Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Om and was rented to a local accountant for $1,200 per month. At the time of the conversion, the FMV of the building was

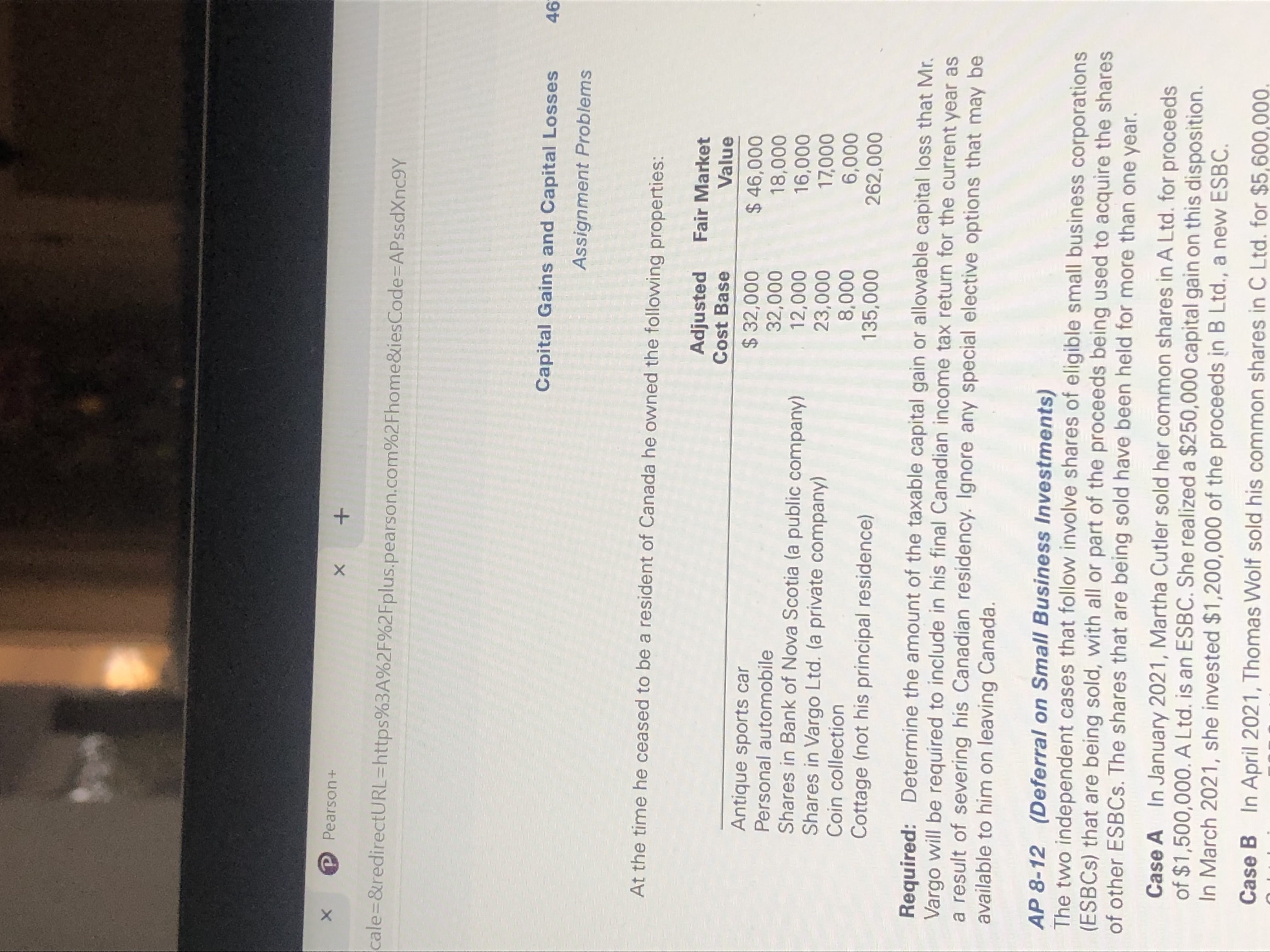

Om and was rented to a local accountant for $1,200 per month. At the time of the conversion, the FMV of the building was $360,000. The FMV of the land was unchanged. Based on the amount of floor space allocated to the office, Miss Coos calculated that 30% of the building was converted into office space. On January 1, 2021, the office was rented by a new tenant who did not require the same amount of floor space as the previous tenant. As a result, one room was converted back to personal use. This room represented 10% of the total floor space, and the FMV of the building was $420,000 at this time. The FMV of the land remains the same at $90,000. Required: What is the maximum CCA that can be deducted in 2019, 2020, and 2021? In addition, indicate any capital gains or capital losses that will result from the changes in use. AP 8-11 (Departure from Canada) Mr. Mark Vargo has been a resident of Canada all of his life. He was recently offered a lucrative job with a reputable firm in Washington, DC. After careful consideration he has decided to make the move and sever his Canadian residency. 18. hp 12 pr X P Pearson+ X + cale=&redirectURL=https%3A%2F%2Fplus.pearson.com%2Fhome&iesCode=APssdXnc9Y Antique sports car Personal automobile At the time he ceased to be a resident of Canada he owned the following properties: Adjusted Cost Base Fair Market Value $ 32,000 32,000 12,000 23,000 8,000 135,000 Capital Gains and Capital Losses Assignment Problems Shares in Bank of Nova Scotia (a public company) Shares in Vargo Ltd. (a private company) Coin collection Cottage (not his principal residence) $ 46,000 18,000 16,000 17,000 6,000 262,000 Required: Determine the amount of the taxable capital gain or allowable capital loss that Mr. Vargo will be required to include in his final Canadian income tax return for the current year as a result of severing his Canadian residency. Ignore any special elective options that may be available to him on leaving Canada. AP 8-12 (Deferral on Small Business Investments) The two independent cases that follow involve shares of eligible small business corporations (ESBCs) that are being sold, with all or part of the proceeds being used to acquire the shares of other ESBCs. The shares that are being sold have been held for more than one year. Case A In January 2021, Martha Cutler sold her common shares in A Ltd. for proceeds of $1,500,000. A Ltd. is an ESBC. She realized a $250,000 capital gain on this disposition. In March 2021, she invested $1,200,000 of the proceeds in B Ltd., a new ESBC. Case B In April 2021, Thomas Wolf sold his common shares in C Ltd. for $5,600,000. 46

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To solve this problem we need to calculate the maximum cost recovery CC that can be deducted in 2019 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started