Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview with format and formula please with format and formula please Question 2 [25 marks) (A) (16 marks) A company is considering purchasing

Old MathJax webview

with format and formula please

with format and formula please

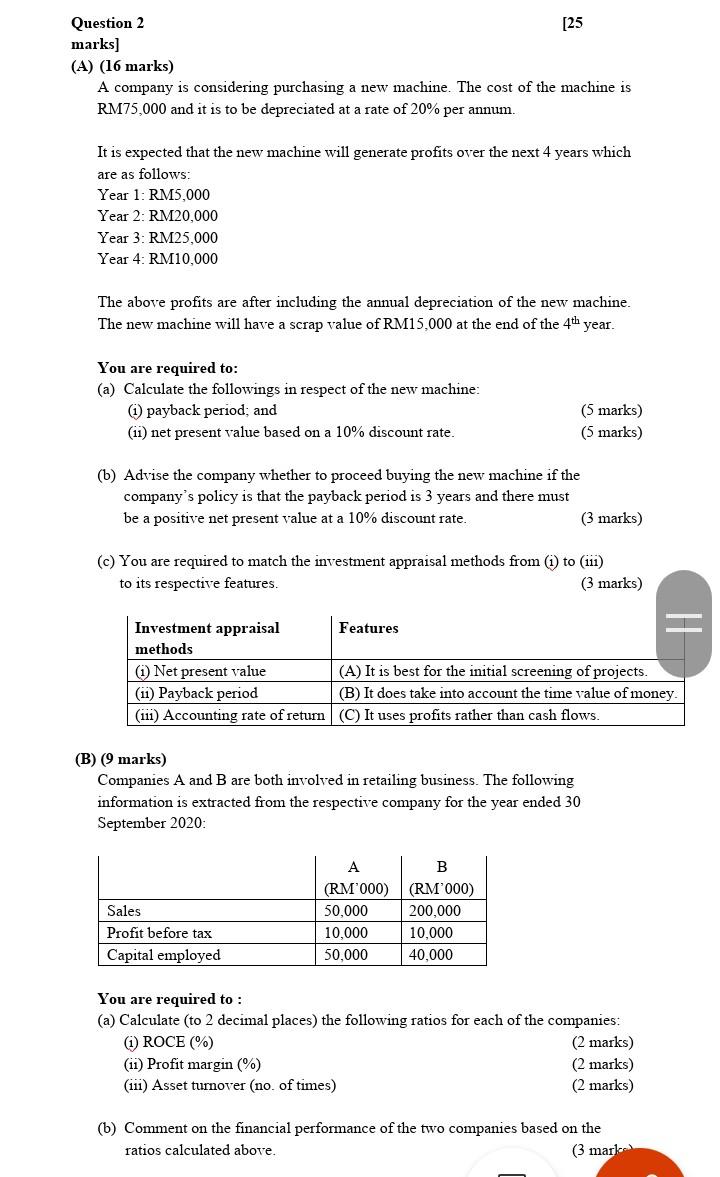

Question 2 [25 marks) (A) (16 marks) A company is considering purchasing a new machine. The cost of the machine is RM75,000 and it is to be depreciated at a rate of 20% per annum. It is expected that the new machine will generate profits over the next 4 years which are as follows: Year 1: RM5,000 Year 2: RM20,000 Year 3: RM25.000 Year 4: RM10,000 The above profits are after including the annual depreciation of the new machine. The new machine will have a scrap value of RM15,000 the end of the 4th year. You are required to: (a) Calculate the followings in respect of the new machine: (1) payback period; and (11) net present value based on a 10% discount rate. (5 marks) (5 marks) (b) Advise the company whether to proceed buying the new machine if the company's policy is that the payback period is 3 years and there must be a positive net present value at a 10% discount rate. (3 marks) (c) You are required to match the investment appraisal methods from (i) to (111) to its respective features. (3 marks) Investment appraisal Features methods (1) Net present value (A) It is best for the initial screening of projects. (1) Payback period (B) It does take into account the time value of money. (111) Accounting rate of return (C) It uses profits rather than cash flows. (B) (9 marks) Companies A and B are both involved in retailing business. The following information is extracted from the respective company for the year ended 30 September 2020 Sales Profit before tax Capital employed A (RM'000) 50,000 10,000 50,000 B (RM'000) 200,000 10,000 40,000 You are required to : (a) Calculate (to 2 decimal places) the following ratios for each of the companies: (1) ROCE (%) (2 marks) (ii) Profit margin (%) (2 marks) (111) Asset turnover (no. of times) (2 marks) (b) Comment on the financial performance of the two companies based on the ratios calculated above. (3 markStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started