Question

Old Road, Inc., a calendar-year C corporation, made a valid S election effective 1/1/2022. Old Road, Inc. had been a C corporation until 2021

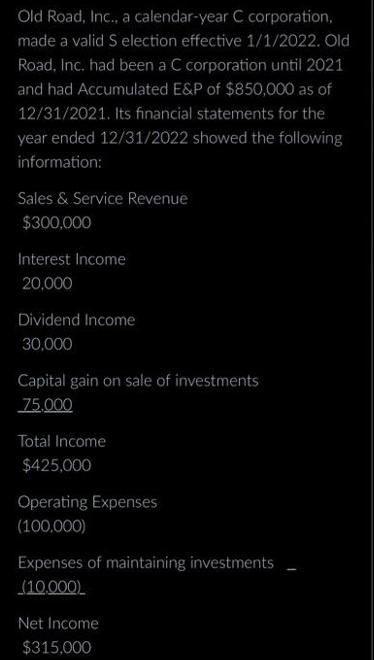

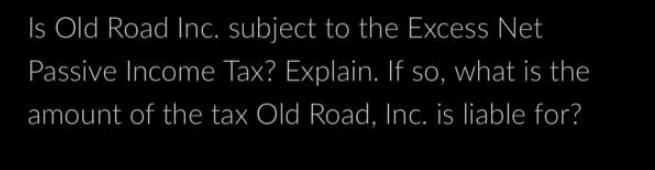

Old Road, Inc., a calendar-year C corporation, made a valid S election effective 1/1/2022. Old Road, Inc. had been a C corporation until 2021 and had Accumulated E&P of $850,000 as of 12/31/2021. Its financial statements for the year ended 12/31/2022 showed the following information: Sales & Service Revenue $300,000 Interest Income 20,000 Dividend Income 30,000 Capital gain on sale of investments 75.000 Total Income $425,000 Operating Expenses (100,000) Expenses of maintaining investments (10,000) Net Income $315,000 Is Old Road Inc. subject to the Excess Net Passive Income Tax? Explain. If so, what is the amount of the tax Old Road, Inc. is liable for?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Old Road Inc made an S corporation election effective 112022 As an S corporation it is subject to ce...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Taxation Of Individuals And Business Entities 2015

Authors: Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

6th Edition

978-1259206955, 1259206955, 77862368, 978-0077862367

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App