Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview Yasmin wants the investment to show at least a 7% rate of return. Using the yearly net cash flow figures I calculated,

Old MathJax webview

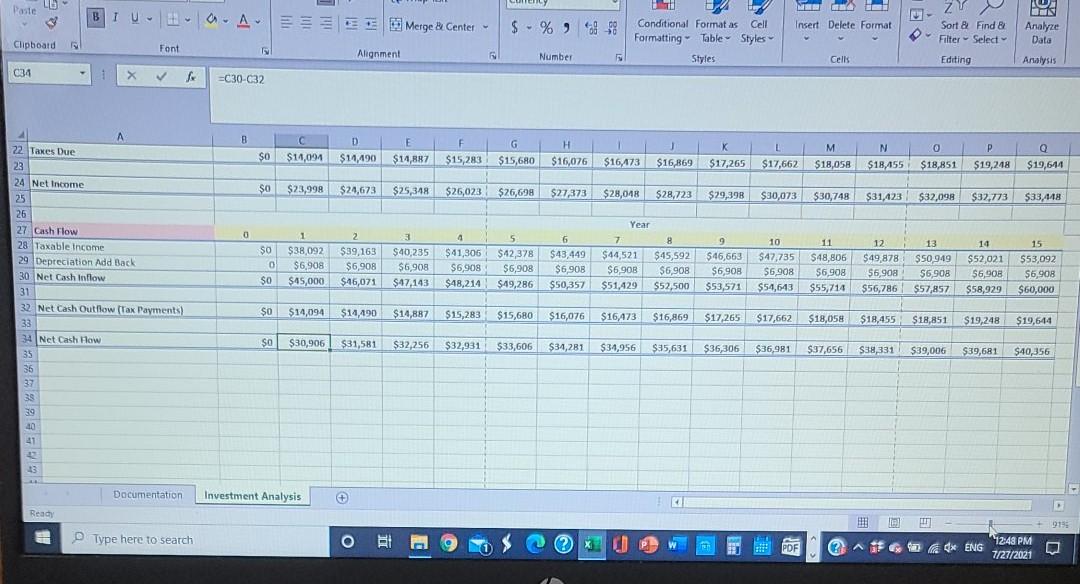

Yasmin wants the investment to show at least a 7% rate of return. Using the yearly net cash flow figures I calculated, calculate the net present value of the investment in the new car wash over its projected 15 years of operation. assume that the initial investment of $350,000 in the building the car wash is made immediately. I need step by step explanation plus answer thanks.

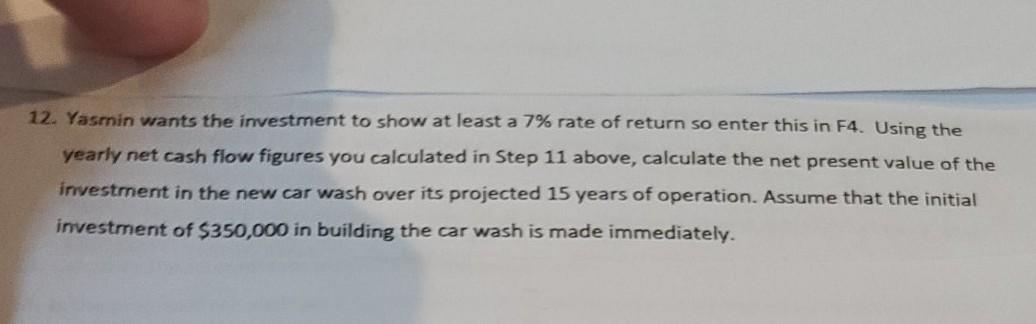

12. Yasmin wants the investment to show at least a 7% rate of return so enter this in F4. Using the yearly net cash flow figures you calculated in Step 11 above, calculate the net present value of the investment in the new car wash over its projected 15 years of operation. Assume that the initial investment of $350,000 in building the car wash is made immediately. Paste 16 LD NI HO BTU - OAE Merge Center $ - % of Insert Delete Format ZY Sort & Find & Filter Select Editing Conditional Format as Cell Formatting Table Styles Styles Clipboard Font Analyze Data Analysis Alignment Number Cells C34 X f =C30-C32 B D $14,490 $0 E $14,887 $14,094 F G $15,283 $15,680 H $16,076 $16,473 $17,265 L $17,662 M $18,058 P $19,248 N 0 $18,455 $18,851 Q $19,614 $16,869 $0 $23,998 $24,673 $25,348 $26,023 $26,698 $27,373 $28,048 $28,723 $29,398 $30,073 $30,748 $31,423 $32,098 $32,773 $33,44 Year 22 Taxes Due 23 24 Net Income 25 26 27 27 Cash Flow 28 Taxable income 29 Depreciation Add Back 30 Net Cash Inflow 31 32 Net Cash Outflow (Tax Payments) 33 34 Net Cash How 0 1 $0 $38,092 0 $6.908 $0 $45,000 2 $39,163 $6,908 $46,071 3 $40,235 $6,908 $47,143 4 $41,300 $6,908 $48.214 5 $42,378 $ $6,908 $49,286 6 $43,449 $6,908 $50,357 7 $44,521 $6,908 $51,429 8 $45,592 $6 908 $52,500 9 $46,663 $6,908 $53,571 10 $47,735 $6,908 $54,643 11 $48,806 $6,908 $55,714 12 $49,878 $6,908 $56,786 13 $50,949 $6,908 $57,857 14 $52,021 56,908 $58,929 15 $53,092 $6.908 $60,000 SO $14,094 $14,490 $14,887 $15,283 $15,680 $16,076 $16,473 $16,869 $17,265 $17,662 $18,058 $18,455 $18,851 $19,248 $19,644 $0 $30,906 $31,581 $32,256 $32,931 $33,606 $34,281 $34,956 $35,631 $36,306 $36,981 $37,656 $38,331 $39,006 $39,681 $40,356 35 36 32 38 39 40 41 42 13 Documentation Investment Analysis Ready Type here to search o Et (?) XP w PDF GA g 3 : (x ENG 12:48 PM 7/27/2021 a

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started