Answered step by step

Verified Expert Solution

Question

1 Approved Answer

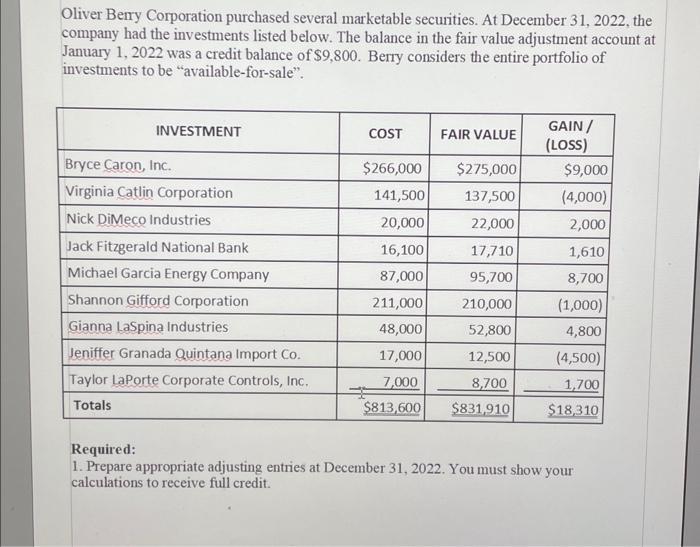

Oliver Berry Corporation purchased several marketable securities. At December 31, 2022, the company had the investments listed below. The balance in the fair value

Oliver Berry Corporation purchased several marketable securities. At December 31, 2022, the company had the investments listed below. The balance in the fair value adjustment account at January 1, 2022 was a credit balance of $9,800. Berry considers the entire portfolio of investments to be "available-for-sale". INVESTMENT Bryce Caron, Inc. Virginia Catlin Corporation Nick DiMeco Industries Jack Fitzgerald National Bank Michael Garcia Energy Company Shannon Gifford Corporation Gianna LaSpina Industries Jeniffer Granada Quintana Import Co. Taylor LaPorte Corporate Controls, Inc. Totals COST $266,000 141,500 20,000 16,100 87,000 211,000 48,000 17,000 7,000 $813,600 3:3 FAIR VALUE $275,000 137,500 22,000 17,710 95,700 210,000 52,800 12,500 8,700 $831,910 GAIN / (LOSS) $9,000 (4,000) 2,000 1,610 8,700 (1,000) 4,800 (4,500) 1,700 $18,310 Required: 1. Prepare appropriate adjusting entries at December 31, 2022. You must show your calculations to receive full credit. Required: 2. Discuss the impact of the unrealized gain or loss on the financial statements three sentences or less.

Step by Step Solution

★★★★★

3.31 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

1 Adjusting Entries at December 31 2022 are as follows Bryce Caron Inc Calculation 275000 Fair Value 266000 Cost 9000 Gain Adjusting Entry Debit Fair ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started