Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview QUESTION 16 There are nine different scenarios that correspond to the expectation (as of today) of the spot exchange rate Escon 20th

Old MathJax webview

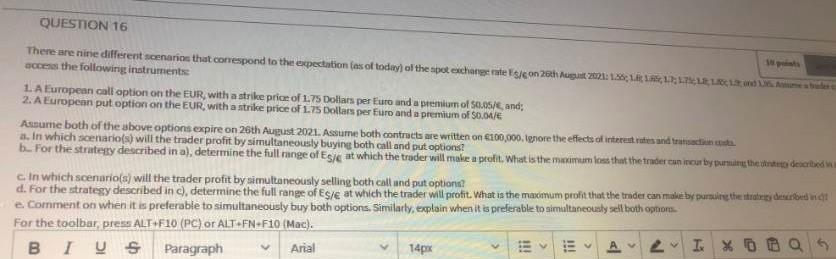

QUESTION 16 There are nine different scenarios that correspond to the expectation (as of today) of the spot exchange rate Escon 20th August 2021: 1.5 L, 101 mere aces the following instruments 1. A European call option on the EUR, with a strike price of 1.75 Dollars per Euro and a premium of $0.00/, and; 2. A European put option on the EUR, with a strike price of 1.75 Dollars per Euro and a premium of 50,00 Asume both of the above options expire on 26th August 202... Assume both contracts are written on C100,000, ignore the effects of interest rates and to bu for the strategy described in a), determine the full range of Este at which the trader will make a profit. What is the maximum land that the trader un mes by turning the intento described cin which scenario(s) will the trader profit by simultaneously selling both call and put option d. For the strategy described in c), determine the full range of Este at which the trader will profit. What is the macimum profit that the trader can make by paring the strategy described it e. Comment on when it is preferable to simultaneously buy both options. Similarly, explain when it is preferable to simaltaneously sell both ophones For the toolbar, press ALT+F10 (PC) or ALT-FN-F10 (Mac). A I % 0 I ps Paragraph 14px Arial !! 2 QUESTION 16 There are nine different scenarios that correspond to the expectation (as of today) of the spot exchange rate Escon 20th August 2021: 1.5 L, 101 mere aces the following instruments 1. A European call option on the EUR, with a strike price of 1.75 Dollars per Euro and a premium of $0.00/, and; 2. A European put option on the EUR, with a strike price of 1.75 Dollars per Euro and a premium of 50,00 Asume both of the above options expire on 26th August 202... Assume both contracts are written on C100,000, ignore the effects of interest rates and to bu for the strategy described in a), determine the full range of Este at which the trader will make a profit. What is the maximum land that the trader un mes by turning the intento described cin which scenario(s) will the trader profit by simultaneously selling both call and put option d. For the strategy described in c), determine the full range of Este at which the trader will profit. What is the macimum profit that the trader can make by paring the strategy described it e. Comment on when it is preferable to simultaneously buy both options. Similarly, explain when it is preferable to simaltaneously sell both ophones For the toolbar, press ALT+F10 (PC) or ALT-FN-F10 (Mac). A I % 0 I ps Paragraph 14px Arial !! 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started