Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview would you please answer this for me? this is the last page QUESTION 3 (40 MARKS; 72 MINUTES) Simon (61) and Stacy

Old MathJax webview

would you please answer this for me?

this is the last page

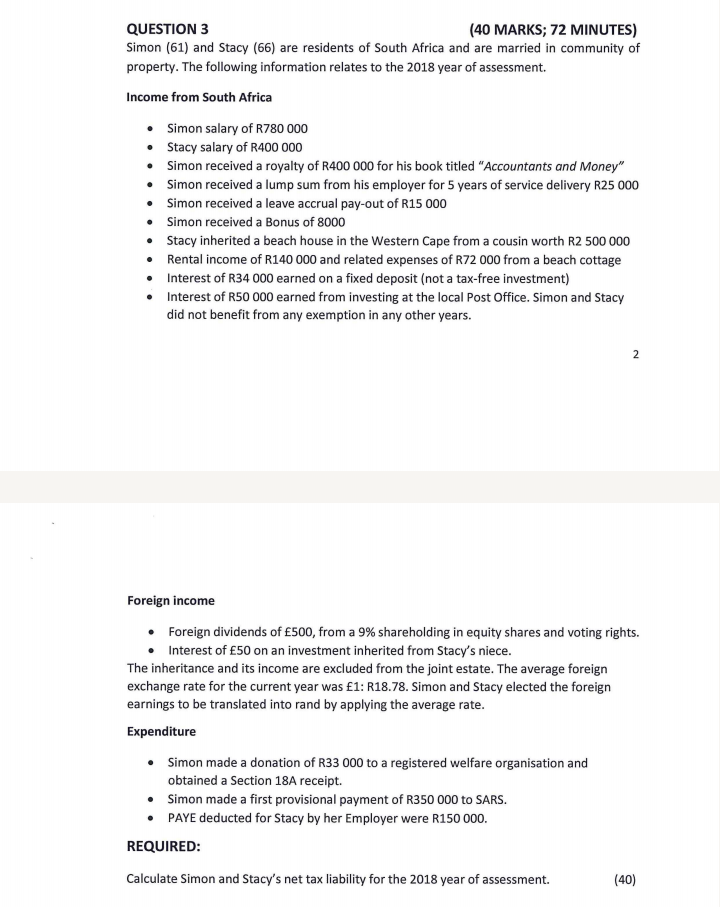

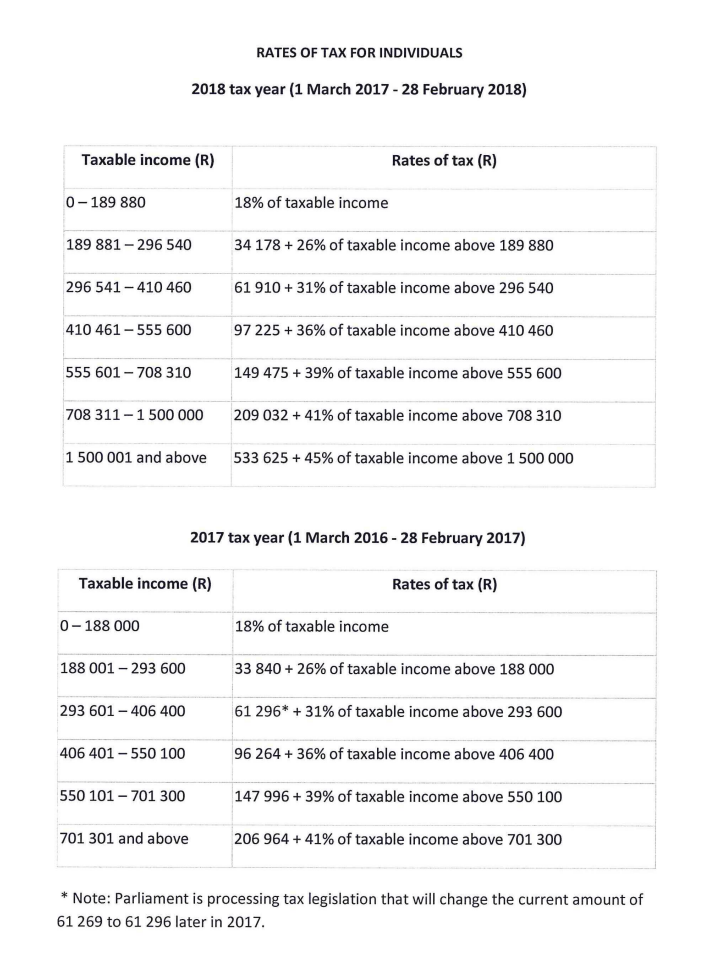

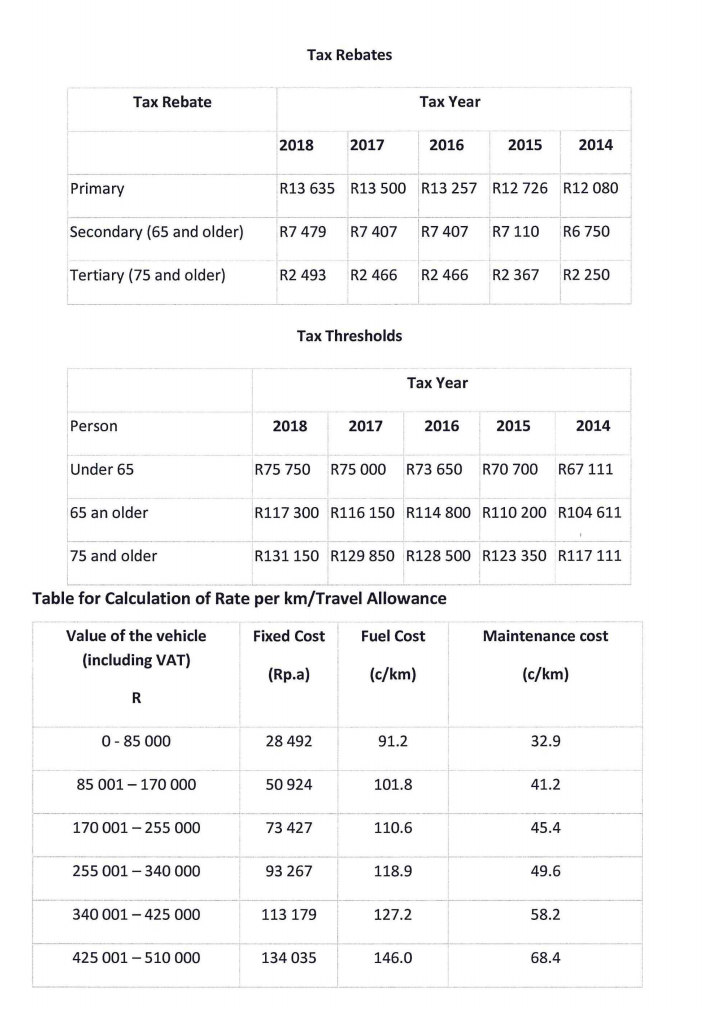

QUESTION 3 (40 MARKS; 72 MINUTES) Simon (61) and Stacy (66) are residents of South Africa and are married in community of property. The following information relates to the 2018 year of assessment. Income from South Africa Simon salary of R780 000 Stacy salary of R400 000 Simon received a royalty of R400 000 for his book titled "Accountants and Money" Simon received a lump sum from his employer for 5 years of service delivery R25 000 Simon received a leave accrual pay-out of R15 000 Simon received a Bonus of 8000 Stacy inherited a beach house in the Western Cape from a cousin worth R2 500 000 Rental income of R140 000 and related expenses of R72 000 from a beach cottage Interest of R34 000 earned on a fixed deposit (not a tax-free investment) Interest of R50 000 earned from investing at the local Post Office. Simon and Stacy did not benefit from any exemption in any other years. 2 Foreign income Foreign dividends of 500, from a 9% shareholding in equity shares and voting rights. Interest of 50 on an investment inherited from Stacy's niece. The inheritance and its income are excluded from the joint estate. The average foreign exchange rate for the current year was 1: R18.78. Simon and Stacy elected the foreign earnings to be translated into rand by applying the average rate. Expenditure Simon made a donation of R33 000 to a registered welfare organisation and obtained a Section 18A receipt. Simon made a first provisional payment of R350 000 to SARS. PAYE deducted for Stacy by her Employer were R150 000. REQUIRED: Calculate Simon and Stacy's net tax liability for the 2018 year of assessment. (40) RATES OF TAX FOR INDIVIDUALS 2018 tax year (1 March 2017 - 28 February 2018) Taxable income (R) Rates of tax (R) 0-189 880 18% of taxable income 189 881-296 540 34 178 +26% of taxable income above 189 880 296 541 - 410 460 61 910 + 31% of taxable income above 296 540 410 461-555 600 97 225 + 36% of taxable income above 410 460 555 601 - 708 310 149 475 + 39% of taxable income above 555 600 708 311-1 500 000 209 032 + 41% of taxable income above 708 310 1 500 001 and above 533 625 + 45% of taxable income above 1 500 000 2017 tax year (1 March 2016 - 28 February 2017) Taxable income (R) Rates of tax (R) 0-188 000 18% of taxable income 188 001-293 600 33 840 + 26% of taxable income above 188 000 293 601 - 406 400 61 296* +31% of taxable income above 293 600 406 401 - 550 100 96 264 + 36% of taxable income above 406 400 550 101 - 701 300 147 996 + 39% of taxable income above 550 100 701 301 and above 206 964 + 41% of taxable income above 701 300 * Note: Parliament is processing tax legislation that will change the current amount of 61 269 to 61 296 later in 2017. Tax Rebates Tax Rebate Tax Year 2018 2017 2016 2015 2014 Primary R13 635 R13 500 R13 257 R12 726 R12 080 Secondary (65 and older) R7 479 R7 407 R7 407 R7 110 R6 750 Tertiary (75 and older) R2 493 R2 466 R2 466 R2 367 R2 250 Tax Thresholds Tax Year Person 2018 2017 2016 2015 2014 Under 65 R75 750 R75 000 R73 650 R70 700 R67 111 65 an older R117 300 R116 150 R114 800 R110 200 R104 611 75 and older R131 150 R129 850 R128 500 R123 350 R117 111 Table for Calculation of Rate per km/Travel Allowance Fixed Cost Fuel Cost Maintenance cost Value of the vehicle (including VAT) (Rp.a) (c/km) (c/km) R 0-85 000 28 492 91.2 32.9 85 001 - 170 000 50 924 101.8 41.2 170 001 - 255 000 73 427 110.6 45.4 255 001 - 340 000 93 267 118.9 49.6 340 001 - 425 000 113 179 127.2 58.2 425 001 - 510 000 134 035 146.0 68.4 QUESTION 3 (40 MARKS; 72 MINUTES) Simon (61) and Stacy (66) are residents of South Africa and are married in community of property. The following information relates to the 2018 year of assessment. Income from South Africa Simon salary of R780 000 Stacy salary of R400 000 Simon received a royalty of R400 000 for his book titled "Accountants and Money" Simon received a lump sum from his employer for 5 years of service delivery R25 000 Simon received a leave accrual pay-out of R15 000 Simon received a Bonus of 8000 Stacy inherited a beach house in the Western Cape from a cousin worth R2 500 000 Rental income of R140 000 and related expenses of R72 000 from a beach cottage Interest of R34 000 earned on a fixed deposit (not a tax-free investment) Interest of R50 000 earned from investing at the local Post Office. Simon and Stacy did not benefit from any exemption in any other years. 2 Foreign income Foreign dividends of 500, from a 9% shareholding in equity shares and voting rights. Interest of 50 on an investment inherited from Stacy's niece. The inheritance and its income are excluded from the joint estate. The average foreign exchange rate for the current year was 1: R18.78. Simon and Stacy elected the foreign earnings to be translated into rand by applying the average rate. Expenditure Simon made a donation of R33 000 to a registered welfare organisation and obtained a Section 18A receipt. Simon made a first provisional payment of R350 000 to SARS. PAYE deducted for Stacy by her Employer were R150 000. REQUIRED: Calculate Simon and Stacy's net tax liability for the 2018 year of assessment. (40) RATES OF TAX FOR INDIVIDUALS 2018 tax year (1 March 2017 - 28 February 2018) Taxable income (R) Rates of tax (R) 0-189 880 18% of taxable income 189 881-296 540 34 178 +26% of taxable income above 189 880 296 541 - 410 460 61 910 + 31% of taxable income above 296 540 410 461-555 600 97 225 + 36% of taxable income above 410 460 555 601 - 708 310 149 475 + 39% of taxable income above 555 600 708 311-1 500 000 209 032 + 41% of taxable income above 708 310 1 500 001 and above 533 625 + 45% of taxable income above 1 500 000 2017 tax year (1 March 2016 - 28 February 2017) Taxable income (R) Rates of tax (R) 0-188 000 18% of taxable income 188 001-293 600 33 840 + 26% of taxable income above 188 000 293 601 - 406 400 61 296* +31% of taxable income above 293 600 406 401 - 550 100 96 264 + 36% of taxable income above 406 400 550 101 - 701 300 147 996 + 39% of taxable income above 550 100 701 301 and above 206 964 + 41% of taxable income above 701 300 * Note: Parliament is processing tax legislation that will change the current amount of 61 269 to 61 296 later in 2017. Tax Rebates Tax Rebate Tax Year 2018 2017 2016 2015 2014 Primary R13 635 R13 500 R13 257 R12 726 R12 080 Secondary (65 and older) R7 479 R7 407 R7 407 R7 110 R6 750 Tertiary (75 and older) R2 493 R2 466 R2 466 R2 367 R2 250 Tax Thresholds Tax Year Person 2018 2017 2016 2015 2014 Under 65 R75 750 R75 000 R73 650 R70 700 R67 111 65 an older R117 300 R116 150 R114 800 R110 200 R104 611 75 and older R131 150 R129 850 R128 500 R123 350 R117 111 Table for Calculation of Rate per km/Travel Allowance Fixed Cost Fuel Cost Maintenance cost Value of the vehicle (including VAT) (Rp.a) (c/km) (c/km) R 0-85 000 28 492 91.2 32.9 85 001 - 170 000 50 924 101.8 41.2 170 001 - 255 000 73 427 110.6 45.4 255 001 - 340 000 93 267 118.9 49.6 340 001 - 425 000 113 179 127.2 58.2 425 001 - 510 000 134 035 146.0 68.4Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started