Answered step by step

Verified Expert Solution

Question

1 Approved Answer

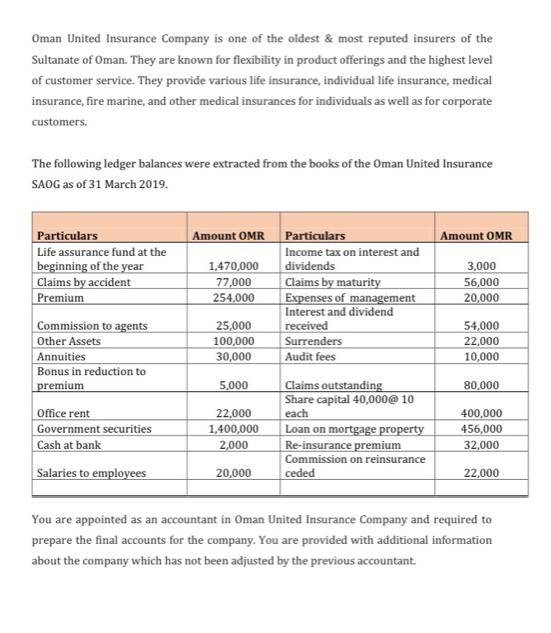

Oman United Insurance Company is one of the oldest & most reputed insurers of the Sultanate of Oman. They are known for flexibility in

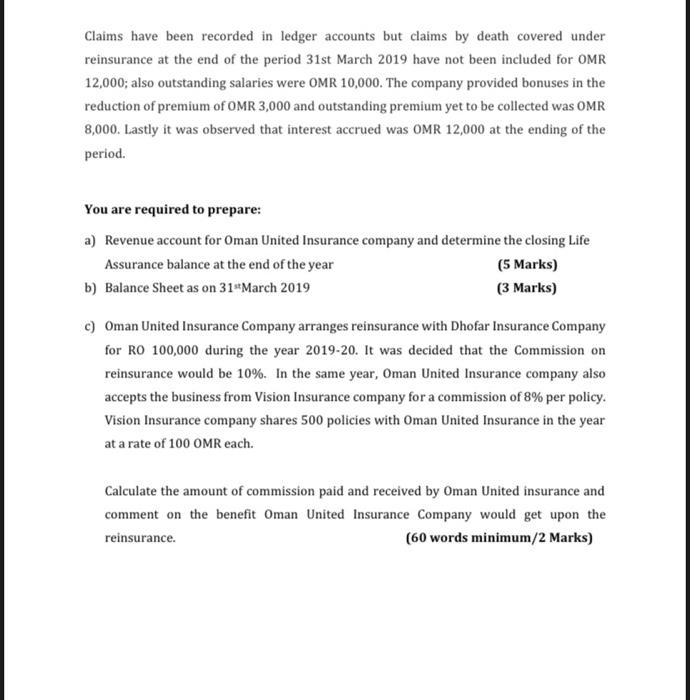

Oman United Insurance Company is one of the oldest & most reputed insurers of the Sultanate of Oman. They are known for flexibility in product offerings and the highest level of customer service. They provide various life insurance, individual life insurance, medical insurance, fire marine, and other medical insurances for individuals as well as for corporate customers. The following ledger balances were extracted from the books of the Oman United Insurance SAOG as of 31 March 2019. Particulars Life assurance fund at the beginning of the year Claims by accident Premium Commission to agents Other Assets Annuities Bonus in reduction to premium Office rent Government securities Cash at bank Salaries to employees Amount OMR 1,470,000 77,000 254,000 25,000 100,000 30,000 5,000 22,000 1,400,000 2,000 20,000 Particulars Income tax on interest and dividends Claims by maturity Expenses of management Interest and dividend received Surrenders Audit fees Claims outstanding Share capital 40,000@ 10 each Loan on mortgage property Re-insurance premium Commission on reinsurance ceded Amount OMR 3,000 56,000 20,000 54,000 22,000 10,000 80,000 400,000 456,000 32,000 22,000 You are appointed as an accountant in Oman United Insurance Company and required to prepare the final accounts for the company. You are provided with additional information about the company which has not been adjusted by the previous accountant. Claims have been recorded in ledger accounts but claims by death covered under reinsurance at the end of the period 31st March 2019 have not been included for OMR 12,000; also outstanding salaries were OMR 10,000. The company provided bonuses in the reduction of premium of OMR 3,000 and outstanding premium yet to be collected was OMR 8,000. Lastly it was observed that interest accrued was OMR 12,000 at the ending of the period. You are required to prepare: a) Revenue account for Oman United Insurance company and determine the closing Life Assurance balance at the end of the year b) Balance Sheet as on 31st March 2019 (5 Marks) (3 Marks) c) Oman United Insurance Company arranges reinsurance with Dhofar Insurance Company for RO 100,000 during the year 2019-20. It was decided that the Commission on reinsurance would be 10%. In the same year, Oman United Insurance company also accepts the business from Vision Insurance company for a commission of 8% per policy. Vision Insurance company shares 500 policies with Oman United Insurance in the year at a rate of 100 OMR each. Calculate the amount of commission paid and received by Oman United insurance and comment on the benefit Oman United Insurance Company would get upon the reinsurance. (60 words minimum/2 Marks)

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a Oman United Insurance Company Revenue Account as on 31032019 Particulars Amount Premium earned Net ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started