Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview Show calculations where needed Please. Year ended June 31,2018 Kurt Daley is a sole trader who operates a wholesale. The following trial

Old MathJax webview

Show calculations where needed Please.

Year ended June 31,2018

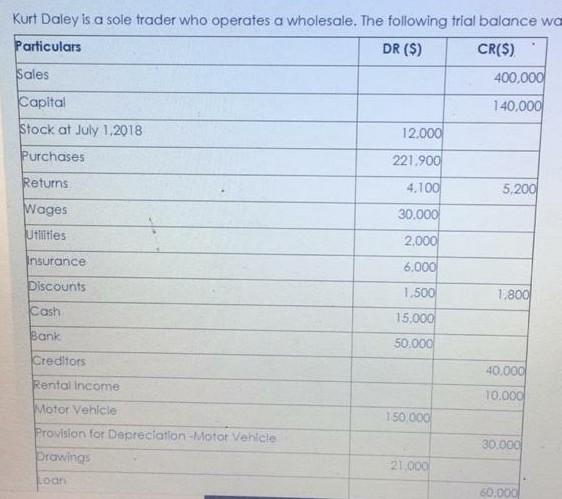

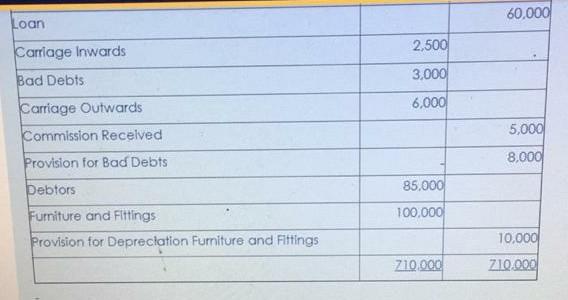

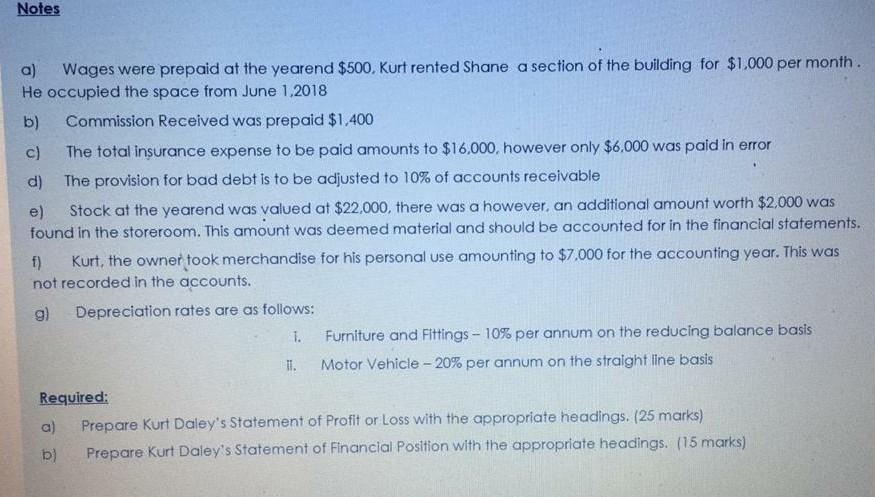

Kurt Daley is a sole trader who operates a wholesale. The following trial balance wa Particulars DR ($) CR(S) Sales 400,000 140,000 Capital Stock at July 1 2018 12.000 Purchases 221.900 Returns 4,100 5,200 Wages Utitles 30.000 2.000 Insurance 6.000 Discounts 1.500 1.800 Cash Bank 15,000 50.000 40.000 10.000 Creditors Rental income Motor Vehicle Provision for Depreciation Motor Vehicle Prawings 150.000 30.000 21.000 Lod 60.000 60.000 Loan 2,500 Carriage Inwards Bad Debts 3,000 6,000 Carriage Outwards Commission Received Provision for Bad Debts 5,000 8,000 Debtors 85.000 100,000 Furniture and Fittings Provision for Depreciation Furniture and Fittings 10,000 710.000 210.000 Notes a) Wages were prepaid at the yearend $500. Kurt rented Shane a section of the building for $1.000 per month. He occupied the space from June 1,2018 b) Commission Received was prepaid $1,400 c) The total insurance expense to be paid amounts to $16,000, however only $6,000 was paid in error d) The provision for bad debt is to be adjusted to 10% of accounts receivable e) Stock at the yearend was valued at $22,000, there was a however, an additional amount worth $2,000 was found in the storeroom. This amount as deemed material and should be accounted for in the financial statements. f) Kurt, the owner took merchandise for his personal use amounting to $7,000 for the accounting year. This was not recorded in the accounts. g) Depreciation rates are as follows: 1. Furniture and Fittings - 10% per annum on the reducing balance basis 11. Motor Vehicle -20% per annum on the straight line basis Required: a) Prepare Kurt Daley's Statement of Profit or Loss with the appropriate headings. (25 marks) b) Prepare Kurt Daley's Statement of Financial Position with the appropriate headings. (15 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started