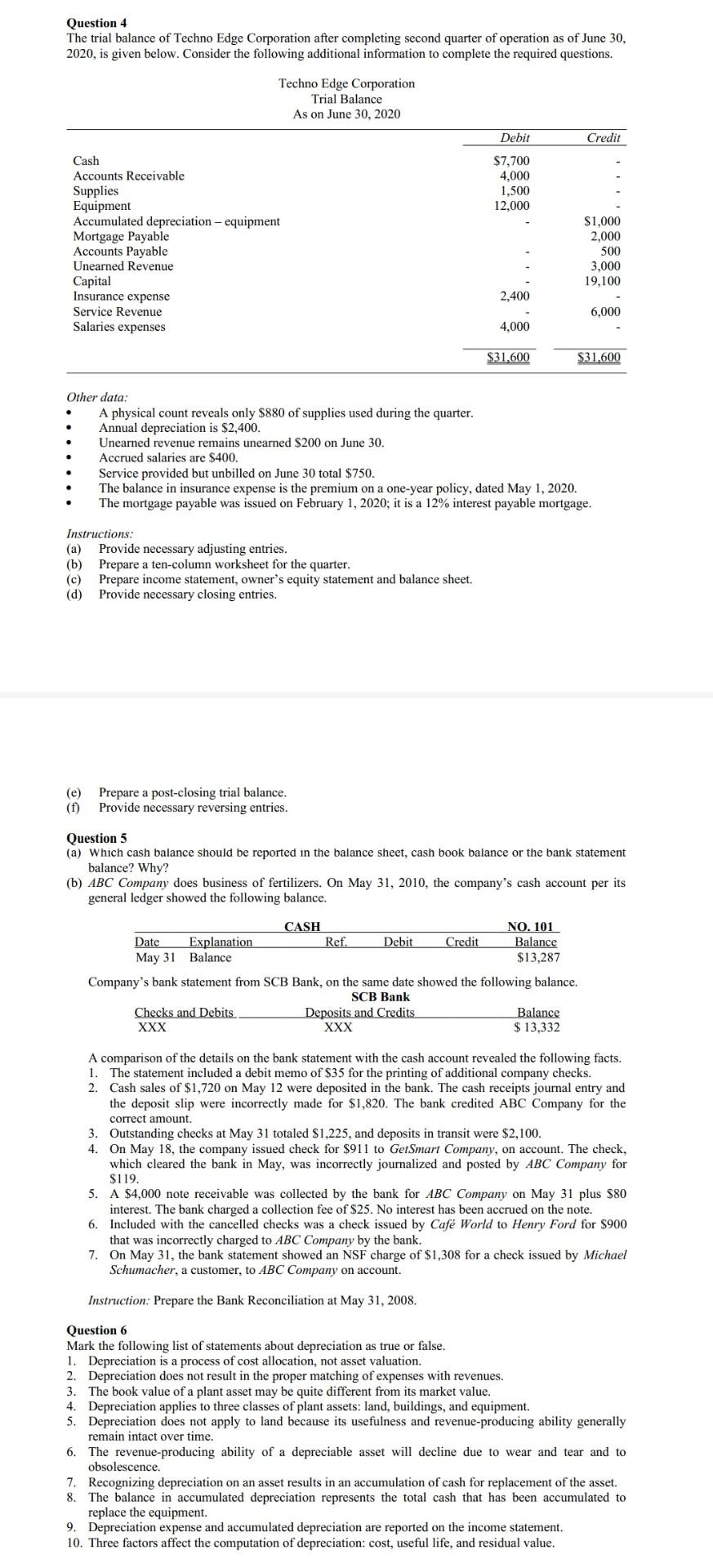

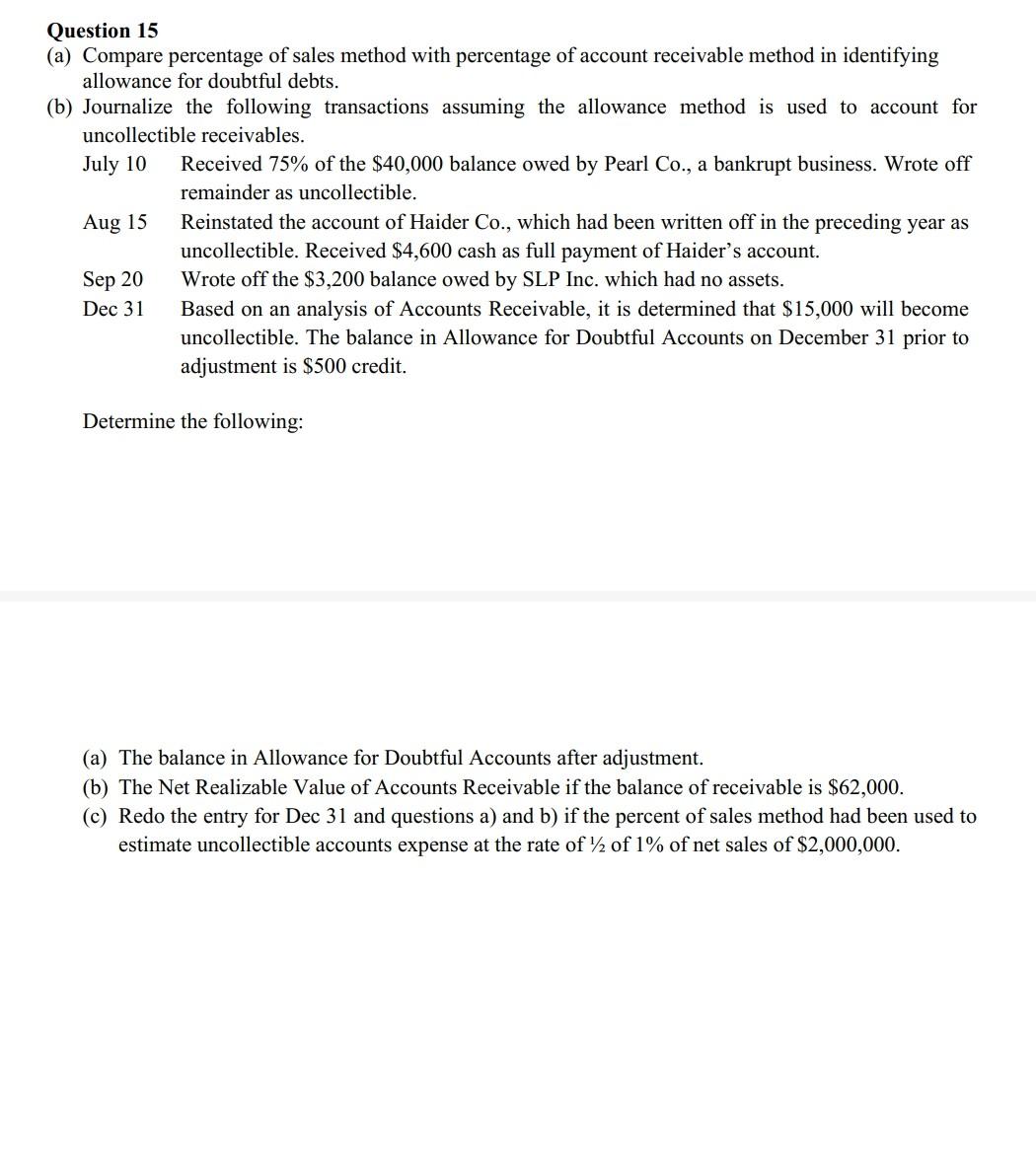

Question 4 The trial balance of Techno Edge Corporation after completing second quarter of operation as of June 30, 2020, is given below. Consider the following additional information to complete the required questions. Techno Edge Corporation Trial Balance As on June 30, 2020 Debit Credit $7,700 4,000 1,500 12,000 Cash Accounts Receivable Supplies Equipment Accumulated depreciation - equipment Mortgage Payable Accounts Payable Unearned Revenue Capital Insurance expense Service Revenue Salaries expenses $1,000 2,000 500 3.000 19,100 2,400 6,000 4,000 $31,600 $31.600 Other data: A physical count reveals only $880 of supplies used during the quarter. Annual depreciation is $2,400. Unearned revenue remains unearned $200 on June 30. Accrued salaries are $400. Service provided but unbilled on June 30 total $750. The balance in insurance expense is the premium on a one-year policy, dated May 1, 2020. The mortgage payable was issued on February 1, 2020; it is a 12% interest payable mortgage. Instructions: (a) Provide necessary adjusting entries. (b) Prepare a ten-column worksheet for the quarter. (c) Prepare income statement, owner's equity statement and balance sheet. (d) Provide necessary closing entries. (e) (f) Prepare a post-closing trial balance. Provide necessary reversing entries. Question 5 (a) Which cash balance should be reported in the balance sheet, cash book balance or the bank statement balance? Why? (b) ABC Company does business of fertilizers. On May 31, 2010, the company's cash account per its general ledger showed the following balance. CASH NO. 101 Date Explanation Ref. Debit Credit Balance May 31 Balance $13,287 Company's bank statement from SCB Bank, on the same date showed the following balance. SCB Bank Checks and Debits Deposits and Credits Balance XXX XXX $ 13,332 A comparison of the details on the bank statement with the cash account revealed the following facts. 1. The statement included a debit memo of $35 for the printing of additional company checks. 2. Cash sales of $1,720 on May 12 were deposited in the bank. The cash receipts journal entry and the deposit slip were incorrectly made for $1,820. The bank credited ABC Company for the correct amount. 3. Outstanding checks at May 31 totaled $1,225, and deposits in transit were $2,100. 4. On May 18, the company issued check for $911 to GetSmart Company, on account. The check, which cleared the bank in May, was incorrectly journalized and posted by ABC Company for $119. 5. A $4,000 note receivable was collected by the bank for ABC Company on May 31 plus $80 interest. The bank charged a collection fee of $25. No interest has been accrued on the note. 6. Included with the cancelled checks was a check issued by Caf World to Henry Ford for $900 that was incorrectly charged to ABC Company by the bank. 7. On May 31, the bank statement showed an NSF charge of $1,308 for a check issued by Michael Schumacher, a customer, to ABC Company on account. Instruction: Prepare the Bank Reconciliation at May 31, 2008. Question 6 Mark the following list of statements about depreciation as true or false. 1. Depreciation is a process of cost allocation, not asset valuation. 2. Depreciation does not result in the proper matching of expenses with revenues. 3. The book value of a plant asset may be quite different from its market value. 4. Depreciation applies to three classes of plant assets: land, buildings, and equipment. 5. Depreciation does not apply to land because its usefulness and revenue-producing ability generally remain intact over time. 6. The revenue-producing ability of a depreciable asset will decline due to wear and tear and to obsolescence. 7. Recognizing depreciation on an asset results in an accumulation of cash for replacement of the asset. 8. The balance in accumulated depreciation represents the total cash that has been accumulated to replace the equipment. 9. Depreciation expense and accumulated depreciation are reported on the income statement. 10. Three factors affect the computation of depreciation: cost, useful life, and residual value. Question 15 (a) Compare percentage of sales method with percentage of account receivable method in identifying allowance for doubtful debts. (b) Journalize the following transactions assuming the allowance method is used to account for uncollectible receivables. July 10 Received 75% of the $40,000 balance owed by Pearl Co., a bankrupt business. Wrote off remainder as uncollectible. Reinstated the account of Haider Co., which had been written off in the preceding year as uncollectible. Received $4,600 cash as full payment of Haider's account. Wrote off the $3,200 balance owed by SLP Inc. which had no assets. Dec 31 Based on an analysis of Accounts Receivable, it is determined that $15,000 will become uncollectible. The balance in Allowance for Doubtful Accounts on December 31 prior to adjustment is $500 credit. Aug 15 Sep 20 Determine the following: (a) The balance in Allowance for Doubtful Accounts after adjustment. (b) The Net Realizable Value of Accounts Receivable if the balance of receivable is $62,000. (c) Redo the entry for Dec 31 and questions a) and b) if the percent of sales method had been used to estimate uncollectible accounts expense at the rate of /2 of 1% of net sales of $2,000,000. Question 4 The trial balance of Techno Edge Corporation after completing second quarter of operation as of June 30, 2020, is given below. Consider the following additional information to complete the required questions. Techno Edge Corporation Trial Balance As on June 30, 2020 Debit Credit $7,700 4,000 1,500 12.000 Cash Accounts Receivable Supplies Equipment Accumulated depreciation - equipment Mortgage Payable Accounts Payable Unearned Revenue Capital Insurance expense Service Revenue Salaries expenses $1,000 2,000 500 3,000 19,100 2,400 6,000 4,000 $31,600 $31.600 Other data: A physical count reveals only $880 of supplies used during the quarter. Annual depreciation is $2,400. Unearned revenue remains unearned $200 on June 30. Accrued salaries are $400. Service provided but unbilled on June 30 total $750. The balance in insurance expense is the premium on a one-year policy, dated May 1, 2020. The mortgage payable was issued on February 1, 2020; it is a 12% interest payable mortgage. Instructions: (a) Provide necessary adjusting entries. (b) Prepare a ten-column worksheet for the quarter. (c) Prepare income statement, owner's equity statement and balance sheet. (d) Provide necessary closing entries. (e) Prepare a post-closing trial balance. Provide necessary reversing entries. Question 5 (a) Which cash balance should be reported in the balance sheet, cash book balance or the bank statement balance? Why? (b) ABC Company does business of fertilizers. On May 31, 2010, the company's cash account per its general ledger showed the following balance. Date CASH NO. 101 Explanation Ref. Debit Credit Balance May 31 Balance $13,287 Company's bank statement from SCB Bank, on the same date showed the following balance. SCB Bank Checks and Debits Deposits and Credits Balance XXX XXX $ 13,332 A comparison of the details on the bank statement with the cash account revealed the following facts. 1. The statement included a debit memo of $35 for the printing of additional company checks. 2. Cash sales of $1,720 on May 12 were deposited in the bank. The cash receipts journal entry and the deposit slip were incorrectly made for $1,820. The bank credited ABC Company for the correct amount. 3. Outstanding checks at May 31 totaled $1,225, and deposits in transit were $2,100. 4. On May 18, the company issued check for $911 to GetSmart Company, on account. The check, which cleared the bank in May, was incorrectly journalized and posted by ABC Company for $119. 5. A $4,000 note receivable was collected by the bank for ABC Company on May 31 plus $80 interest. The bank charged a collection fee of $25. No interest has been accrued on the note. 6. Included with the cancelled checks was a check issued by Caf World to Henry Ford for $900 that was incorrectly charged to ABC Company by the bank. 7. On May 31, the bank statement showed an NSF charge of $1,308 for a check issued by Michael Schumacher, a customer, to ABC Company on account. Instruction: Prepare the Bank Reconciliation at May 31, 2008. Question 6 Mark the following list of statements about depreciation as true or false. 1. Depreciation is a process of cost allocation, not asset valuation. 2. Depreciation does not result in the proper matching of expenses with revenues. 3. The book value of a plant asset may be quite different from its market value. 4. Depreciation applies to three classes of plant assets: land, buildings, and equipment. 5. Depreciation does not apply to land because its usefulness and revenue-producing ability generally remain intact over time. 6. The revenue-producing ability of a depreciable asset will decline due to wear and tear and to obsolescence. 7. Recognizing depreciation on an asset results in an accumulation of cash for replacement of the asset. 8. The balance in accumulated depreciation represents the total cash that has been accumulated to replace the equipment. 9. Depreciation expense and accumulated depreciation are reported on the income statement. 10. Three factors affect the computation of depreciation: cost, useful life, and residual value. July 10 Question 15 (a) Compare percentage of sales method with percentage of account receivable method in identifying allowance for doubtful debts. (b) Journalize the following transactions assuming the allowance method is used to account for uncollectible receivables. Received 75% of the $40,000 balance owed by Pearl Co., a bankrupt business. Wrote off remainder as uncollectible. Reinstated the account of Haider Co., which had been written off in the preceding year as uncollectible. Received $4,600 cash as full payment of Haider's account. Sep 20 Wrote off the $3,200 balance owed by SLP Inc. which had no assets. Dec 31 Based on an analysis of Accounts Receivable, it is determined that $15,000 will become uncollectible. The balance in Allowance for Doubtful Accounts on December 31 prior to adjustment is $500 credit. Aug 15 Determine the following: (a) The balance in Allowance for Doubtful Accounts after adjustment. (b) The Net Realizable Value of Accounts Receivable if the balance of receivable is $62,000. (c) Redo the entry for Dec 31 and questions a) and b) if the percent of sales method had been used to estimate uncollectible accounts expense at the rate of 2 of 1% of net sales of $2,000,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started