Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Olivia has just got her accounting degree and started working for Mainely Lobster Inc., a company that is known for their delicious footlong lobster

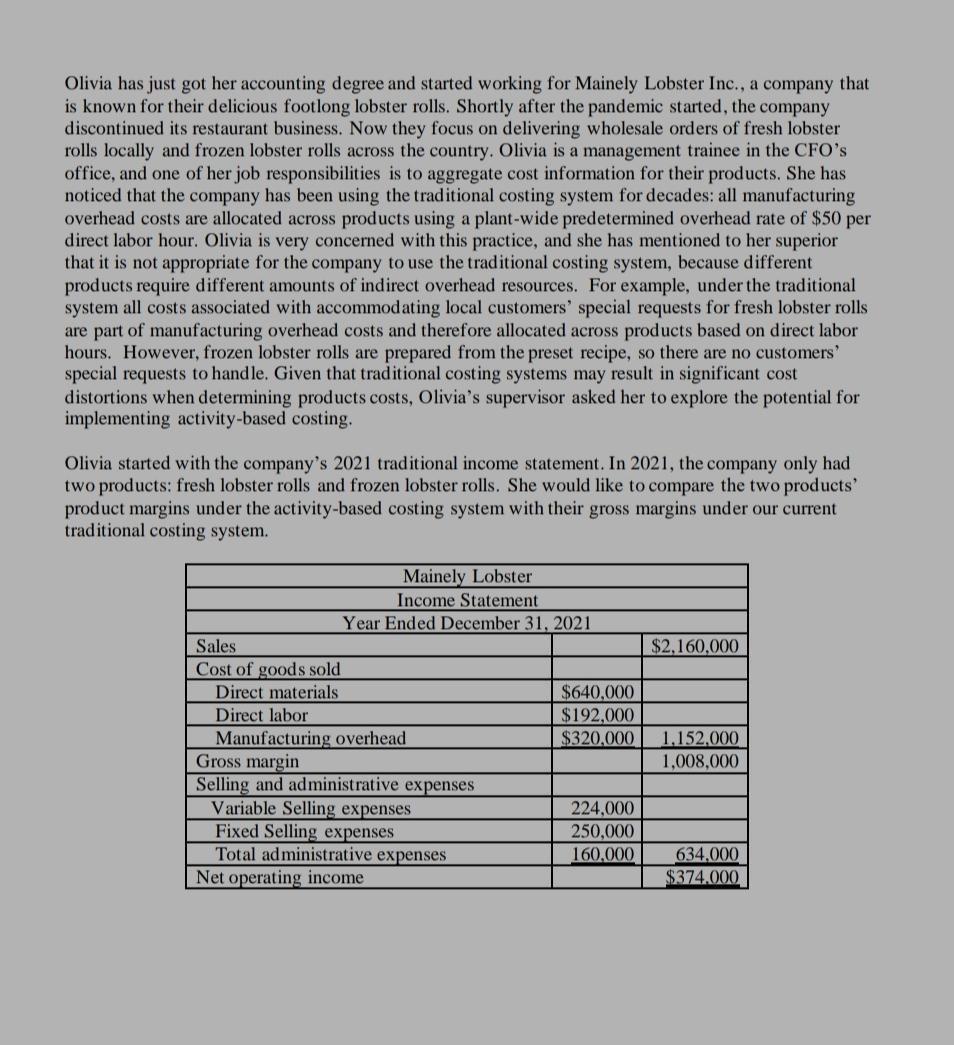

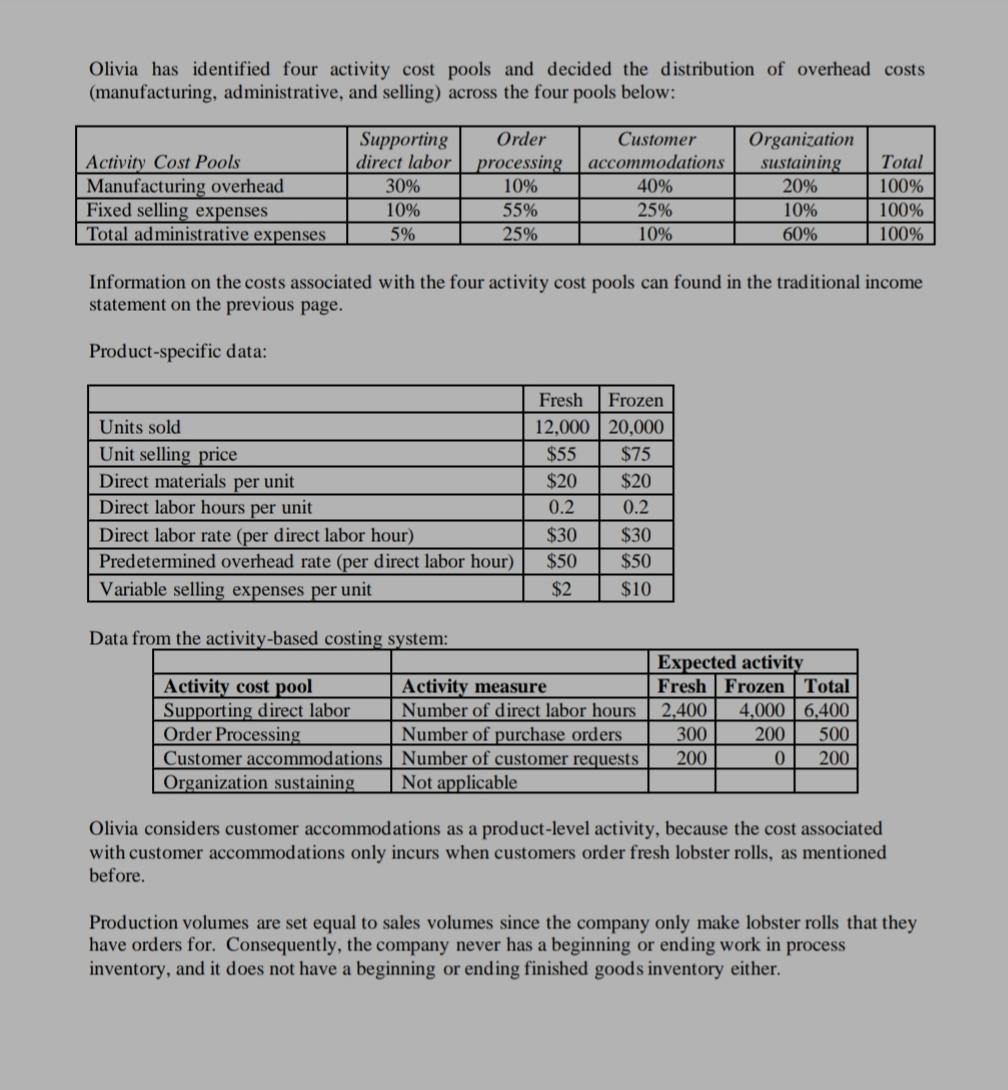

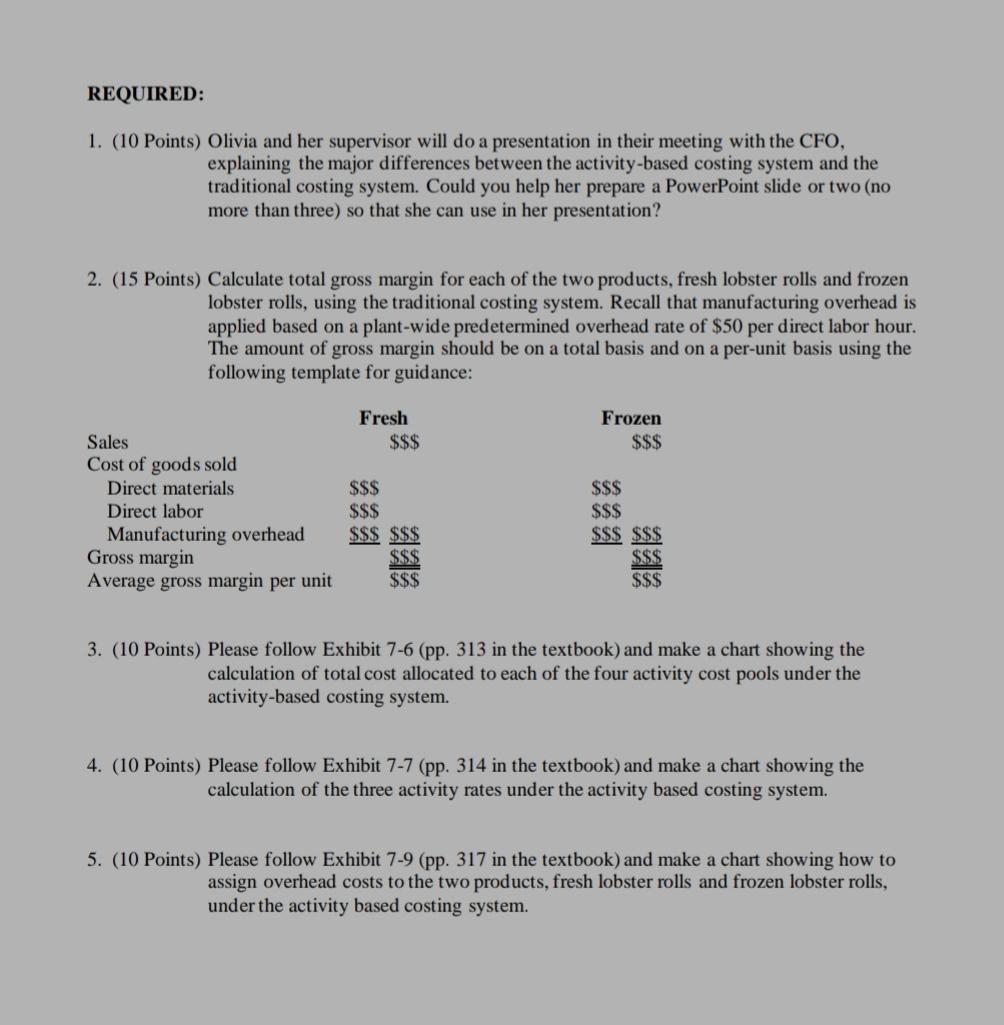

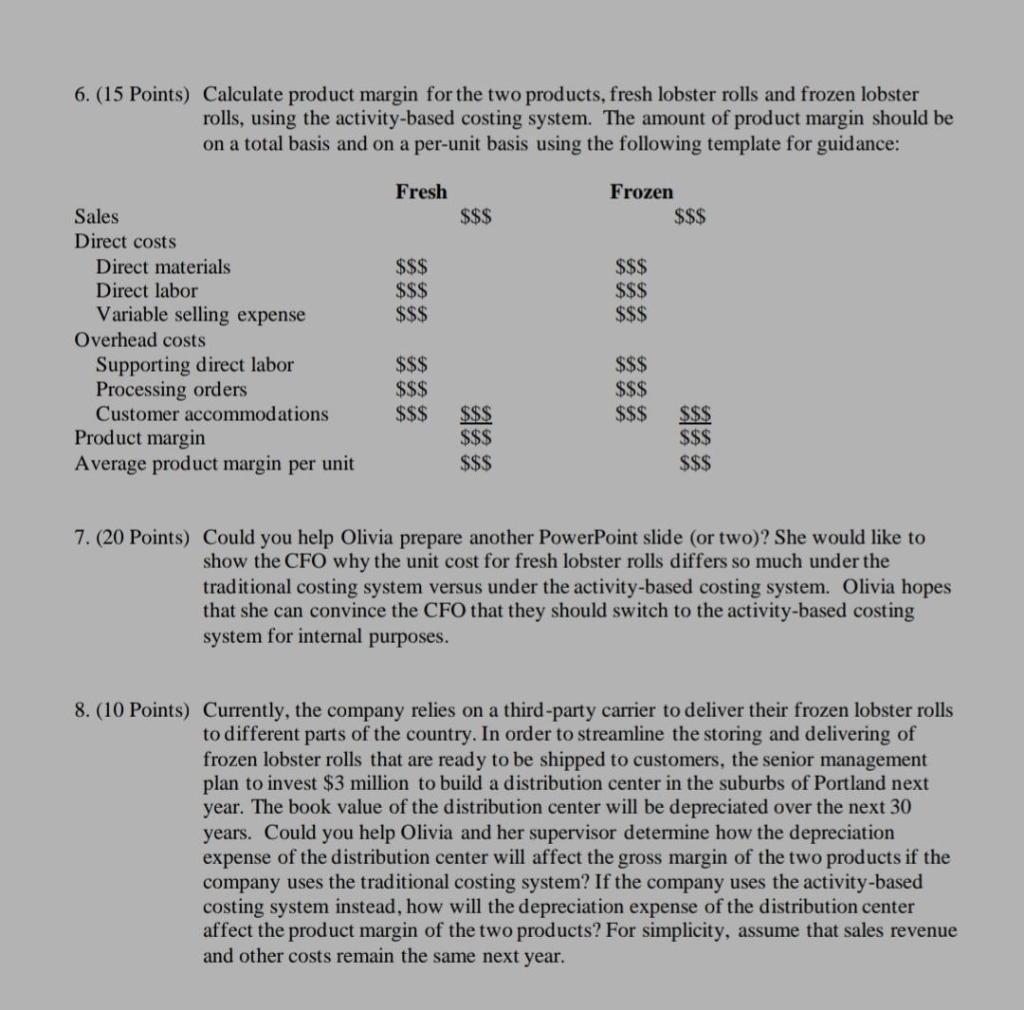

Olivia has just got her accounting degree and started working for Mainely Lobster Inc., a company that is known for their delicious footlong lobster rolls. Shortly after the pandemic started, the company discontinued its restaurant business. Now they focus on delivering wholesale orders of fresh lobster rolls locally and frozen lobster rolls across the country. Olivia is a management trainee in the CFO's office, and one of her job responsibilities is to aggregate cost information for their products. She has noticed that the company has been using the traditional costing system for decades: all manufacturing overhead costs are allocated across products using a plant-wide predetermined overhead rate of $50 per direct labor hour. Olivia is very concerned with this practice, and she has mentioned to her superior that it is not appropriate for the company to use the traditional costing system, because different products require different amounts of indirect overhead resources. For example, under the traditional system all costs associated with accommodating local customers' special requests for fresh lobster rolls are part of manufacturing overhead costs and therefore allocated across products based on direct labor hours. However, frozen lobster rolls are prepared from the preset recipe, so there are no customers' special requests to handle. Given that traditional costing systems may result in significant cost distortions when determining products costs, Olivia's supervisor asked her to explore the potential for implementing activity-based costing. Olivia started with the company's 2021 traditional income statement. In 2021, the company only had two products: fresh lobster rolls and frozen lobster rolls. She would like to compare the two products' product margins under the activity-based costing system with their gross margins under our current traditional costing system. Sales Cost of goods sold Direct materials Direct labor Mainely Lobster Income Statement Year Ended December 31, 2021 Manufacturing overhead Gross margin Selling and administrative expenses Variable Selling expenses Fixed Selling expenses Total administrative expenses Net operating income $640,000 $192,000 $320,000 224,000 250,000 160,000 $2,160,000 1,152,000 1,008,000 634,000 $374.000 Olivia has identified four activity cost pools and decided the distribution of overhead costs (manufacturing, administrative, and selling) across the four pools below: Activity Cost Pools Manufacturing overhead Fixed selling expenses Total administrative expenses Supporting direct labor 30% 10% 5% Units sold Unit selling price Direct materials per unit Direct labor hours per unit Order processing 10% 55% 25% Direct labor rate (per direct labor hour) Predetermined overhead rate (per direct labor hour) Variable selling expenses per unit Data from the activity-based costing system: Activity cost pool Supporting direct labor Order Processing Customer accommodations Organization sustaining Customer accommodations 40% 25% 10% Information on the costs associated with the four activity cost pools can found in the traditional income statement on the previous page. Product-specific data: Fresh Frozen 12,000 20,000 $55 $75 $20 $20 0.2 0.2 $30 $50 $10 $30 $50 $2 Organization sustaining 20% 10% 60% Activity measure Number of direct labor hours Number of purchase orders Number of customer requests Not applicable Total 100% 100% 100% Expected activity Fresh Frozen Total 2,400 4,000 6,400 300 200 500 200 0 200 Olivia considers customer accommodations as a product-level activity, because the cost associated with customer accommodations only incurs when customers order fresh lobster rolls, as mentioned before. Production volumes are set equal to sales volumes since the company only make lobster rolls that they have orders for. Consequently, the company never has a beginning or ending work in process inventory, and it does not have a beginning or ending finished goods inventory either. REQUIRED: 1. (10 Points) Olivia and her supervisor will do a presentation in their meeting with the CFO, explaining the major differences between the activity-based costing system and the traditional costing system. Could you help her prepare a PowerPoint slide or two (no more than three) so that she can use in her presentation? 2. (15 Points) Calculate total gross margin for each of the two products, fresh lobster rolls and frozen lobster rolls, using the traditional costing system. Recall that manufacturing overhead is applied based on a plant-wide predetermined overhead rate of $50 per direct labor hour. The amount of gross margin should be on a total basis and on a per-unit basis using the following template for guidance: Sales Cost of goods sold Direct materials Direct labor Manufacturing overhead Gross margin Average gross margin per unit Fresh $$$. $$$ $$$ $$$ $$$ $$$ $$$ Frozen $$$ $$$ $$$ $$$ $$$ $$$ 3. (10 Points) Please follow Exhibit 7-6 (pp. 313 in the textbook) and make a chart showing the calculation of total cost allocated to each of the four activity cost pools under the activity-based costing system. 4. (10 Points) Please follow Exhibit 7-7 (pp. 314 in the textbook) and make a chart showing the calculation of the three activity rates under the activity based costing system. 5. (10 Points) Please follow Exhibit 7-9 (pp. 317 in the textbook) and make a chart showing how to assign overhead costs to the two products, fresh lobster rolls and frozen lobster rolls, under the activity based costing system. 6. (15 Points) Calculate product margin for the two products, fresh lobster rolls and frozen lobster rolls, using the activity-based costing system. The amount of product margin should be on a total basis and on a per-unit basis using the following template for guidance: Sales Direct costs Direct materials Direct labor Variable selling expense Overhead costs Supporting direct labor Processing orders Customer accommodations Product margin Average product margin per unit Fresh $$$ $$$ $$$ $$$ $$$ $$$ $$$ $$$ Frozen $$$ $$$ $$$ $$$ $$$ $$$ $$$ $$$ $$$ 7. (20 Points) Could you help Olivia prepare another PowerPoint slide (or two)? She would like to show the CFO why the unit cost for fresh lobster rolls differs so much under the traditional costing system versus under the activity-based costing system. Olivia hopes that she can convince the CFO that they should switch to the activity-based costing system for internal purposes. 8. (10 Points) Currently, the company relies on a third-party carrier to deliver their frozen lobster rolls to different parts of the country. In order to streamline the storing and delivering of frozen lobster rolls that are ready to be shipped to customers, the senior management plan to invest $3 million to build a distribution center in the suburbs of Portland next year. The book value of the distribution center will be depreciated over the next 30 years. Could you help Olivia and her supervisor determine how the depreciation expense of the distribution center will affect the gross margin of the two products if the company uses the traditional costing system? If the company uses the activity-based costing system instead, how will the depreciation expense of the distribution center affect the product margin of the two products? For simplicity, assume that sales revenue and other costs remain the same next year.

Step by Step Solution

★★★★★

3.55 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

To answer these questions well need to perform a series of calculations based on both the traditional costing system and the activitybased costing sys...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started