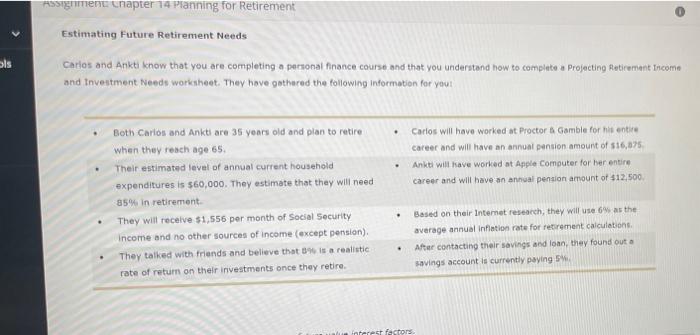

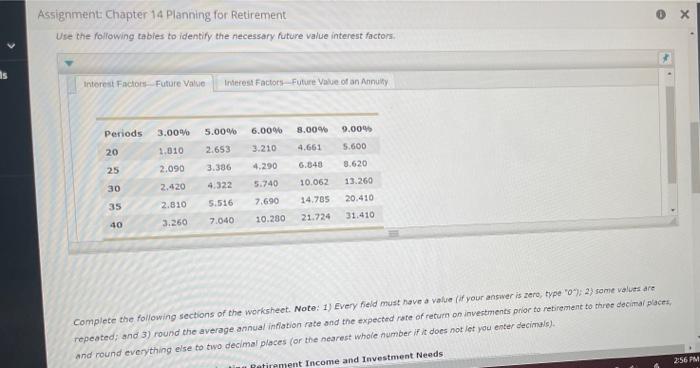

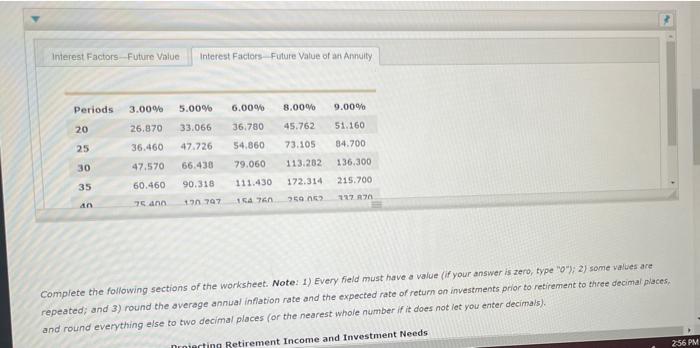

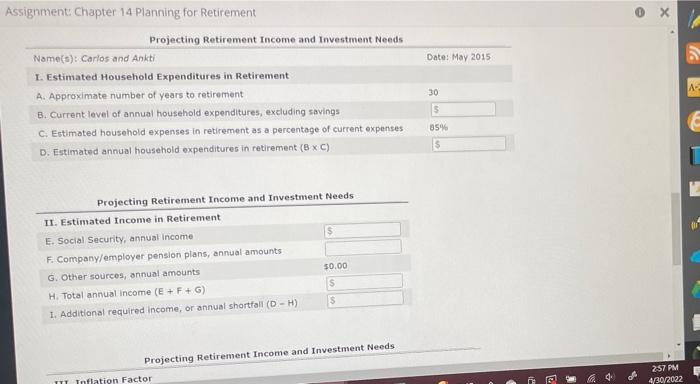

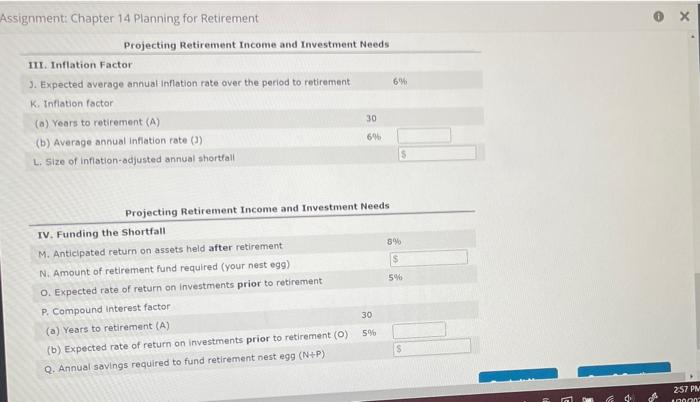

ols Assignment: Chapter 14 Planning for Retirement Estimating Future Retirement Needs Carlos and Ankti know that you are completing a personal finance course and that you understand how to complete a Projecting Retirement Income and Investment Needs worksheet. They have gathered the following information for you: Both Carlos and Ankti are 35 years old and plan to retire when they reach age 65. . Carlos will have worked at Proctor & Gamble for his entire career and will have an annual pension amount of $16,875 Ankti will have worked at Apple Computer for her entire career and will have an annual pension amount of $12,500. . Their estimated level of annual current household expenditures is $60,000. They estimate that they will need 85% in retirement. They will receive $1,556 per month of Social Security income and no other sources of income (except pension). They talked with friends and believe that 8% is a realistic rate of return on their investments once they retire. Based on their Internet research, they will use 6% as the average annual inflation rate for retirement calculations. After contacting their savings and loan, they found out a savings account is currently paying 5% . interest factors. s Assignment: Chapter 14 Planning for Retirement Use the following tables to identify the necessary future value interest factors. Interest Factors Future Value - Interest Factors-Future Value of an Annuity Periods 3.00% 5.00% 6.00% 8.00% 9.00% 20 1.010 2.653 3.210 4.661 5.600 25 2.090 3.306 4.290 6.848 8.620 30 2,420 4.322 5.740 10.062 13.260 35 14.705 20.410 2.810 5.516 3.260 7.690 7.040 10.280 21.724 31.410. 40 Complete the following sections of the worksheet. Note: 1) Every field must have a value (if your answer is zero, type "0"); 2) some values are repeated; and 3) round the average annual inflation rate and the expected rate of return on investments prior to retirement to three decimal places, and round everything else to two decimal places (or the nearest whole number if it does not let you enter decimals). Retirement Income and Investment Needs 2:56 PM Interest Factors Future Value Interest Factors Future Value of an Annuity Periods 9.00% 3.00% 5.00% 6.00% 8.00% 26.870 33.066 36.780 45.762 51.160 20 25 36.460 47.726 54.860 73.105 84.700 30 47.570 66.438 79.060 113.282 136.300 35 60.460 90.318 111.430 172.314 215.700 75 400 250.053 154 760 170 797 40 127 870 Complete the following sections of the worksheet. Note: 1) Every field must have a value (if your answer is zero, type "0"); 2) some values are repeated; and 3) round the average annual inflation rate and the expected rate of return on investments prior to retirement to three decimal places, and round everything else to two decimal places (or the nearest whole number if it does not let you enter decimals). Droiecting Retirement Income and Investment Needs 2:56 PM Assignment: Chapter 14 Planning for Retirement Projecting Retirement Income and Investment Needs Name(s): Carlos and Ankti I. Estimated Household Expenditures in Retirement A. Approximate number of years to retirement B. Current level of annual household expenditures, excluding savings C. Estimated household expenses in retirement as a percentage of current expenses D. Estimated annual household expenditures in retirement (B x C) Projecting Retirement Income and Investment Needs II. Estimated Income in Retirement E. Social Security, annual income $ F. Company/employer pension plans, annual amounts G. Other sources, annual amounts $0.00 $ H. Total annual income (E+ F + G) $ 1. Additional required income, or annual shortfall (D-H) Projecting Retirement Income and Investment Needs III Inflation Factor Date: May 2015 30 $ 85% $ 2:57 PM 4/30/2022 A Assignment: Chapter 14 Planning for Retirement III. Inflation Factor 3. Expected average annual inflation rate over the period to retirement K. Inflation factor. (a) Years to retirement (A) 30 (b) Average annual inflation rate (3) 6% L. Size of inflation-adjusted annual shortfall $ Projecting Retirement Income and Investment Needs IV. Funding the Shortfall M. Anticipated return on assets held after retirement 8% N. Amount of retirement fund required (your nest egg) $ 5% O. Expected rate of return on investments prior to retirement P. Compound Interest factor 30 (a) Years to retirement (A) 5% (b) Expected rate of return on investments prior to retirement (0) Q. Annual savings required to fund retirement nest egg (N+P) Projecting Retirement Income and Investment Needs 6% $ 2:57 PM 100002 ols Assignment: Chapter 14 Planning for Retirement Estimating Future Retirement Needs Carlos and Ankti know that you are completing a personal finance course and that you understand how to complete a Projecting Retirement Income and Investment Needs worksheet. They have gathered the following information for you: Both Carlos and Ankti are 35 years old and plan to retire when they reach age 65. . Carlos will have worked at Proctor & Gamble for his entire career and will have an annual pension amount of $16,875 Ankti will have worked at Apple Computer for her entire career and will have an annual pension amount of $12,500. . Their estimated level of annual current household expenditures is $60,000. They estimate that they will need 85% in retirement. They will receive $1,556 per month of Social Security income and no other sources of income (except pension). They talked with friends and believe that 8% is a realistic rate of return on their investments once they retire. Based on their Internet research, they will use 6% as the average annual inflation rate for retirement calculations. After contacting their savings and loan, they found out a savings account is currently paying 5% . interest factors. s Assignment: Chapter 14 Planning for Retirement Use the following tables to identify the necessary future value interest factors. Interest Factors Future Value - Interest Factors-Future Value of an Annuity Periods 3.00% 5.00% 6.00% 8.00% 9.00% 20 1.010 2.653 3.210 4.661 5.600 25 2.090 3.306 4.290 6.848 8.620 30 2,420 4.322 5.740 10.062 13.260 35 14.705 20.410 2.810 5.516 3.260 7.690 7.040 10.280 21.724 31.410. 40 Complete the following sections of the worksheet. Note: 1) Every field must have a value (if your answer is zero, type "0"); 2) some values are repeated; and 3) round the average annual inflation rate and the expected rate of return on investments prior to retirement to three decimal places, and round everything else to two decimal places (or the nearest whole number if it does not let you enter decimals). Retirement Income and Investment Needs 2:56 PM Interest Factors Future Value Interest Factors Future Value of an Annuity Periods 9.00% 3.00% 5.00% 6.00% 8.00% 26.870 33.066 36.780 45.762 51.160 20 25 36.460 47.726 54.860 73.105 84.700 30 47.570 66.438 79.060 113.282 136.300 35 60.460 90.318 111.430 172.314 215.700 75 400 250.053 154 760 170 797 40 127 870 Complete the following sections of the worksheet. Note: 1) Every field must have a value (if your answer is zero, type "0"); 2) some values are repeated; and 3) round the average annual inflation rate and the expected rate of return on investments prior to retirement to three decimal places, and round everything else to two decimal places (or the nearest whole number if it does not let you enter decimals). Droiecting Retirement Income and Investment Needs 2:56 PM Assignment: Chapter 14 Planning for Retirement Projecting Retirement Income and Investment Needs Name(s): Carlos and Ankti I. Estimated Household Expenditures in Retirement A. Approximate number of years to retirement B. Current level of annual household expenditures, excluding savings C. Estimated household expenses in retirement as a percentage of current expenses D. Estimated annual household expenditures in retirement (B x C) Projecting Retirement Income and Investment Needs II. Estimated Income in Retirement E. Social Security, annual income $ F. Company/employer pension plans, annual amounts G. Other sources, annual amounts $0.00 $ H. Total annual income (E+ F + G) $ 1. Additional required income, or annual shortfall (D-H) Projecting Retirement Income and Investment Needs III Inflation Factor Date: May 2015 30 $ 85% $ 2:57 PM 4/30/2022 A Assignment: Chapter 14 Planning for Retirement III. Inflation Factor 3. Expected average annual inflation rate over the period to retirement K. Inflation factor. (a) Years to retirement (A) 30 (b) Average annual inflation rate (3) 6% L. Size of inflation-adjusted annual shortfall $ Projecting Retirement Income and Investment Needs IV. Funding the Shortfall M. Anticipated return on assets held after retirement 8% N. Amount of retirement fund required (your nest egg) $ 5% O. Expected rate of return on investments prior to retirement P. Compound Interest factor 30 (a) Years to retirement (A) 5% (b) Expected rate of return on investments prior to retirement (0) Q. Annual savings required to fund retirement nest egg (N+P) Projecting Retirement Income and Investment Needs 6% $ 2:57 PM 100002