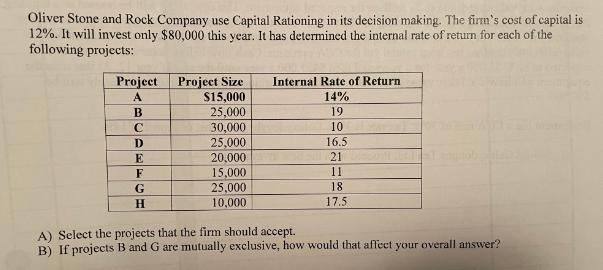

Oliver Stone and Rock Company use Capital Rationing in its decision making. The firm's cost of capital is 12%. It will invest only $80,000

Oliver Stone and Rock Company use Capital Rationing in its decision making. The firm's cost of capital is 12%. It will invest only $80,000 this year. It has determined the internal rate of return for each of the following projects: Project A B C D E F G H Project Size $15,000 25,000 30,000 25,000 20,000 15,000 25,000 10,000 Internal Rate of Return. 14% 19 10 16.5 21 11 18 17.5 A) Select the projects that the firm sho accept. B) If projects B and G are mutually exclusive, how would that affect your overall answer?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine which projects Oliver Stone and Rock Company should accept using capital rationing we n...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started