Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview Required: a. Prepare a variable costing income statement at the current level of production and sales. b. Calculate the unit CM in

Old MathJax webview

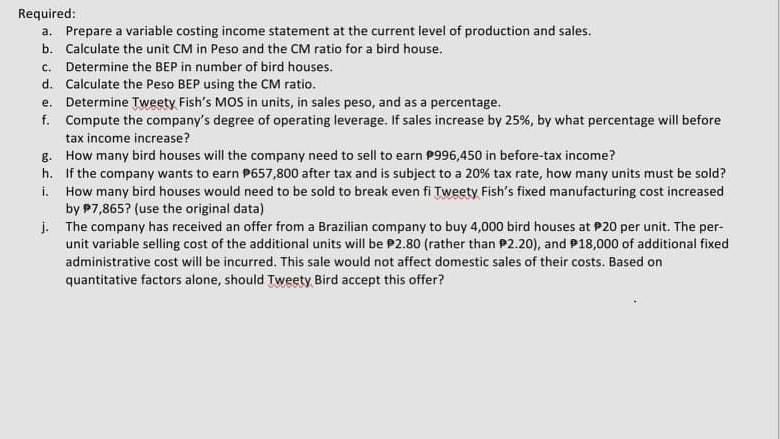

Required: a. Prepare a variable costing income statement at the current level of production and sales. b. Calculate the unit CM in Peso and the CM ratio for a bird house. c. Determine the BEP in number of bird houses. d. Calculate the Peso BEP using the CM ratio. e. Determine Tweety Fish's MOS in units, in sales peso, and as a percentage. f. Compute the company's degree of operating leverage. If sales increase by 25%, by what percentage will before tax income increase? g. How many bird houses will the company need to sell to earn P996,450 in before-tax income? h. If the company wants to earn P657,800 after tax and is subject to a 20% tax rate, how many units must be sold? 1. How many bird houses would need to be sold to break even fi Tweety Fish's fixed manufacturing cost increased by P7,865? (use the original data) 1. The company has received an offer from a Brazilian company to buy 4,000 bird houses at P20 per unit. The per- unit variable selling cost of the additional units will be P2.80 (rather than P2.20), and P18,000 of additional fixed administrative cost will be incurred. This sale would not affect domestic sales of their costs. Based on quantitative factors alone, should Tweety Bird accept this offer? Required: a. Prepare a variable costing income statement at the current level of production and sales. b. Calculate the unit CM in Peso and the CM ratio for a bird house. c. Determine the BEP in number of bird houses. d. Calculate the Peso BEP using the CM ratio. e. Determine Tweety Fish's MOS in units, in sales peso, and as a percentage. f. Compute the company's degree of operating leverage. If sales increase by 25%, by what percentage will before tax income increase? g. How many bird houses will the company need to sell to earn P996,450 in before-tax income? h. If the company wants to earn P657,800 after tax and is subject to a 20% tax rate, how many units must be sold? 1. How many bird houses would need to be sold to break even fi Tweety Fish's fixed manufacturing cost increased by P7,865? (use the original data) 1. The company has received an offer from a Brazilian company to buy 4,000 bird houses at P20 per unit. The per- unit variable selling cost of the additional units will be P2.80 (rather than P2.20), and P18,000 of additional fixed administrative cost will be incurred. This sale would not affect domestic sales of their costs. Based on quantitative factors alone, should Tweety Bird accept this offer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started