Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview Use (a) the percentage method and (b) the wage bracket method to compute the federal income taxes to withhold from the wages

Old MathJax webview

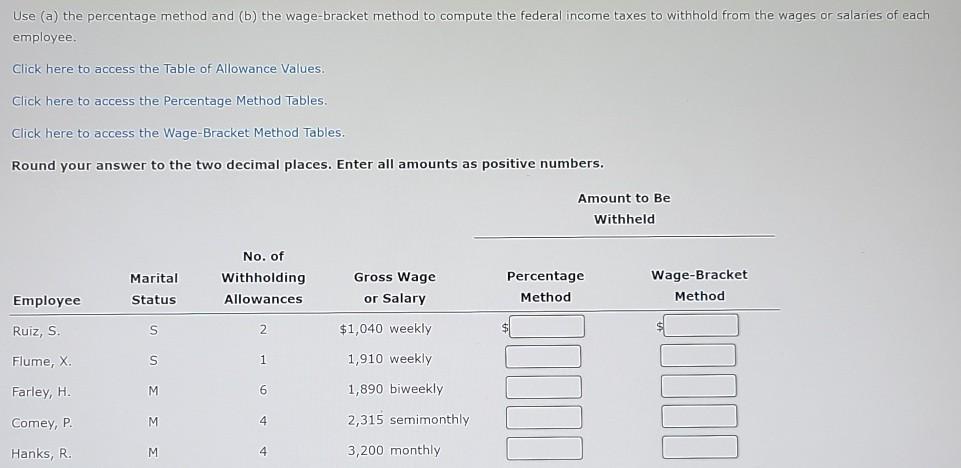

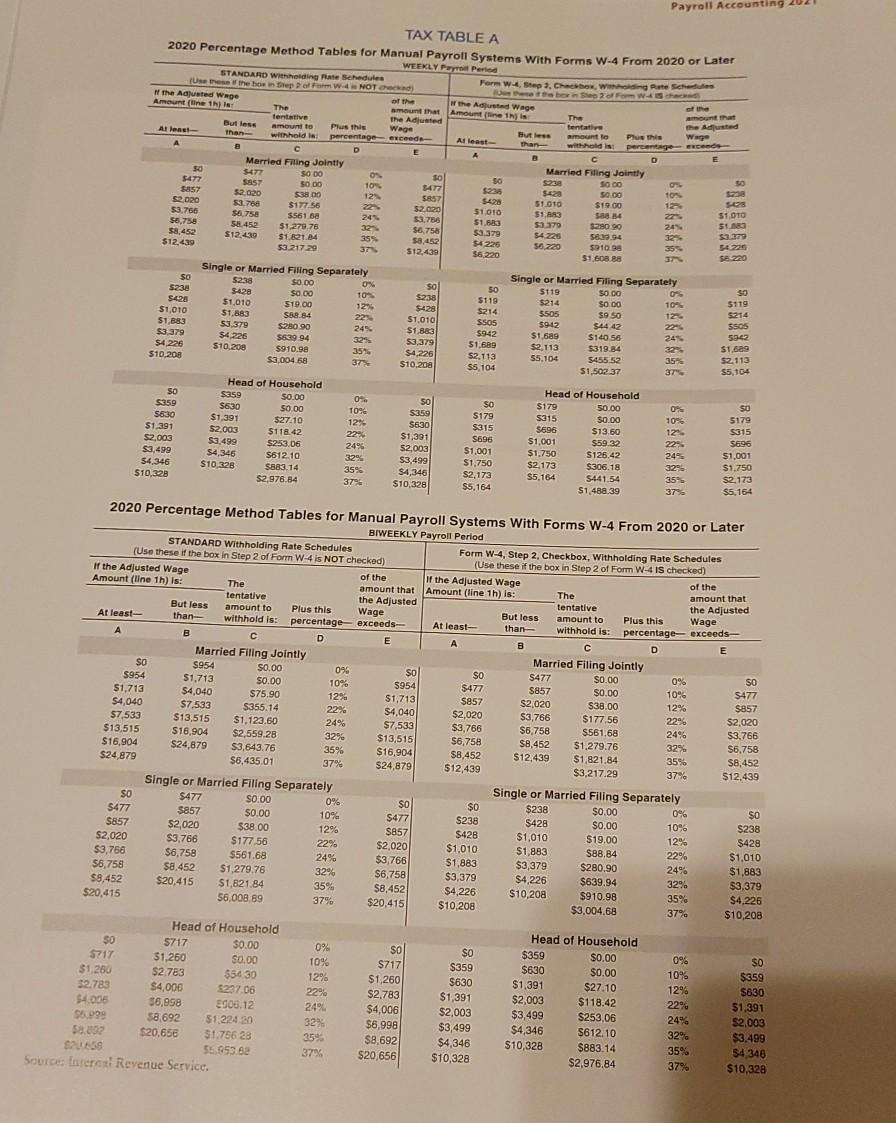

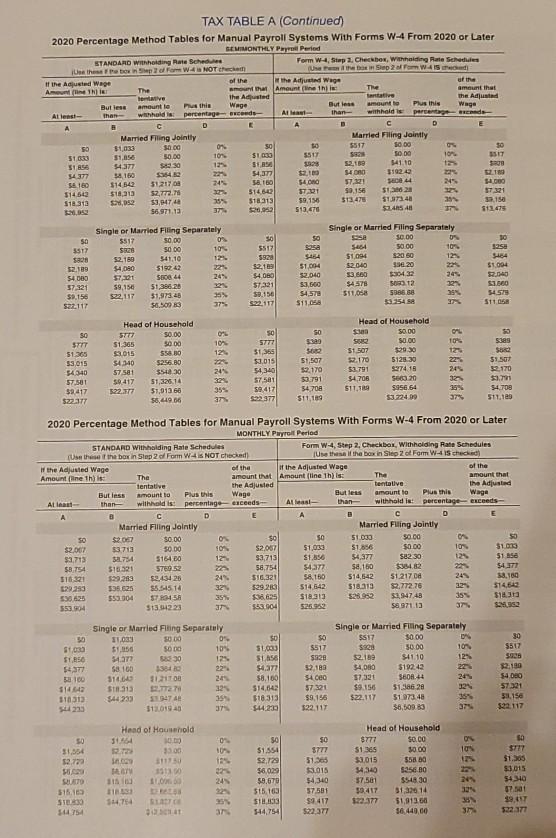

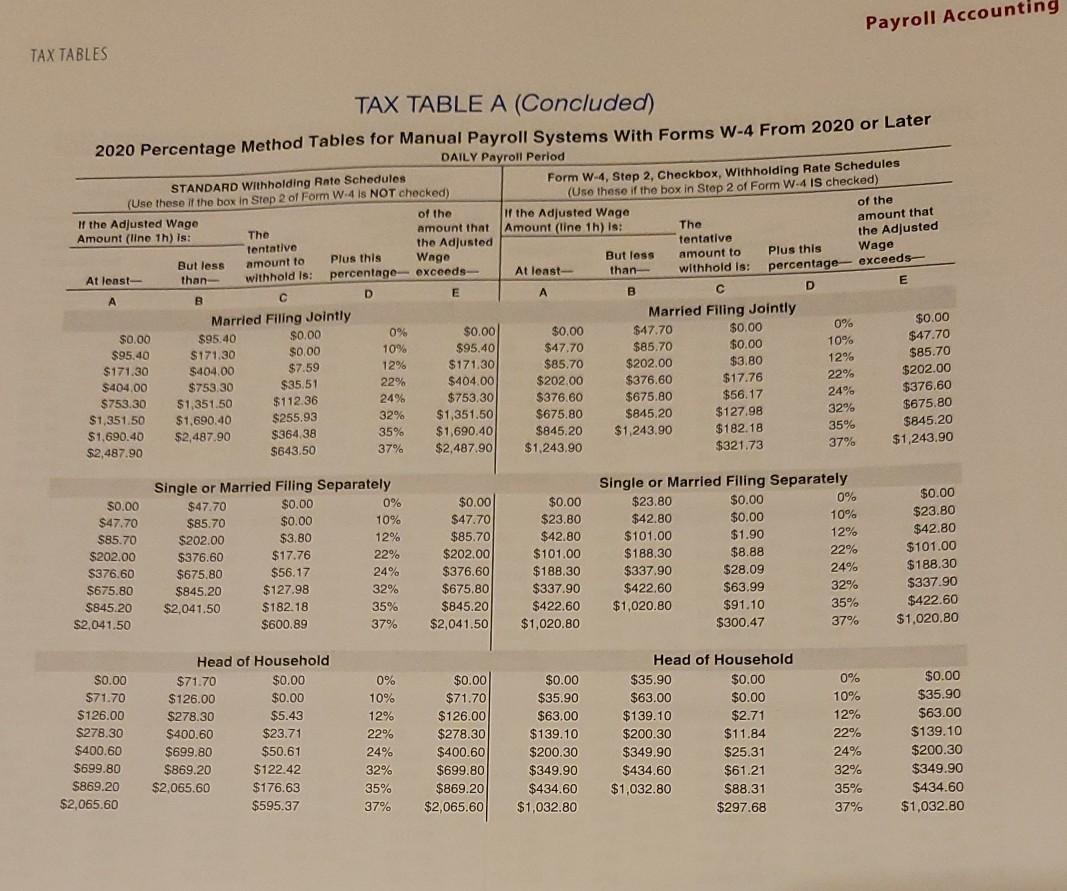

Use (a) the percentage method and (b) the wage bracket method to compute the federal income taxes to withhold from the wages or salaries of each employee. Click here to access the Table of Allowance Values. Click here to access the Percentage Method Tables Click here to access the Wage-Bracket Method Tables, Round your answer to the two decimal places. Enter all amounts as positive numbers. Amount to Be Withheld No. of Marital Withholding Allowances Gross Wage or Salary Percentage Method Wage-Bracket Method Employee Status Ruiz, S. S 2 $1,040 weekly Flume, X S 1 1,910 weekly Farley, H. M 6 1,890 biweekly Comey, P. M 4 2,315 semimonthly Hanks, R. M 4 3,200 monthly Payroll Accounting 202 that TAX TABLE A 2020 Percentage Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later WEEKLY Payo Period STANDARD withholding Rate Schedule (Uses the box Shepam. W.NOT Check Form W-4, Step 7. Chow, Whing Pute sich borowth If the Adjusted Wage of the Amount (line 1h) the Add Wage of the The amount that Amountine 1 tentative The The Adjusted But less tentative The Adjusted Plus this Al least Amount to Wage than withhold lat percentage exceede- But amount to Plus this Wago Alleest A withheld ist percentagence D O Married Filing Jointly S4T Married Filing Jointly $0.00 0 so 5477 30 SO 00 $857 50.00 10% 17 sas sas 52020 $420 sza 50.00 10 538 DO 12 5857 $2.020 $420 $19.00 51.010 12 $3.768 505 $177.56 22 $2.020 $3.756 51 $1.010 $6.750 51.583 51 OTO $561 24 58814 $3,750 56,75 51,683 58.452 24 $280 90 $1.279,76 $6,758 58.452 53.379 $4225 5833.94 32 537 $12.439 $1.821.14 355 $3,452 $12.439 $4 225 56.220 $3.217.29 $910.30 37 $12,439 $6220 $1.608 BB S220 Single or Married Filing Separately Single or Married Filing Separately SO 5238 $0.00 0% $0 5238 50 5119 50.00 SO 0 $0.00 10 $238 $428 $119 $214 SO 00 5119 10- $1,010 519.00 129 $428 $1,010 $214 5505 $1,883 $9 50 12 5214 S88.84 22 $1,010 SSOS $1,883 $942 $4442 22 3.379 5SOS $280.90 249. $3379 $1,883 $942 51.689 $140 56 249 $4226 5942 $639.94 325. $3,379 $4.226 51.689 $10.200 $2,113 $319.84 32 $1,6g $910.90 35% 54.226 $10.200 S2,113 55.104 5455.52 35% $2,113 $3,004 68 37 $10.200 55,104 $1,502 37 37 $5,104 51. $428 SO $359 5630 $1,391 $2,003 $3,499 54.346 $10,328 Head of Household 5359 S0.00 $630 50.00 $1,391 $27/10 $2,003 $118.42 $3,499 5253.06 54346 5612.10 $10.328 5883.14 $2,976.84 09 10% 12 22 24% 32% 35% 37% SO 5359 $630 $1,391 52,003 $3,499 $4,346 $10,328 SO 5179 $315 5696 $1,001 $1,750 $2,173 $5,164 Head of Household $179 50.00 5315 $0.00 $696 $13.50 $1.001 $59.32 $1,750 S126,42 $2.173 $306.18 $5,164 $441,54 $1,488,39 0% 10% 12 229 249 320 359 37. SO 5179 $315 5696 51.001 $1.750 52173 $5,164 The 2020 Percentage Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later BIWEEKLY Payroll Period STANDARD Withholding Rate Schedules (Use these if the box in Step 2 of Form W-4 is NOT checked) Form W-4, Step 2, Checkbox, Withholding Rate Schedules If the Adjusted Wage (Use these if the box in Step 2 of Form W-4 IS checked) of the Amount (line 1h) is: If the Adjusted Wage of the The amount that Amount (line 1h) is: amount that tentative the Adjusted tentative But less amount to the Adjusted Plus this At least Wage than But loss withhold is: amount to Plus this Wage percentage exceeds- At least than withhold is percentage exceeds A B D E A B C D E Married Filing Jointly Married Filing Jointly SO $954 S0.00 096 SO SO $954 $477 $0.00 0% 51,713 SO $0.00 10% 5954 $477 $1,713 $857 $0.00 $4,040 106 5477 $75,90 1296 $1,713 $857 $4,040 S2,020 $7,533 $38.00 12% $857 S355.14 22%. $4,040 $2,020 57,533 $3,766 $177 56 $13,515 22% $2,020 $1.123.60 24% $7,533 $3,766 $13,515 $6.758 5561.68 S16,904 24% $3.766 $2,559.28 329 $13,515 $16,904 $6,758 S8,452 $24,879 $1.279.76 $3,643.76 32% $6.758 35% $16,904 $8,452 $24,879 $12,439 $1,821.84 35% $8,452 $6,435.01 37% $24,879 $12,439 $3,217.29 37% $12.439 Single or Married Filing Separately Single or Married Filing Separately SO $477 $0.00 0% SO $0 $238 $477 5857 $0.00 0 0% $0 $0.00 10% $477 S238 5857 $428 $0.00 $2,020 10% $238 $38.00 12% $857 $428 $2,020 $1,010 $19.00 12% $428 $3.766 $177.56 22% $2,020 $1,010 53,766 $6,758 $1,883 $88.84 22% $1,010 $561.68 24% $3,766 $1,883 56,758 $3,379 $8,452 $280.90 24% $1,883 $1,279.76 32% $6,758 $3,379 $8,452 $639.94 $20,415 $1,821.84 32% $3,379 35% $8,452 $4,226 $10,208 $20,415 $910.98 35% $4,226 56,008,89 37% $20.415 $10,208 $3,004,68 37% $10,208 Head of Household Head of Household 50 $717 0% SO SO 5717 $359 $1,260 $0.00 0% $0 S0.00 10% S717 $359 $630 $0.00 10% $1,250 $2.783 $5430 $359 12% $1,260 $630 $1,391 52.783 $4,000 12% $227.06 $27.10 22% $2.783 $1,391 $2,003 $118.42 $4.006 56,998 22 $1,391 2006.12 24% $4,006 $2,003 $3,499 $253,06 $5.99 58,692 24% $2,003 $1.224:30 325 $6,998 $3,499 $4,346 S612.10 $8.00 $20,65 32% $3.499 $1.75628 35% $8,692 $4,346 $10,328 SPLASS $883.14 35% 56.953 62 54346 37% $20,656 $10,328 $2,976.84 37% Source Carros Revenue Service. $10,328 $4 226 $0.00 5630 of the TAX TABLE A (Continued) 2020 Percentage Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later SEMIMONTHLY Pay Period STANDARD Winding Rate Schedule Form W-4, Step 2. Checkbox, whiding Rate Schedules Use the top of w4a NOT check Une mini Sap 2 Tom W415 If the Adjusted Wage the Adjusted Wage of the And INI The Amount that Amountinin The amount that tentative The Adjusted Santa the Adju But less amount to Pus this Wage But les amount Plus this Wage At least than whalda percentage seeds Al than with haid percentage de D B C D Married Filing Jointly Married Filing Jointly $1,033 50.00 0 50 5517 0.00 30 31.033 $1,054 50.00 104 $1630 5517 SO DO 10% SIT 51856 54.377 $30 12 St. 1928 2.1 14110 54377 $4,372 2100 $400 3192.43 210 10 512170 24 $8.50 5400 97.1 44 245 400 314642 $18,313 52,772 514640 53,154 $1,020 57321 $1313 S02 $3,04740 35% $18313 59,150 $13.470 $1.97340 31 33.150 56,971,13 37 2052 513.470 57.48540 $11.45 in so gasa sa 3517 $ 12.109 54000 57 121 $8.156 S22.117 Single or Married Filing Separately 5517 50.00 0 SRZS 50 00 10% 52.180 541.10 129 $4.00 519242 22 22 S44 24% 59,154 51,366.26 22 $22,117 31,373.28 35 $0.500 37 50 55171 5928 $2.100 $4.00 $7,321 $0.150 522.117 Single or Married Filing Separately 30.00 09 5454 50.00 104 $1,094 320 50 12% $2.040 336.20 33.560 249 $4.57 Sat2 327 511.08 5366 35 35354 SA 10 use 5464 $1.004 4D 51.004 2,040 53.560 54.578 511.05 54.57 511.05 SO $180 50 $777 51365 53,015 34340 57.501 59.417 522377 Head of Household 5777 50.00 51 305 50.00 3015 s 54340 $256.80 57581 S530 59417 51,325.14 122.77 $1,013 56 58,449 06 OL 10% 12 2 24 32 359 37 50 5777 31.365 $3,015 54,340 S7581 59 4121 522 377 562 51,507 $2.170 53.791 54708 $11.19 Head of Household sen 50.00 S2 S0.00 51 507 $29.30 2.170 5128 30 53.791 9374.16 54,706 5600 20 $11.19 $956.64 $324 DO OL 10% 125 22% 24% 32 35% 37% 53 5385 $52 $1.507 2.170 . 54.709 511.125 2020 Percentage Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later MONTHLY Payroll Period STANDARD Withholding Rate Schedules Form W-4, Step 2. Checkbor, Withholding Rate Schedules Use these the box in Step 2 For WAS NOT checked Use these if the box in Slo2 of Form W-4 Schedd the Adjusted Wage of the of the Adjusted Wage of the Amount (line 1h) is The amount that Amount (line This The amount that tentative the Adjusted tentative the Adjusted Butless amount to Plus this Wago But less amount to Plus this Waga Atlant than withheld ist percentage diceeds.. Al laaste than withhold is percentage exceeds c D A C D Married Filing Jointly Married Filing Jointly so 52067 5000 O $0 50 51.030 $0.00 so $2.067 53 713 50.00 10% S2.057 $1,030 $1,656 $0.00 10 $1.00 $2.713 $4.754 $164.00 12 $3,713 $1,550 54.377 82.30 12 51 Ase $8.754 $16521 5760 52 58754 54.377 $8,150 $384.82 547 51621 3283 $9.434 26 24 516,321 58.150 514.542 5121708 249 3818 29293 135.5 $8.54518 32 529 200 $14,642 $18.313 $2.772.70 $14.646 5035 550.004 570458 35% 65 S18313 528 92 5294748 35 313 55394 $13.223 37 3837004 526.952 58 71.13 50 St030 S150 547 3100 51442 110313 5233 Single or Married Filing Separately 11.030 3000 09 $1,056 Sood 10 54377 5-30 125 58 100 35 22 314.640 31.711700 21 S313 2.7278 32% $44233 35 51301340 37 50 $1.000 $1,856 S432 $8.100 $14,643 $18,313 $44.232 so 5517 $828 5.189 4 57321 $9,156 122.117 Single or Married Filing Separately 5517 30.00 5928 50.00 109 $2.189 $41.10 12% 34,080 5192.43 57321 560.44 24 $9.156 51.586 28 32 $22.117 5127348 36 $6,50089 30 5517 $930 12:180 $4.000 57321 31,150 $22.117 sa On 10 10 1.354 52.772 Head of Household SA 100) 33.00 In 1150 15110 11.0 22 24% 30 51.554 52.729 $6.029 59,670 515163 St. 544,754 $0 3777 51.30 $5.018 $4340 37581 $9417 Head of Household $777 $0.00 51.35 30.00 31.015 558 50 4340 $356.60 37.501 $54830 $9.417 3132014 322377 51,913.00 16.440,00 STO 2 33 3 $1.505 $3.013 54340 07.01 39.47 144754 ST3 54754 STO 23 25 31 3 Payroll Accounting TAX TABLES TAX TABLE A (Concluded) 2020 Percentage Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later DAILY Payroll Period STANDARD Withholding Rate Schedules Form W-4, Stop 2, Checkbox, Withholding Rate Schedules (Use these if the box in Step 2 of Form W 4 is NOT checked) (Use these if the box in Step 2 of Form W-4 IS checked) If the Adjusted Wage of the If the Adjusted Wage of the Amount (line 1h) is: The amount that Amount (line 1h) is: The amount that tentative the Adjusted tentative the Adjusted But less amount to Plus this Wago But loss amount to Plus this Wage At least than withhold is: percentage exceeds- At least than withhold is: percentage - exceeds- B D E B D E Married Filing Jointly Married Filing Jointly $0.00 $95.40 $0.00 0% $0.00 $0.00 $47.70 $0.00 0% $0.00 $95.40 $171,30 $0.00 10% $95.40 $47.70 $85.70 $0.00 10% $47.70 $171.30 $404.00 $7.59 12% $171.30 $85.70 $202.00 $3.80 12% $85.70 $404.00 $753.30 $35.51 22% $404.00 $202.00 $376.60 22% $202.00 $753.30 $1,351.50 $112.36 2496 $753,30 $376,60 $675.80 $56.17 24% $376,60 $1,351.50 $1,690.40 $255.93 32% $1.351.50 $845,20 $127.98 32% $675.80 $1.690.40 $2,487.90 $364,38 35% $1.690.40 $845,20 $1,243,90 $182.18 35% $845.20 $2,487.90 $643.50 $2,487.90 $1,243.90 $321.73 37% $1,243.90 $17.76 $675.80 37% $0.00 $47.70 $85.70 $202.00 S376.60 $675.80 $845.20 $2,041.50 Single or Married Filing Separately $47.70 $0.00 0% $85.70 $0.00 10% $202.00 $3.80 12% $376.60 $17.76 22% $675.80 $56.17 24% $845.20 $127.98 32% $2,041.50 $182.18 35% $600.89 37% $0.00 $47.70 $85.70 $202.00 $376.60 $675.80 $845.20 $2,041.50 $0.00 $23.80 $42.80 $101.00 $188.30 $337.90 $422.60 $1,020.80 Single or Married Filing Separately $23.80 $0.00 0% $42.80 $0.00 10% $101.00 $1.90 12% $188.30 $8.88 22% $337.90 $28.09 24% $422.60 $63.99 32% $1,020.80 $91.10 35% $300.47 37% $0.00 $23.80 $42.80 $101.00 $188.30 $337.90 $422.60 $1,020.80 $0.00 $71.70 $126.00 S278.30 $400.60 $699.80 $869.20 $2,065.60 Head of Household $71.70 $0.00 $126.00 $0.00 $278.30 $5.43 $400.60 $23.71 $699.80 $50.61 $869.20 $122.42 $2,065.60 $176.63 $595.37 0% 10% 12% 22% 24% 32% $0.00 $71.70 $126.00 $278.30 $400.60 $699.80 $869.20 $2,065.60 $0.00 $35.90 $63.00 $139.10 $200.30 $349.90 $434.60 $1,032.80 Head of Household $35.90 $0.00 $63.00 $0.00 $139.10 $2.71 $200.30 $11.84 $349.90 $25.31 $434.60 $61.21 $1,032.80 $88.31 $297.68 0% 10% 12% 22% 24% 32% 35% 37% $0.00 $35.90 $63.00 $139.10 $200.30 $349.90 $434.60 $1,032.80 35% 37% Use (a) the percentage method and (b) the wage bracket method to compute the federal income taxes to withhold from the wages or salaries of each employee. Click here to access the Table of Allowance Values. Click here to access the Percentage Method Tables Click here to access the Wage-Bracket Method Tables, Round your answer to the two decimal places. Enter all amounts as positive numbers. Amount to Be Withheld No. of Marital Withholding Allowances Gross Wage or Salary Percentage Method Wage-Bracket Method Employee Status Ruiz, S. S 2 $1,040 weekly Flume, X S 1 1,910 weekly Farley, H. M 6 1,890 biweekly Comey, P. M 4 2,315 semimonthly Hanks, R. M 4 3,200 monthly Payroll Accounting 202 that TAX TABLE A 2020 Percentage Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later WEEKLY Payo Period STANDARD withholding Rate Schedule (Uses the box Shepam. W.NOT Check Form W-4, Step 7. Chow, Whing Pute sich borowth If the Adjusted Wage of the Amount (line 1h) the Add Wage of the The amount that Amountine 1 tentative The The Adjusted But less tentative The Adjusted Plus this Al least Amount to Wage than withhold lat percentage exceede- But amount to Plus this Wago Alleest A withheld ist percentagence D O Married Filing Jointly S4T Married Filing Jointly $0.00 0 so 5477 30 SO 00 $857 50.00 10% 17 sas sas 52020 $420 sza 50.00 10 538 DO 12 5857 $2.020 $420 $19.00 51.010 12 $3.768 505 $177.56 22 $2.020 $3.756 51 $1.010 $6.750 51.583 51 OTO $561 24 58814 $3,750 56,75 51,683 58.452 24 $280 90 $1.279,76 $6,758 58.452 53.379 $4225 5833.94 32 537 $12.439 $1.821.14 355 $3,452 $12.439 $4 225 56.220 $3.217.29 $910.30 37 $12,439 $6220 $1.608 BB S220 Single or Married Filing Separately Single or Married Filing Separately SO 5238 $0.00 0% $0 5238 50 5119 50.00 SO 0 $0.00 10 $238 $428 $119 $214 SO 00 5119 10- $1,010 519.00 129 $428 $1,010 $214 5505 $1,883 $9 50 12 5214 S88.84 22 $1,010 SSOS $1,883 $942 $4442 22 3.379 5SOS $280.90 249. $3379 $1,883 $942 51.689 $140 56 249 $4226 5942 $639.94 325. $3,379 $4.226 51.689 $10.200 $2,113 $319.84 32 $1,6g $910.90 35% 54.226 $10.200 S2,113 55.104 5455.52 35% $2,113 $3,004 68 37 $10.200 55,104 $1,502 37 37 $5,104 51. $428 SO $359 5630 $1,391 $2,003 $3,499 54.346 $10,328 Head of Household 5359 S0.00 $630 50.00 $1,391 $27/10 $2,003 $118.42 $3,499 5253.06 54346 5612.10 $10.328 5883.14 $2,976.84 09 10% 12 22 24% 32% 35% 37% SO 5359 $630 $1,391 52,003 $3,499 $4,346 $10,328 SO 5179 $315 5696 $1,001 $1,750 $2,173 $5,164 Head of Household $179 50.00 5315 $0.00 $696 $13.50 $1.001 $59.32 $1,750 S126,42 $2.173 $306.18 $5,164 $441,54 $1,488,39 0% 10% 12 229 249 320 359 37. SO 5179 $315 5696 51.001 $1.750 52173 $5,164 The 2020 Percentage Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later BIWEEKLY Payroll Period STANDARD Withholding Rate Schedules (Use these if the box in Step 2 of Form W-4 is NOT checked) Form W-4, Step 2, Checkbox, Withholding Rate Schedules If the Adjusted Wage (Use these if the box in Step 2 of Form W-4 IS checked) of the Amount (line 1h) is: If the Adjusted Wage of the The amount that Amount (line 1h) is: amount that tentative the Adjusted tentative But less amount to the Adjusted Plus this At least Wage than But loss withhold is: amount to Plus this Wage percentage exceeds- At least than withhold is percentage exceeds A B D E A B C D E Married Filing Jointly Married Filing Jointly SO $954 S0.00 096 SO SO $954 $477 $0.00 0% 51,713 SO $0.00 10% 5954 $477 $1,713 $857 $0.00 $4,040 106 5477 $75,90 1296 $1,713 $857 $4,040 S2,020 $7,533 $38.00 12% $857 S355.14 22%. $4,040 $2,020 57,533 $3,766 $177 56 $13,515 22% $2,020 $1.123.60 24% $7,533 $3,766 $13,515 $6.758 5561.68 S16,904 24% $3.766 $2,559.28 329 $13,515 $16,904 $6,758 S8,452 $24,879 $1.279.76 $3,643.76 32% $6.758 35% $16,904 $8,452 $24,879 $12,439 $1,821.84 35% $8,452 $6,435.01 37% $24,879 $12,439 $3,217.29 37% $12.439 Single or Married Filing Separately Single or Married Filing Separately SO $477 $0.00 0% SO $0 $238 $477 5857 $0.00 0 0% $0 $0.00 10% $477 S238 5857 $428 $0.00 $2,020 10% $238 $38.00 12% $857 $428 $2,020 $1,010 $19.00 12% $428 $3.766 $177.56 22% $2,020 $1,010 53,766 $6,758 $1,883 $88.84 22% $1,010 $561.68 24% $3,766 $1,883 56,758 $3,379 $8,452 $280.90 24% $1,883 $1,279.76 32% $6,758 $3,379 $8,452 $639.94 $20,415 $1,821.84 32% $3,379 35% $8,452 $4,226 $10,208 $20,415 $910.98 35% $4,226 56,008,89 37% $20.415 $10,208 $3,004,68 37% $10,208 Head of Household Head of Household 50 $717 0% SO SO 5717 $359 $1,260 $0.00 0% $0 S0.00 10% S717 $359 $630 $0.00 10% $1,250 $2.783 $5430 $359 12% $1,260 $630 $1,391 52.783 $4,000 12% $227.06 $27.10 22% $2.783 $1,391 $2,003 $118.42 $4.006 56,998 22 $1,391 2006.12 24% $4,006 $2,003 $3,499 $253,06 $5.99 58,692 24% $2,003 $1.224:30 325 $6,998 $3,499 $4,346 S612.10 $8.00 $20,65 32% $3.499 $1.75628 35% $8,692 $4,346 $10,328 SPLASS $883.14 35% 56.953 62 54346 37% $20,656 $10,328 $2,976.84 37% Source Carros Revenue Service. $10,328 $4 226 $0.00 5630 of the TAX TABLE A (Continued) 2020 Percentage Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later SEMIMONTHLY Pay Period STANDARD Winding Rate Schedule Form W-4, Step 2. Checkbox, whiding Rate Schedules Use the top of w4a NOT check Une mini Sap 2 Tom W415 If the Adjusted Wage the Adjusted Wage of the And INI The Amount that Amountinin The amount that tentative The Adjusted Santa the Adju But less amount to Pus this Wage But les amount Plus this Wage At least than whalda percentage seeds Al than with haid percentage de D B C D Married Filing Jointly Married Filing Jointly $1,033 50.00 0 50 5517 0.00 30 31.033 $1,054 50.00 104 $1630 5517 SO DO 10% SIT 51856 54.377 $30 12 St. 1928 2.1 14110 54377 $4,372 2100 $400 3192.43 210 10 512170 24 $8.50 5400 97.1 44 245 400 314642 $18,313 52,772 514640 53,154 $1,020 57321 $1313 S02 $3,04740 35% $18313 59,150 $13.470 $1.97340 31 33.150 56,971,13 37 2052 513.470 57.48540 $11.45 in so gasa sa 3517 $ 12.109 54000 57 121 $8.156 S22.117 Single or Married Filing Separately 5517 50.00 0 SRZS 50 00 10% 52.180 541.10 129 $4.00 519242 22 22 S44 24% 59,154 51,366.26 22 $22,117 31,373.28 35 $0.500 37 50 55171 5928 $2.100 $4.00 $7,321 $0.150 522.117 Single or Married Filing Separately 30.00 09 5454 50.00 104 $1,094 320 50 12% $2.040 336.20 33.560 249 $4.57 Sat2 327 511.08 5366 35 35354 SA 10 use 5464 $1.004 4D 51.004 2,040 53.560 54.578 511.05 54.57 511.05 SO $180 50 $777 51365 53,015 34340 57.501 59.417 522377 Head of Household 5777 50.00 51 305 50.00 3015 s 54340 $256.80 57581 S530 59417 51,325.14 122.77 $1,013 56 58,449 06 OL 10% 12 2 24 32 359 37 50 5777 31.365 $3,015 54,340 S7581 59 4121 522 377 562 51,507 $2.170 53.791 54708 $11.19 Head of Household sen 50.00 S2 S0.00 51 507 $29.30 2.170 5128 30 53.791 9374.16 54,706 5600 20 $11.19 $956.64 $324 DO OL 10% 125 22% 24% 32 35% 37% 53 5385 $52 $1.507 2.170 . 54.709 511.125 2020 Percentage Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later MONTHLY Payroll Period STANDARD Withholding Rate Schedules Form W-4, Step 2. Checkbor, Withholding Rate Schedules Use these the box in Step 2 For WAS NOT checked Use these if the box in Slo2 of Form W-4 Schedd the Adjusted Wage of the of the Adjusted Wage of the Amount (line 1h) is The amount that Amount (line This The amount that tentative the Adjusted tentative the Adjusted Butless amount to Plus this Wago But less amount to Plus this Waga Atlant than withheld ist percentage diceeds.. Al laaste than withhold is percentage exceeds c D A C D Married Filing Jointly Married Filing Jointly so 52067 5000 O $0 50 51.030 $0.00 so $2.067 53 713 50.00 10% S2.057 $1,030 $1,656 $0.00 10 $1.00 $2.713 $4.754 $164.00 12 $3,713 $1,550 54.377 82.30 12 51 Ase $8.754 $16521 5760 52 58754 54.377 $8,150 $384.82 547 51621 3283 $9.434 26 24 516,321 58.150 514.542 5121708 249 3818 29293 135.5 $8.54518 32 529 200 $14,642 $18.313 $2.772.70 $14.646 5035 550.004 570458 35% 65 S18313 528 92 5294748 35 313 55394 $13.223 37 3837004 526.952 58 71.13 50 St030 S150 547 3100 51442 110313 5233 Single or Married Filing Separately 11.030 3000 09 $1,056 Sood 10 54377 5-30 125 58 100 35 22 314.640 31.711700 21 S313 2.7278 32% $44233 35 51301340 37 50 $1.000 $1,856 S432 $8.100 $14,643 $18,313 $44.232 so 5517 $828 5.189 4 57321 $9,156 122.117 Single or Married Filing Separately 5517 30.00 5928 50.00 109 $2.189 $41.10 12% 34,080 5192.43 57321 560.44 24 $9.156 51.586 28 32 $22.117 5127348 36 $6,50089 30 5517 $930 12:180 $4.000 57321 31,150 $22.117 sa On 10 10 1.354 52.772 Head of Household SA 100) 33.00 In 1150 15110 11.0 22 24% 30 51.554 52.729 $6.029 59,670 515163 St. 544,754 $0 3777 51.30 $5.018 $4340 37581 $9417 Head of Household $777 $0.00 51.35 30.00 31.015 558 50 4340 $356.60 37.501 $54830 $9.417 3132014 322377 51,913.00 16.440,00 STO 2 33 3 $1.505 $3.013 54340 07.01 39.47 144754 ST3 54754 STO 23 25 31 3 Payroll Accounting TAX TABLES TAX TABLE A (Concluded) 2020 Percentage Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later DAILY Payroll Period STANDARD Withholding Rate Schedules Form W-4, Stop 2, Checkbox, Withholding Rate Schedules (Use these if the box in Step 2 of Form W 4 is NOT checked) (Use these if the box in Step 2 of Form W-4 IS checked) If the Adjusted Wage of the If the Adjusted Wage of the Amount (line 1h) is: The amount that Amount (line 1h) is: The amount that tentative the Adjusted tentative the Adjusted But less amount to Plus this Wago But loss amount to Plus this Wage At least than withhold is: percentage exceeds- At least than withhold is: percentage - exceeds- B D E B D E Married Filing Jointly Married Filing Jointly $0.00 $95.40 $0.00 0% $0.00 $0.00 $47.70 $0.00 0% $0.00 $95.40 $171,30 $0.00 10% $95.40 $47.70 $85.70 $0.00 10% $47.70 $171.30 $404.00 $7.59 12% $171.30 $85.70 $202.00 $3.80 12% $85.70 $404.00 $753.30 $35.51 22% $404.00 $202.00 $376.60 22% $202.00 $753.30 $1,351.50 $112.36 2496 $753,30 $376,60 $675.80 $56.17 24% $376,60 $1,351.50 $1,690.40 $255.93 32% $1.351.50 $845,20 $127.98 32% $675.80 $1.690.40 $2,487.90 $364,38 35% $1.690.40 $845,20 $1,243,90 $182.18 35% $845.20 $2,487.90 $643.50 $2,487.90 $1,243.90 $321.73 37% $1,243.90 $17.76 $675.80 37% $0.00 $47.70 $85.70 $202.00 S376.60 $675.80 $845.20 $2,041.50 Single or Married Filing Separately $47.70 $0.00 0% $85.70 $0.00 10% $202.00 $3.80 12% $376.60 $17.76 22% $675.80 $56.17 24% $845.20 $127.98 32% $2,041.50 $182.18 35% $600.89 37% $0.00 $47.70 $85.70 $202.00 $376.60 $675.80 $845.20 $2,041.50 $0.00 $23.80 $42.80 $101.00 $188.30 $337.90 $422.60 $1,020.80 Single or Married Filing Separately $23.80 $0.00 0% $42.80 $0.00 10% $101.00 $1.90 12% $188.30 $8.88 22% $337.90 $28.09 24% $422.60 $63.99 32% $1,020.80 $91.10 35% $300.47 37% $0.00 $23.80 $42.80 $101.00 $188.30 $337.90 $422.60 $1,020.80 $0.00 $71.70 $126.00 S278.30 $400.60 $699.80 $869.20 $2,065.60 Head of Household $71.70 $0.00 $126.00 $0.00 $278.30 $5.43 $400.60 $23.71 $699.80 $50.61 $869.20 $122.42 $2,065.60 $176.63 $595.37 0% 10% 12% 22% 24% 32% $0.00 $71.70 $126.00 $278.30 $400.60 $699.80 $869.20 $2,065.60 $0.00 $35.90 $63.00 $139.10 $200.30 $349.90 $434.60 $1,032.80 Head of Household $35.90 $0.00 $63.00 $0.00 $139.10 $2.71 $200.30 $11.84 $349.90 $25.31 $434.60 $61.21 $1,032.80 $88.31 $297.68 0% 10% 12% 22% 24% 32% 35% 37% $0.00 $35.90 $63.00 $139.10 $200.30 $349.90 $434.60 $1,032.80 35% 37%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started