Answered step by step

Verified Expert Solution

Question

1 Approved Answer

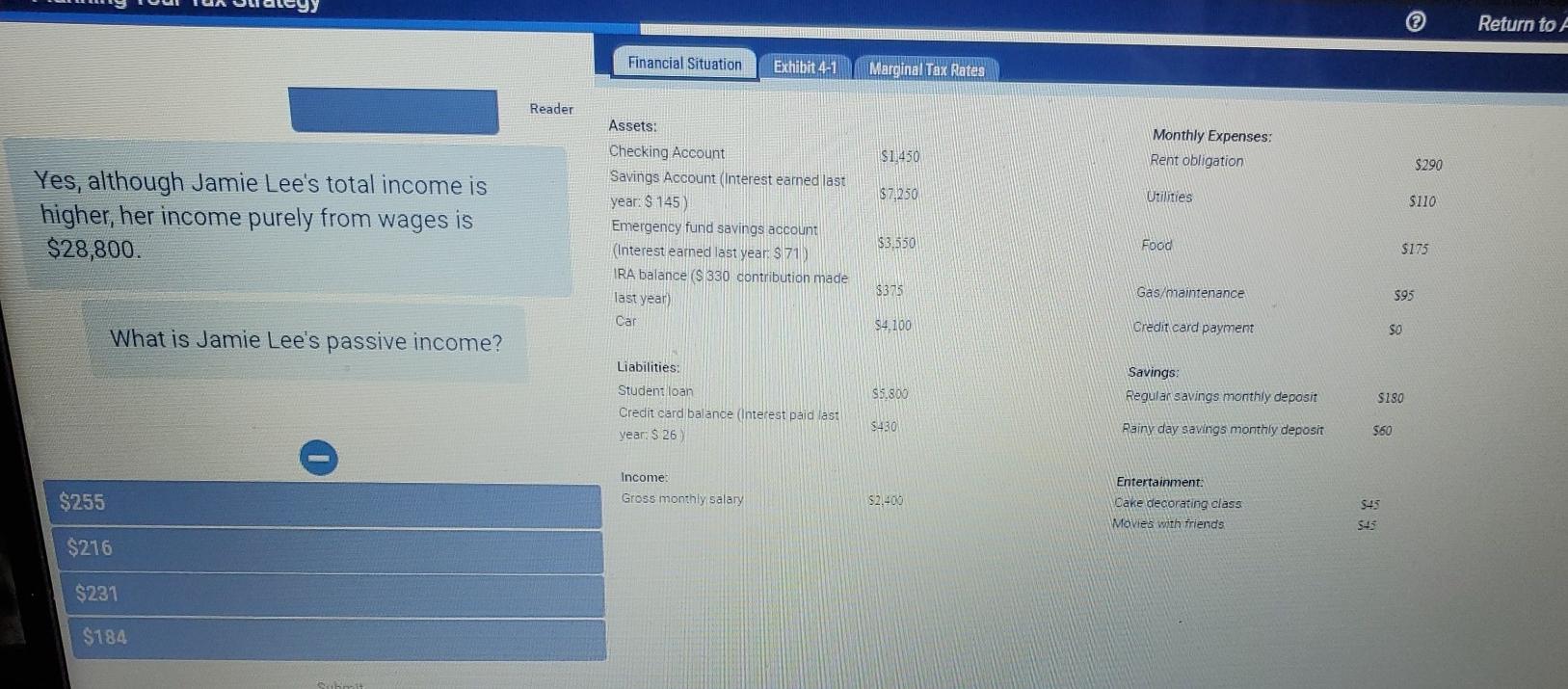

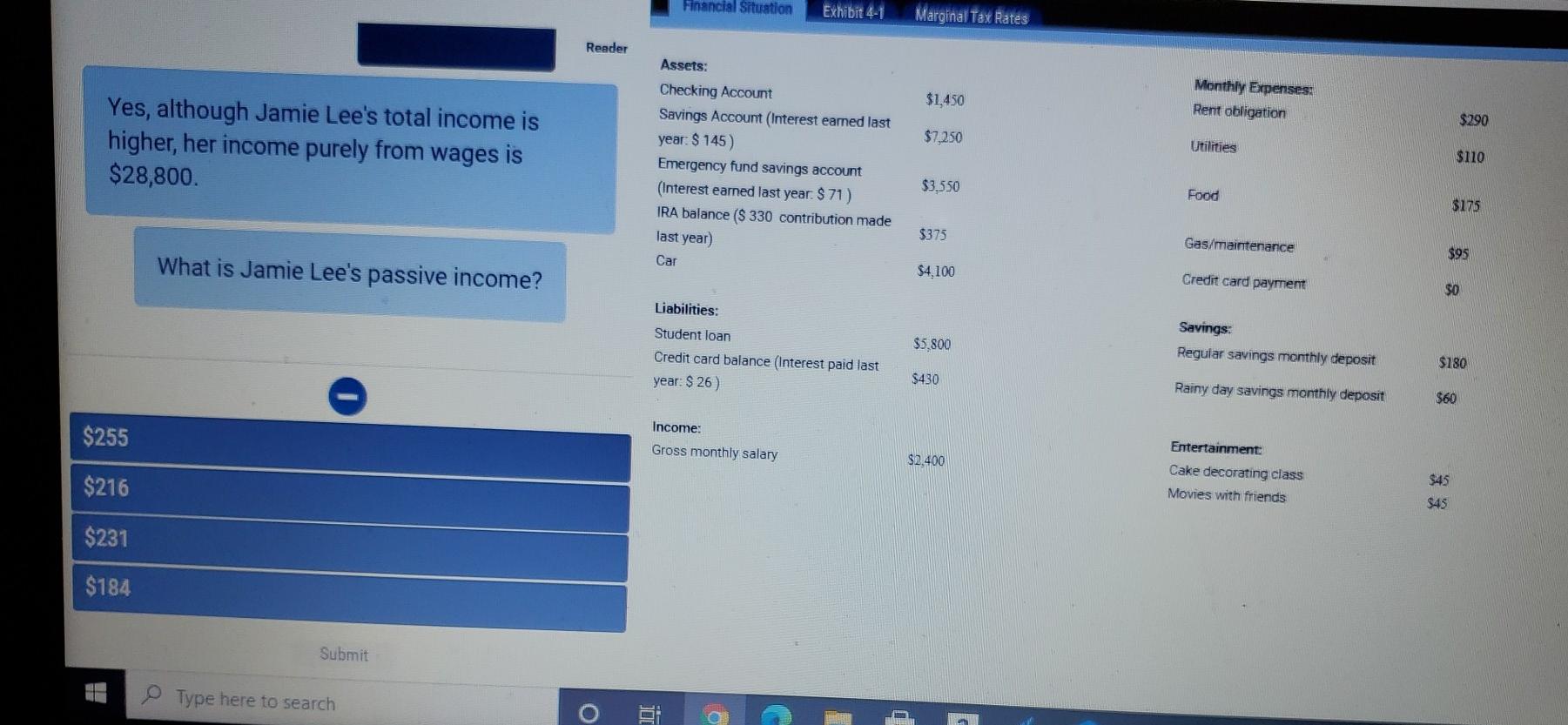

Old MathJax webview Return to Financial Situation Exhibit 4-1 Marginal Tax Rates Reader Assets: $1.450 Monthly Expenses: Rent obligation $290 $7.250 Utilities $110 Yes, although

Old MathJax webview

Return to Financial Situation Exhibit 4-1 Marginal Tax Rates Reader Assets: $1.450 Monthly Expenses: Rent obligation $290 $7.250 Utilities $110 Yes, although Jamie Lee's total income is higher, her income purely from wages is $28,800. Checking Account Savings Account (Interest earned last year: $ 145) Emergency fund savings account (Interest eamed last year $71) IRA balance (s 330 contribution made last year) $3.550 Food $175 $375 Gas/maintenance 595 Car $4.100 Credit card payment SO What is Jamie Lee's passive income? Liabilities: Savings: $5.800 Regular savings monthly deposit $180 Student loan Credit card balance (Interest paid last year: S 26 $430 Rainy day savings monthly deposit $60 Income Entertainment: $255 Gross monthly salary $2.400 $45 Cake decorating class Movies with friends $45 $216 $231 $184 Financial Situation Exhibit 4-1 Marginal Tax Rates Reader Assets: Monthly Expenses: $1,450 Rent obligation $290 Yes, although Jamie Lee's total income is higher, her income purely from wages is $28,800. $7.250 Utilities $110 Checking Account Savings Account (Interest earned last year: $ 145) Emergency fund savings account (Interest eamed last year. $ 71) IRA balance ($ 330 contribution made last year) $3.550 Food $175 $375 Gas/maintenance $95 Car What is Jamie Lee's passive income? $4,100 Credit card payment $0 Liabilities: Student loan Savings: $5,800 Regular savings monthly deposit Credit card balance (Interest paid last year: $ 26) $180 $430 Rainy day savings monthly deposit $60 Income: $255 Gross monthly salary Entertainment $2.400 Cake decorating class $216 $45 Movies with friends $45 $231 $184 Submit Type here to search

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started