Question

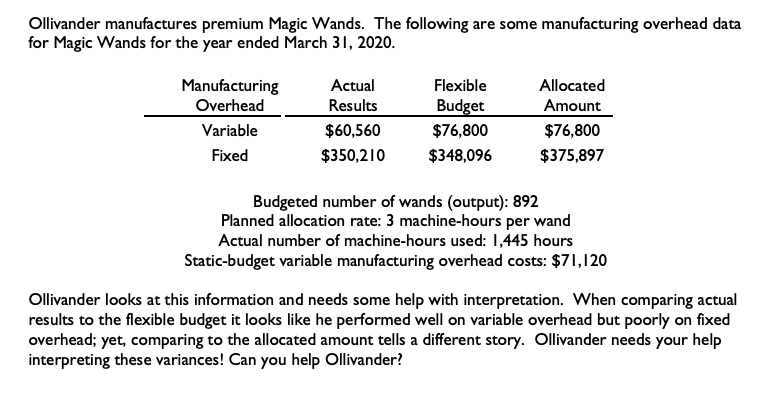

Ollivander manufactures premium Magic Wands. The following are some manufacturing overhead data for Magic Wands for the year ended March 31, 2020. For the year

Ollivander manufactures premium Magic Wands. The following are some manufacturing overhead data for Magic Wands for the year ended March 31, 2020.

-

For the year ended March 2020, compute the variance, indicating whether each is favourable (F) or unfavourable (U).

-

Variable manufacturing overhead efficiency variance

-

Total manufacturing overhead rate variance

-

Production volume variance

-

-

Select any two of the variances calculated and prepare an explanation (or possible explanation) that you would present to the management team. Suggestion: select two of the more significant variances OR select two that are related to eachother,

-

Prepare the journal entry(ies) to record your variances and write them off at the end of the year. Assume the variance accounts are written off to Cost of Goods Sold. Show your work.

-

Before making any adjustments for variances, (ie. The journal entry you wrote in part 3) will net income for the year be over-stated, or under-stated?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started