Answered step by step

Verified Expert Solution

Question

1 Approved Answer

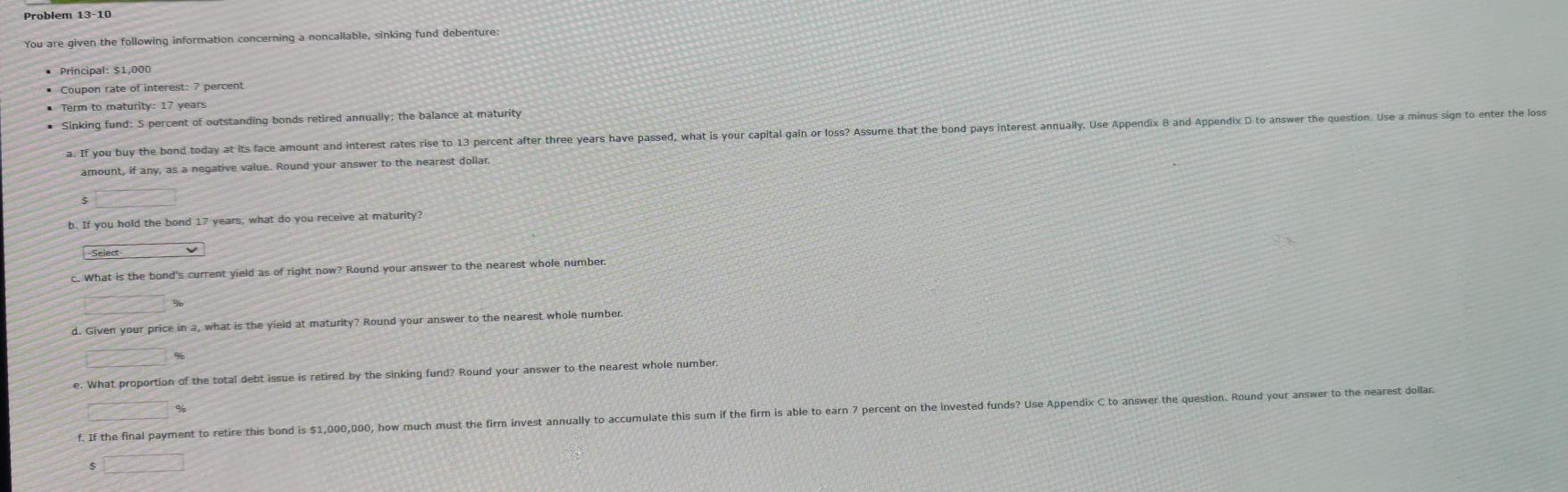

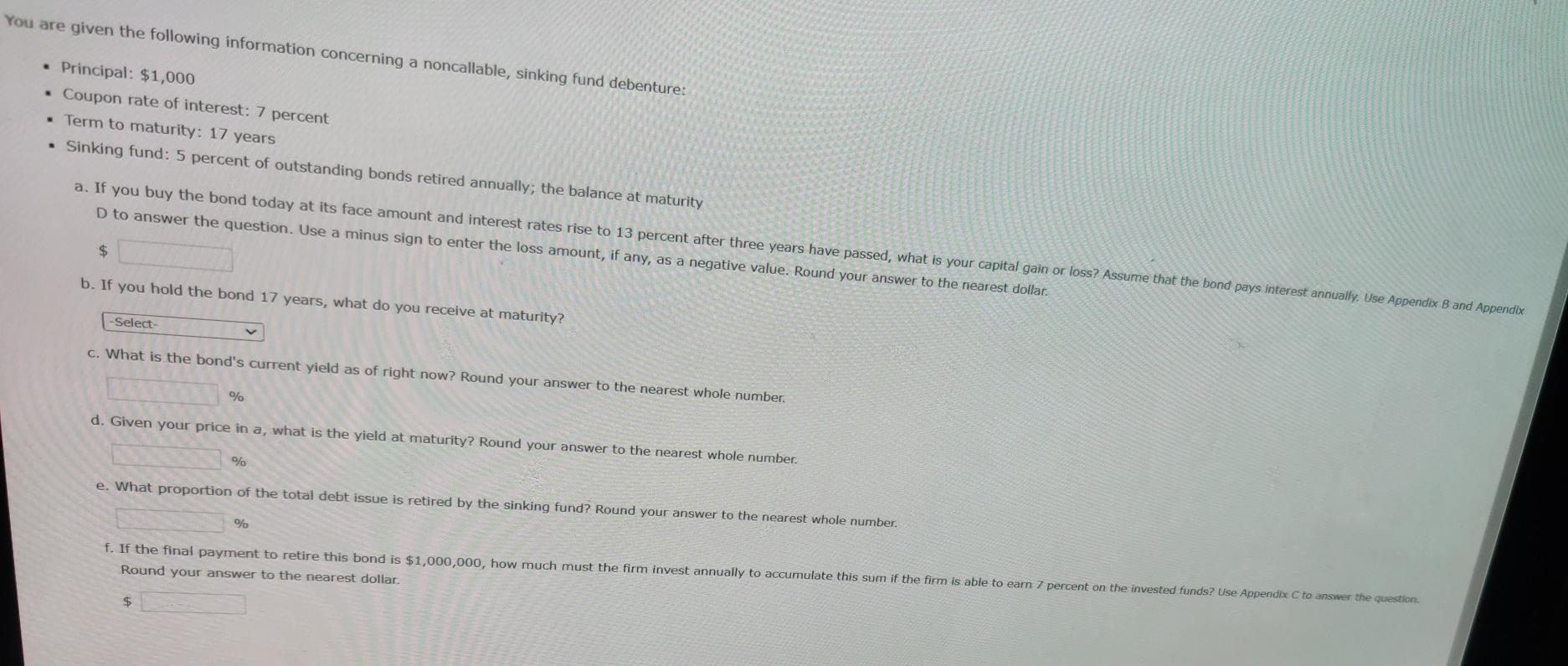

Old MathJax webview Problem 13-10 You are given the following information concerning a noncalable, sinking fund debenture: Principal: $1,000 Coupon rate of interest: 7 percent

Old MathJax webview

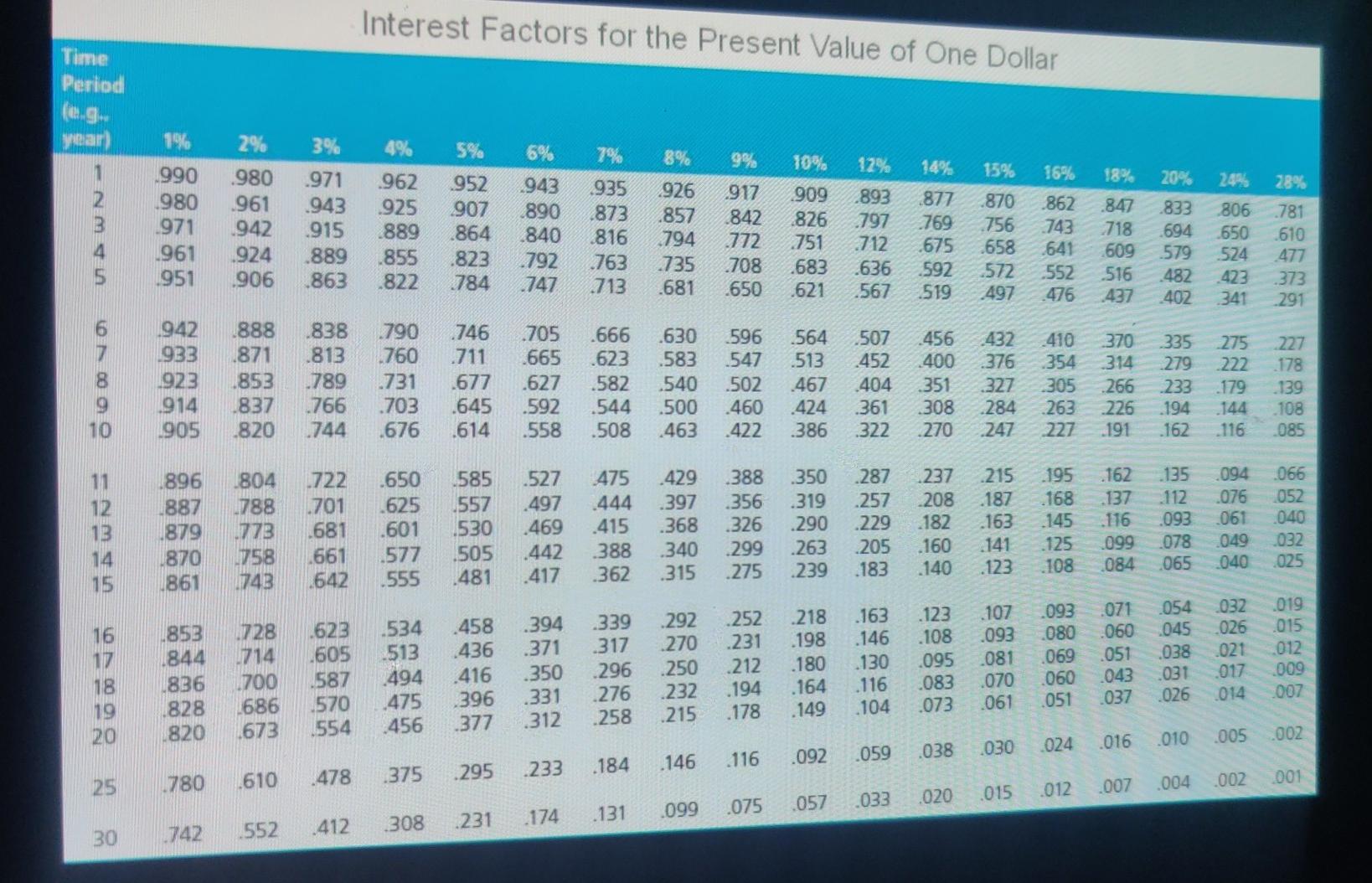

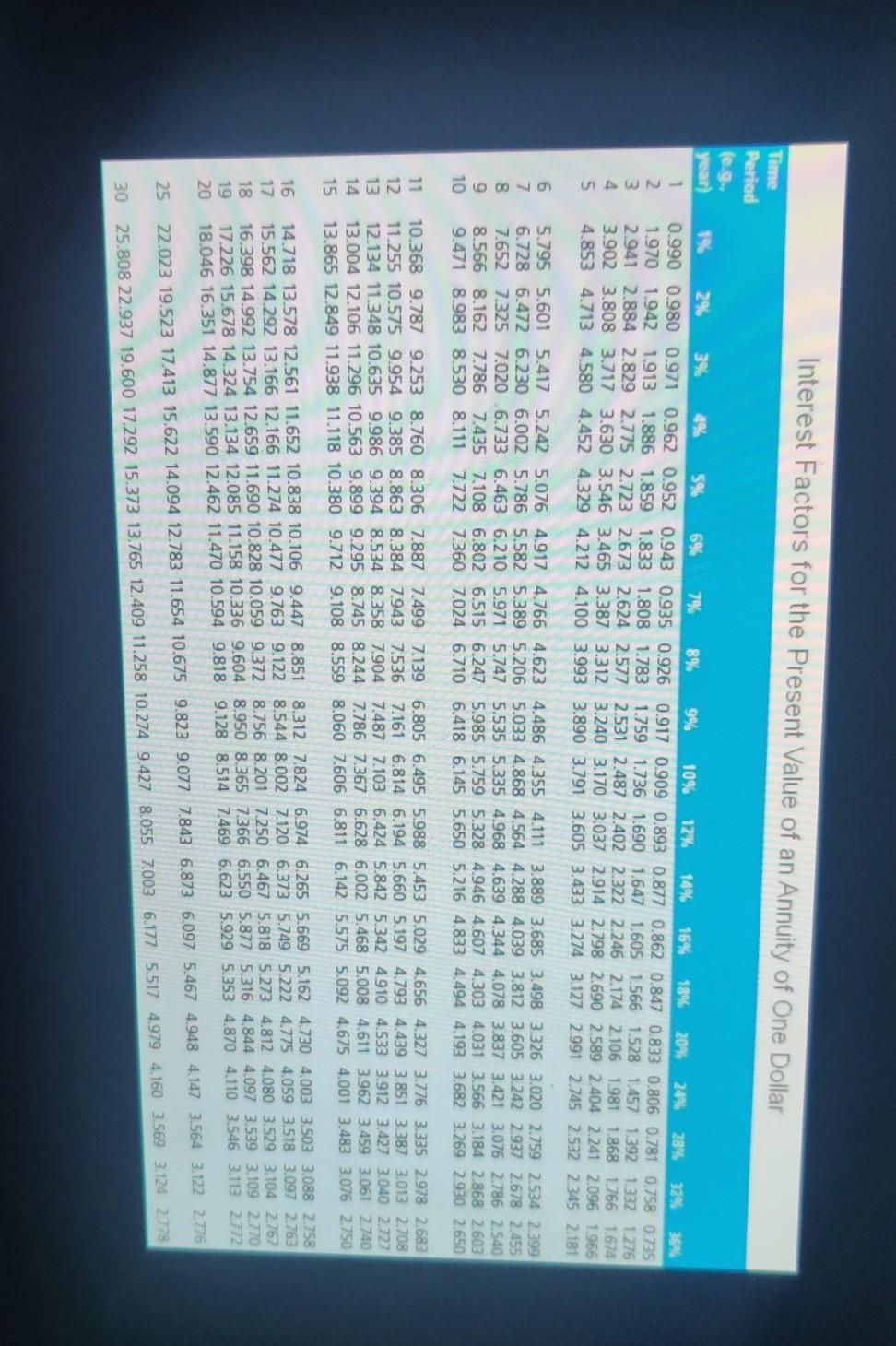

Problem 13-10 You are given the following information concerning a noncalable, sinking fund debenture: Principal: $1,000 Coupon rate of interest: 7 percent Term to maturity: 17 years Sinking fund: 5 percent of outstanding bonds retired annually; the balance at maturity a. If you buy the bond today at its face amount and interest rates rise to 13 percent after three years have passed, what is your capital gain or loss? Assume that the bond pays interest annually. Use Appendix B and Appendix D to answer the question. Use a minus sign to enter the loss amount, if any, as a negative value. Round your answer to the nearest dollar. b. If you hold the bond 17 years, what do you receive at maturity? Select c. What is the bond's current yield as of right now? Round your answer to the nearest whole number. d. Given your price in a. what is the yield at maturity? Round your answer to the nearest whole number. e. What proportion of the total debt issue is retired by the sinking fund? Round your answer to the nearest whole number. f. If the final payment to retire this bond is $1,000,000, how much must the firm invest annually to accumulate this sum if the firm is able to earn 7 percent on the invested funds? Use Appendix C to answer the question. Round your answer to the nearest dollar You are given the following information concerning a noncallable, sinking fund debenture: Principal: $1,000 Coupon rate of interest: 7 percent Term to maturity: 17 years Sinking fund: 5 percent of outstanding bonds retired annually, the balance at maturity a. If you buy the bond today at its face amount and interest rates rise to 13 percent after three years have passed, what is your capital gain or loss? Assume that the bond pays interest annually. Use Appendix B and Appendix D to answer the question. Use a minus sign to enter the loss amount, if any, as a negative value. Round your answer to the nearest dollar. $ b. If you hold the bond 17 years, what do you receive at maturity? -Select c. What is the bond's current yield as of right now? Round your answer to the nearest whole number. % d. Given your price in a, what is the yield at maturity? Round your answer to the nearest whole number. % e. What proportion of the total debt issue is retired by the sinking fund? Round your answer to the nearest whole number. % f. If the final payment to retire this bond is $1,000,000, how much must the firm invest annually to accumulate this sum if the firm is able to earn 7 percent on the invested funds? Use Appendix C to answer the question Round your answer to the nearest dollar. Interest Factors for the Present Value of One Dollar Time Period (e.g. year) 1 2 1% 6% 7% 8% 9% 10% 12% 15% 18% 28% WN 1990 1980 1971 1961 1951 2% .980 961 1942 924 1906 3% .971 .943 1915 .889 863 4% 962 925 889 .855 .822 5% 952 907 .864 .823 784 943 890 840 .792 747 935 873 816 .763 713 1926 857 794 735 .681 917 842 772 708 .650 909 826 751 .683 621 .893 .797 .712 .636 .567 14% 877 769 .675 592 519 .870 756 658 572 497 16% 862 743 641 552 476 .847 718 -609 516 437 20% .833 .694 579 482 402 24% 806 650 524 423 341 .781 .610 477 .373 .291 1746 1942 933 1923 1914 1905 888 .871 .853 .837 .820 .838 .813 -789 .766 1.744 1790 1760 .731 .703 .676 .711 .677 .645 .614 .705 665 .627 .592 .558 .666 .623 .582 .544 .508 .630 .583 .540 .500 463 596 1547 .502 .460 422 .564 .513 467 .424 .386 507 452 404 .361 .322 456 400 .351 .308 .270 432 .376 .327 .284 .247 410 354 305 263 227 370 314 .266 .226 .191 335 279 .233 .194 .162 275 .222 179 144 .116 227 178 139 .108 085 10 475 .896 .887 1879 870 1861 804 788 1773 758 743 .722 .701 1681 .661 .642 .650 .625 .601 .577 .555 585 1557 1530 1505 481 .527 .497 .469 .442 .417 .444 .415 388 .362 429 .397 .368 340 .315 .388 .356 .326 .299 .275 .350 .319 .290 .263 .239 .287 .257 .229 .205 .183 .237 208 182 .160 .140 .215 .187 .163 .141 .123 195 168 .145 .125 . 108 .162 .137 .116 099 084 135 .112 093 078 065 .094 076 061 049 040 066 052 040 032 025 .107 032 026 .093 o o o BWW= .853 1844 836 .828 820 054 045 038 1728 0714 1.700 686 1673 .623 .605 .587 1570 1554 .534 513 494 475 456 458 436 416 396 .394 .371 350 .331 .312 .339 .317 .296 .276 .258 .292 270 .250 .232 .215 .252 .231 .212 .194 .178 .218 .198 .180 .164 .149 .123 .108 .095 3083 .073 .163 .146 .130 .116 .104 .093 .080 .069 .060 .051 071 060 .051 043 037 .081 .070 061 .019 015 012 2009 007 021 .017 2014 031 026 .377 20 .016 024 .005 .002 .010 030 .059 038 .092 116 .146 233 .184 .295 1780 .610 .375 25 .478 001 2004 .002 .007 .012 .015 020 .033 057 .075 .099 .131 .174 .231 308 412 30 1742 552 Interest Factors for the Present Value of an Annuity of One Dollar Time Period leg 39 year 1 2. 3 4. 5 AWN 1% 2% 5% 6% 7% 8% 9% 10% 12% 14% 16% 18% 20% 24% 28% 32% 36% 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.893 0.877 0.862 0.847 0.833 0.806 0.781 0.758 0.735 1.970 1.942 1913 1.886 1.859 1.833 1.808 1.783 1.759 1.736 1.690 1.647 1.605 1.566 1.528 1.457 1.392 1.332 1.275 2.941 2.884 2.829 2.775 2.723 2.673 2.624 2.577 2.531 2.487 2.402 2.322 2.246 2.174 2.106 1981 1.868 1766 1674 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3.037 2.914 2.798 2.690 2.589 2.404 2.241 2.096 1966 4.853 4.713 4.580 4.452 4.329 4.212 4.100 3.993 3.890 3.791 3.605 3.433 3.274 3.127 2.991 2.745 2.532 2.345 2.181 6 7 8 9 10 5.795 5.601 5.417 5.242 5.076 4.917 4.766 4.623 4.486 4.355 4.111 3.889 3.685 3.498 3.326 3.020 2.759 2.534 2.399 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.564 4.288 4.039 3.812 3.605 3.242 2.937 2.678 2.455 7.652 7.325 7.020 6.733 6.463 6.210 5.971 5.747 5.535 5.335 4.968 4.639 4.344 4.078 3.837 3.421 3.076 2.786 2.540 8.566 8.162 7.786 7.435 7.108 6.802 6.515 6.247 5.985 5.759 5.328 4.946 4.607 4.303 4.031 3.566 3.184 2.868 2.603 9.471 8.983 8.530 8.111 7.722 7.360 7.024 6.710 6.418 6.145 5.650 5.216 4.833 4.494 4.193 3.682 3.269 2.930 2.650 22 11 12. 13 14 15 10.368 9.787 9.253 8.760 8.306 7.887 7.499 7.139 6.805 6.495 5.988 5.453 5.029 4.656 4.327 3.776 3.335 2.978 2.683 11.255 10.575 9.954 9.385 8.863 8.384 7.943 7.536 7.161 6.814 6.194 5.660 5.197 4.793 4.439 3.851 3.387 3.013 2.708 12.134 11.348 10.635 9.986 9.394 8.534 8.358 7.904 7.487 7.103 6.424 5.842 5.342 4.910 4.533 3.912 3.427 3.040 2.727 13.004 12.106 11.296 10.563 9.899 9.295 8.745 8.244 7.786 7.367 6.628 6.002 5.468 5.008 4.611 3.962 3.459 3.061 2.740 13.865 12.849 11.938 11.118 10.380 9.712 9.108 8.559 8.060 7.606 6.811 6.142 5.575 5.092 4.675 4.001 3.483 3.076 2.750 16 17 18 19 20 14.718 13.578 12.561 11.652 10.838 10.106 9.447 8.851 8.312 7.824 6.974 6.265 5.669 5.162 4.730 4.003 3.503 3.088 2.758 15.562 14.292 13.166 12.166 11.274 10.477 9.763 9.122 8.544 8.002 Z.120 6.373 5.749 5.222 4.775 4,059 3.518 3.097 2.763 16.398 14.992 13.754 12.659 11.690 10.828 10.059 9.372 8.756 8.2017.250 6.467 5.818 5.273 4.812 4.080 3.529 3.104 2.767 17.226 15.678 14.324 13.134 12.085 11.158 10.336 9.604 8.950 8.365 7.366 6.550 5.877 5.316 4.844 4.0973.539 3.109 2.770 18.046 16.351 14.877 13.590 12.462 11.470 10.594 9.818 9.128 8.514 7.469 6.623 5.929 5.353 4.870 4.110 3.546 3.113 2.772 25 22.023 19.523 17.413 15.622 14.094 12.783 11.654 10.675 9.823 9.077 7.843 6.873 6.097 5.467 4.948 4.147 3.564 3.122 2.776 30 25.808 22.937 19.600 17.292 15.373 13.765 12.409 11.258 10.274 9.427 8.055 7003 6.177 5517 4.979 4.160 3.569 3.124 2778 Problem 13-10 You are given the following information concerning a noncalable, sinking fund debenture: Principal: $1,000 Coupon rate of interest: 7 percent Term to maturity: 17 years Sinking fund: 5 percent of outstanding bonds retired annually; the balance at maturity a. If you buy the bond today at its face amount and interest rates rise to 13 percent after three years have passed, what is your capital gain or loss? Assume that the bond pays interest annually. Use Appendix B and Appendix D to answer the question. Use a minus sign to enter the loss amount, if any, as a negative value. Round your answer to the nearest dollar. b. If you hold the bond 17 years, what do you receive at maturity? Select c. What is the bond's current yield as of right now? Round your answer to the nearest whole number. d. Given your price in a. what is the yield at maturity? Round your answer to the nearest whole number. e. What proportion of the total debt issue is retired by the sinking fund? Round your answer to the nearest whole number. f. If the final payment to retire this bond is $1,000,000, how much must the firm invest annually to accumulate this sum if the firm is able to earn 7 percent on the invested funds? Use Appendix C to answer the question. Round your answer to the nearest dollar You are given the following information concerning a noncallable, sinking fund debenture: Principal: $1,000 Coupon rate of interest: 7 percent Term to maturity: 17 years Sinking fund: 5 percent of outstanding bonds retired annually, the balance at maturity a. If you buy the bond today at its face amount and interest rates rise to 13 percent after three years have passed, what is your capital gain or loss? Assume that the bond pays interest annually. Use Appendix B and Appendix D to answer the question. Use a minus sign to enter the loss amount, if any, as a negative value. Round your answer to the nearest dollar. $ b. If you hold the bond 17 years, what do you receive at maturity? -Select c. What is the bond's current yield as of right now? Round your answer to the nearest whole number. % d. Given your price in a, what is the yield at maturity? Round your answer to the nearest whole number. % e. What proportion of the total debt issue is retired by the sinking fund? Round your answer to the nearest whole number. % f. If the final payment to retire this bond is $1,000,000, how much must the firm invest annually to accumulate this sum if the firm is able to earn 7 percent on the invested funds? Use Appendix C to answer the question Round your answer to the nearest dollar. Interest Factors for the Present Value of One Dollar Time Period (e.g. year) 1 2 1% 6% 7% 8% 9% 10% 12% 15% 18% 28% WN 1990 1980 1971 1961 1951 2% .980 961 1942 924 1906 3% .971 .943 1915 .889 863 4% 962 925 889 .855 .822 5% 952 907 .864 .823 784 943 890 840 .792 747 935 873 816 .763 713 1926 857 794 735 .681 917 842 772 708 .650 909 826 751 .683 621 .893 .797 .712 .636 .567 14% 877 769 .675 592 519 .870 756 658 572 497 16% 862 743 641 552 476 .847 718 -609 516 437 20% .833 .694 579 482 402 24% 806 650 524 423 341 .781 .610 477 .373 .291 1746 1942 933 1923 1914 1905 888 .871 .853 .837 .820 .838 .813 -789 .766 1.744 1790 1760 .731 .703 .676 .711 .677 .645 .614 .705 665 .627 .592 .558 .666 .623 .582 .544 .508 .630 .583 .540 .500 463 596 1547 .502 .460 422 .564 .513 467 .424 .386 507 452 404 .361 .322 456 400 .351 .308 .270 432 .376 .327 .284 .247 410 354 305 263 227 370 314 .266 .226 .191 335 279 .233 .194 .162 275 .222 179 144 .116 227 178 139 .108 085 10 475 .896 .887 1879 870 1861 804 788 1773 758 743 .722 .701 1681 .661 .642 .650 .625 .601 .577 .555 585 1557 1530 1505 481 .527 .497 .469 .442 .417 .444 .415 388 .362 429 .397 .368 340 .315 .388 .356 .326 .299 .275 .350 .319 .290 .263 .239 .287 .257 .229 .205 .183 .237 208 182 .160 .140 .215 .187 .163 .141 .123 195 168 .145 .125 . 108 .162 .137 .116 099 084 135 .112 093 078 065 .094 076 061 049 040 066 052 040 032 025 .107 032 026 .093 o o o BWW= .853 1844 836 .828 820 054 045 038 1728 0714 1.700 686 1673 .623 .605 .587 1570 1554 .534 513 494 475 456 458 436 416 396 .394 .371 350 .331 .312 .339 .317 .296 .276 .258 .292 270 .250 .232 .215 .252 .231 .212 .194 .178 .218 .198 .180 .164 .149 .123 .108 .095 3083 .073 .163 .146 .130 .116 .104 .093 .080 .069 .060 .051 071 060 .051 043 037 .081 .070 061 .019 015 012 2009 007 021 .017 2014 031 026 .377 20 .016 024 .005 .002 .010 030 .059 038 .092 116 .146 233 .184 .295 1780 .610 .375 25 .478 001 2004 .002 .007 .012 .015 020 .033 057 .075 .099 .131 .174 .231 308 412 30 1742 552 Interest Factors for the Present Value of an Annuity of One Dollar Time Period leg 39 year 1 2. 3 4. 5 AWN 1% 2% 5% 6% 7% 8% 9% 10% 12% 14% 16% 18% 20% 24% 28% 32% 36% 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.893 0.877 0.862 0.847 0.833 0.806 0.781 0.758 0.735 1.970 1.942 1913 1.886 1.859 1.833 1.808 1.783 1.759 1.736 1.690 1.647 1.605 1.566 1.528 1.457 1.392 1.332 1.275 2.941 2.884 2.829 2.775 2.723 2.673 2.624 2.577 2.531 2.487 2.402 2.322 2.246 2.174 2.106 1981 1.868 1766 1674 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3.037 2.914 2.798 2.690 2.589 2.404 2.241 2.096 1966 4.853 4.713 4.580 4.452 4.329 4.212 4.100 3.993 3.890 3.791 3.605 3.433 3.274 3.127 2.991 2.745 2.532 2.345 2.181 6 7 8 9 10 5.795 5.601 5.417 5.242 5.076 4.917 4.766 4.623 4.486 4.355 4.111 3.889 3.685 3.498 3.326 3.020 2.759 2.534 2.399 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.564 4.288 4.039 3.812 3.605 3.242 2.937 2.678 2.455 7.652 7.325 7.020 6.733 6.463 6.210 5.971 5.747 5.535 5.335 4.968 4.639 4.344 4.078 3.837 3.421 3.076 2.786 2.540 8.566 8.162 7.786 7.435 7.108 6.802 6.515 6.247 5.985 5.759 5.328 4.946 4.607 4.303 4.031 3.566 3.184 2.868 2.603 9.471 8.983 8.530 8.111 7.722 7.360 7.024 6.710 6.418 6.145 5.650 5.216 4.833 4.494 4.193 3.682 3.269 2.930 2.650 22 11 12. 13 14 15 10.368 9.787 9.253 8.760 8.306 7.887 7.499 7.139 6.805 6.495 5.988 5.453 5.029 4.656 4.327 3.776 3.335 2.978 2.683 11.255 10.575 9.954 9.385 8.863 8.384 7.943 7.536 7.161 6.814 6.194 5.660 5.197 4.793 4.439 3.851 3.387 3.013 2.708 12.134 11.348 10.635 9.986 9.394 8.534 8.358 7.904 7.487 7.103 6.424 5.842 5.342 4.910 4.533 3.912 3.427 3.040 2.727 13.004 12.106 11.296 10.563 9.899 9.295 8.745 8.244 7.786 7.367 6.628 6.002 5.468 5.008 4.611 3.962 3.459 3.061 2.740 13.865 12.849 11.938 11.118 10.380 9.712 9.108 8.559 8.060 7.606 6.811 6.142 5.575 5.092 4.675 4.001 3.483 3.076 2.750 16 17 18 19 20 14.718 13.578 12.561 11.652 10.838 10.106 9.447 8.851 8.312 7.824 6.974 6.265 5.669 5.162 4.730 4.003 3.503 3.088 2.758 15.562 14.292 13.166 12.166 11.274 10.477 9.763 9.122 8.544 8.002 Z.120 6.373 5.749 5.222 4.775 4,059 3.518 3.097 2.763 16.398 14.992 13.754 12.659 11.690 10.828 10.059 9.372 8.756 8.2017.250 6.467 5.818 5.273 4.812 4.080 3.529 3.104 2.767 17.226 15.678 14.324 13.134 12.085 11.158 10.336 9.604 8.950 8.365 7.366 6.550 5.877 5.316 4.844 4.0973.539 3.109 2.770 18.046 16.351 14.877 13.590 12.462 11.470 10.594 9.818 9.128 8.514 7.469 6.623 5.929 5.353 4.870 4.110 3.546 3.113 2.772 25 22.023 19.523 17.413 15.622 14.094 12.783 11.654 10.675 9.823 9.077 7.843 6.873 6.097 5.467 4.948 4.147 3.564 3.122 2.776 30 25.808 22.937 19.600 17.292 15.373 13.765 12.409 11.258 10.274 9.427 8.055 7003 6.177 5517 4.979 4.160 3.569 3.124 2778

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started