Answered step by step

Verified Expert Solution

Question

1 Approved Answer

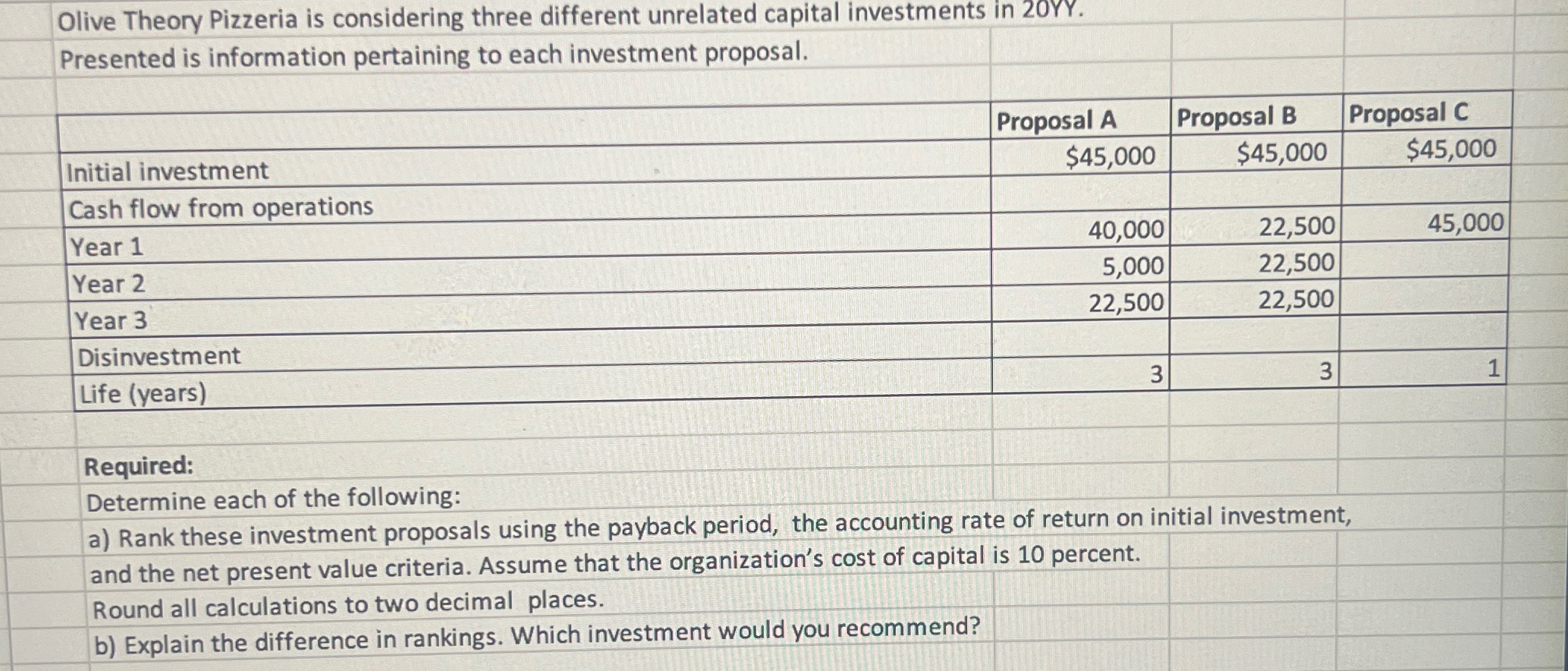

Olive Theory Pizzeria is considering three different unrelated capital investments in 20YY. Presented is information pertaining to each investment proposal. Initial investment Cash flow

Olive Theory Pizzeria is considering three different unrelated capital investments in 20YY. Presented is information pertaining to each investment proposal. Initial investment Cash flow from operations Year 1 Year 2 Year 3 Proposal A Proposal B Proposal C $45,000 $45,000 $45,000 40,000 22,500 45,000 5,000 22,500 22,500 22,500 Disinvestment Life (years) Required: Determine each of the following: 3 3 a) Rank these investment proposals using the payback period, the accounting rate of return on initial investment, and the net present value criteria. Assume that the organization's cost of capital is 10 percent. Round all calculations to two decimal places. b) Explain the difference in rankings. Which investment would you recommend?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Lets calculate the payback period accounting rate of return ARR on initial investment and net pres...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

66425a05dd952_982007.pdf

180 KBs PDF File

66425a05dd952_982007.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started