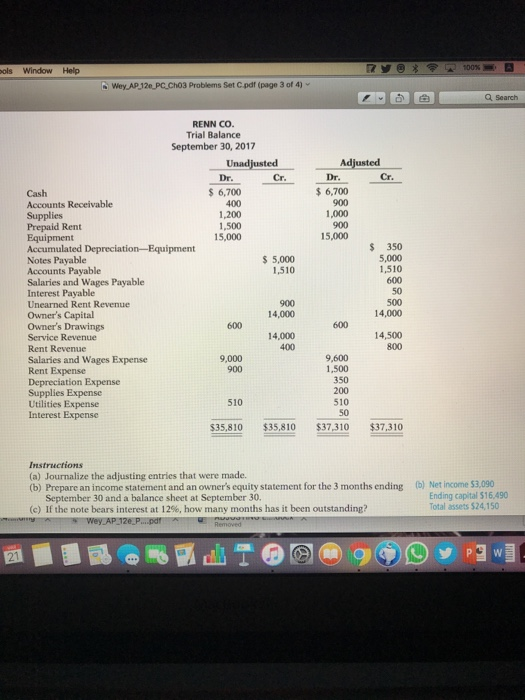

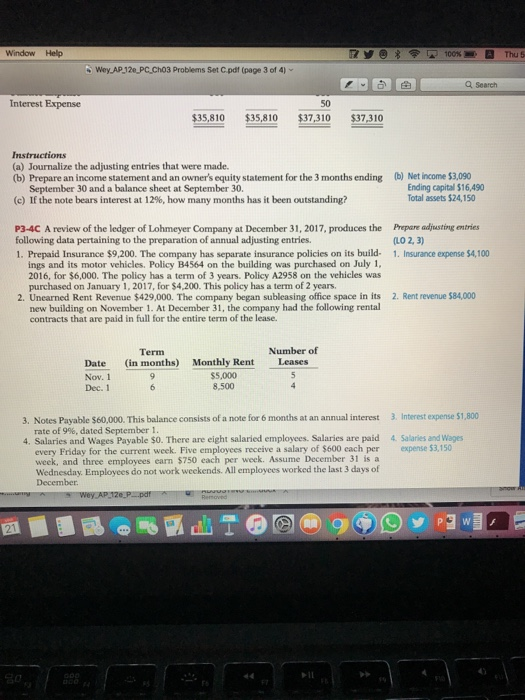

ols Window Help Wey AP 12e PC.Ch03 Problems Set C pdr (page 3 of 4) v Q Search RENN CO Trial Balance September 30, 2017 Unadjusted Adjusted Dr $6,700 1,000 15,000 Cr Cr 6,700 400 1,200 1,500 15,000 Accounts Receivable Supplies Prepaid Rent Equipment Accumulated Depreciation-Equipment Notes Payable Accounts Payable Salaries and Wages Payable Interest Payable Unearned Rent Revenue Owner's Capital Owner's Drawings Service Revenue Rent Revenue Salaries and Wages Expense Rent Expense $ 350 5,000 1,510 600 50 500 14,000 5,000 1,510 900 14,000 600 600 14,000 400 14,500 800 9,000 900 9,600 1,500 350 200 510 Supplies Expense Utilities Expense Interest Expense 510 $35,810 $35,810 $37,310 $37,310 Instructions (a) Journalize the adjusting entries that were made. (b) Prepare an income statement and an owner's equity statement for the 3 months ending (b) Net income $3,090 September 30 and a balance sheet at September 30. (c) If the note bears interest at 12%, how many months has it been outstanding? Ending capital $16,490 Total assets $24,150 Window Help Wey AP 12e PC Ch03 Problems Set C.pdf (page 3 of 4) 1 Q Search Interest Expense S0 $35,810 $35,810 37,310 $37.310 Instructions (a) Journalize the adjusting entries that were made. (b) Prepare an income statement and an owners equity statement for the 3 months ending (b) Net income $3,090 September 30 and a balance sheet at September 30 (c) If the note bears interest at 12%, howmany months has it been outstanding? Ending capital $16,490 Total assets $24,150 P3-4C A review of the ledger of Lohmeyer Company at December 31, 2017, produces the Prepare adjusting entries following data pertaining to the preparation of annual adjusting entries. 1. Prepaid Insurance $9,200. The company has separate insurance policies on its build- 1. Insurance expense $4,100 2.3) ings and its motor vehicles. Policy B4564 on the building was purchased on July 1, 2016, for $6,000. The policy has a term of 3 years. Policy A2958 on the vehicles was purchased on January 1, 2017, for $4,200. This policy has a term of 2 years. 2. Unearned Rent Revenue $429,000. The company began subleasing office space in its 2. Rent revenue $84,000 new building on November 1. At December 31, the company had the following rental contracts that are paid in full for the entire term of the lease. Number of Term (in months) Monthly Rent 5,000 ,500 Leases Date Nov. 1 Dec. 1 3. Notes Payable $60,000. This balance consists of a note for 6 months at an annual interest 3. Interest expense $1,800 4. Salaries and Wages Payable $0. There are eight salaried employees. Salaries are paid 4 Salaries and Wages rate of 9%, dated September i every Friday for the current week. Five employees receive a salary of $600 each per week, and three employees earn $750 each per week. Assume December 31 is a Wednesday. Employees do not work weekends. All employees worked the last 3 days of December expense $3,150 Ph