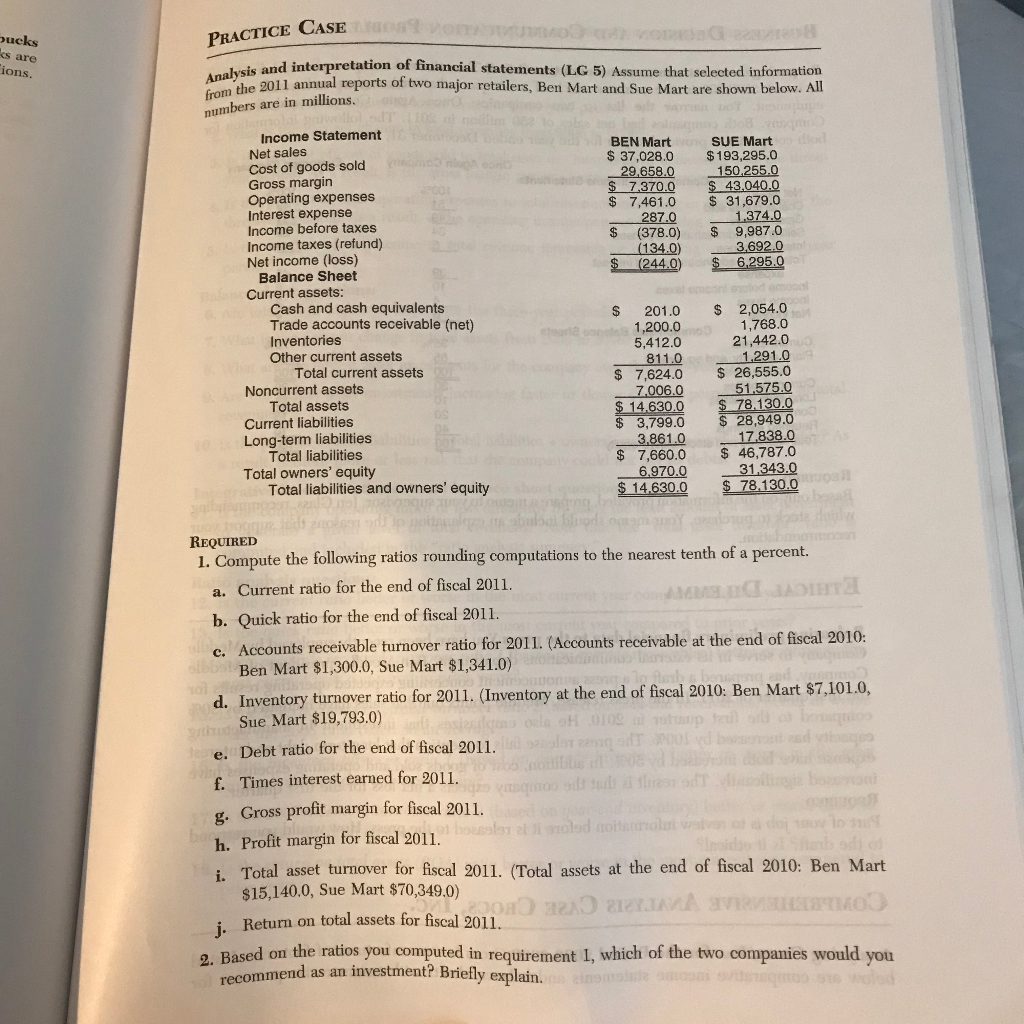

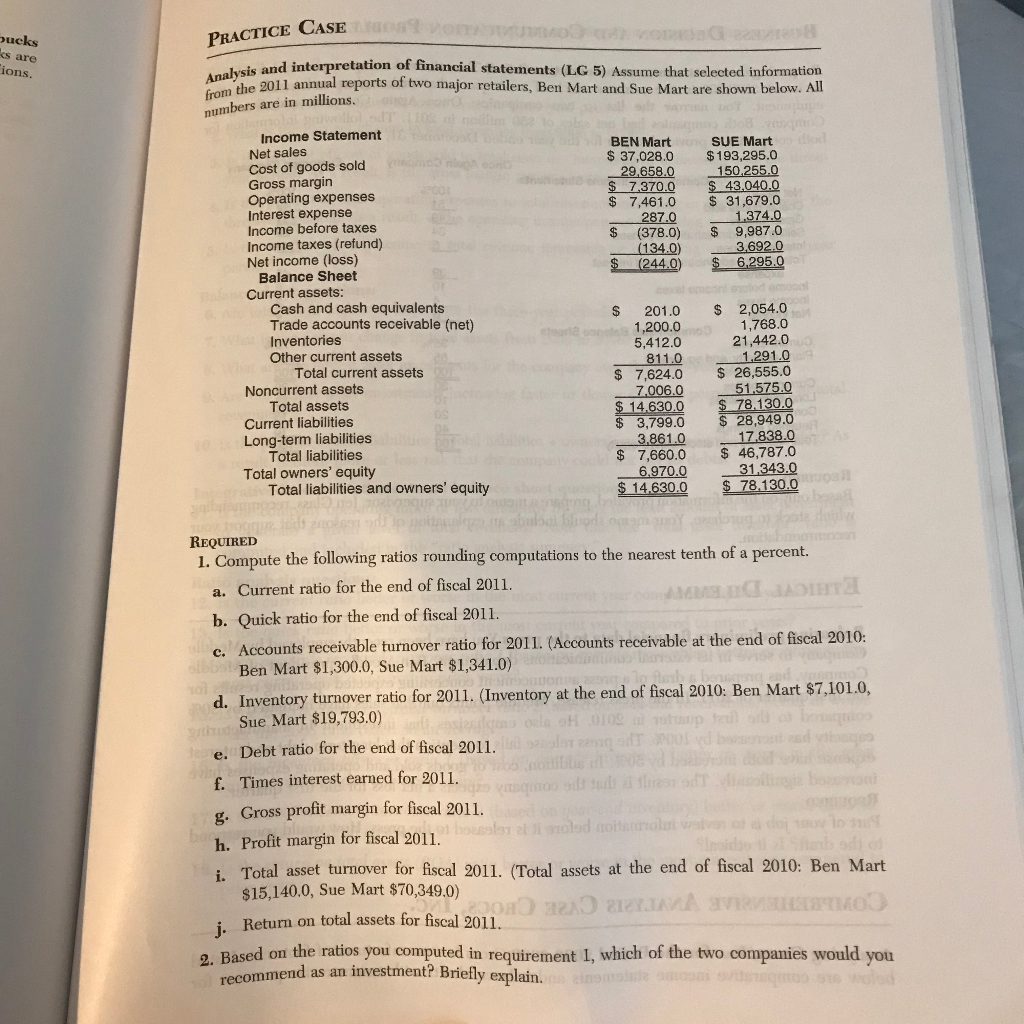

OLKEaGea PRACTICE CASE ucks ks are Analysis and interpretation of financial statements (LG 5) Assume that selected information from the 201l annual reports of two major retailers, Ben Mart and Sue Mart are shown below. All ions. numbers are in millions. vegmo tod Income Statement Net sales Cost of goods sold Gross margin Operating expenses Interest expense Income before taxes Income taxes (refund) Net income (loss) Balance Sheet BEN Mart $37,028.0 29,658.0 $ 7.370.0 $ 7,461.0 287.0 (378.0) (134.0) SUE Mart $193,295.0 150,255.0 $ 43.040.0 31,679.0 1.374.0 9,987.0 3,692.0 S 6.295.0 (244.0) od emooal Current assets: Cash and cash equivalents Trade accounts receivable (net) Inventories Other current assets Total current assets $ 2,054.0 1,768.0 21,442.0 1,291.0 $ 26,555.0 51.575.0 $78.130.0 $ 28,949.0 17.838.0 $ 46,787.0 31.343.0 $78.130.0 201.0 oon 1,200.0 5,412.0 811.0 $ 7.624.0 7,006.0 $ 14.630.0 $ 3,799.0 3,861.0 $ 7,660.0 6,970.0 14.630.0 Noncurrent assets Total assets Current liabilities Long-term liabilities Total liabilities Total owners' equity Total liabilities and owners' equity uoall bea REQUIRED 1. Compute the following ratios rounding computations to the nearest tenth of a percent. Current ratio for the end of fiscal 2011. a. b. Quick ratio for the end of fiscal 2011. AccOunts receivable turnover ratio for 2011. (Accounts receivable at the end of fiscal 2010: Ben Mart $1,300.0, Sue Mart $1.341.0) e C. d. Inventory turnover ratio for 2011. (Inventory at the end of fiscal 2010: Ben Mart $7,101.0, ordSue Mart $19,793,0) e. Debt ratio for the end of fiscal 2011. nsizsdem 0als oH 01O9 tai o o q d 0d b 084 14 d yso 9l b dt teds 2 b f. Times interest earned for 2011 g. Gross profit margin for fiscal 2011. sOu to bousslay at i snolad noit h. Profit margin for fiscal 2011. i, Total asset turnover for fiscal 2011, (Total assets at the end of fiscal 2010: Ben Mart $15,140.0, Sue Mart $70,349.0) j. Return on total assets for fiscal 2011. 2. Based on the ratios you computed in requirement 1, which of the two companies would you recommend as an investment? Briefly explain. aeoisie cion d o od