Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Omar Bhd trades with Amar Bhd and during the current year, Omar Bhd sold goods for RM 500,00 to Amar Bhd. Omar Bhd sold

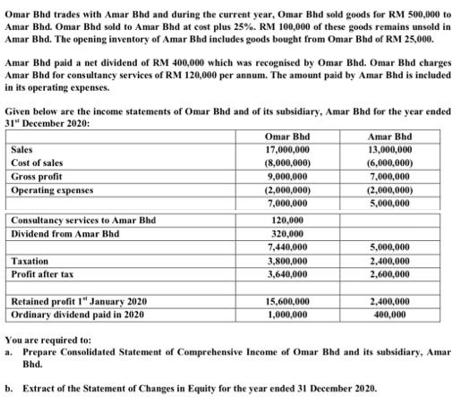

Omar Bhd trades with Amar Bhd and during the current year, Omar Bhd sold goods for RM 500,00 to Amar Bhd. Omar Bhd sold to Amar Bhd at cost plus 25%. RM 100,000 of these goods remains unsold in Amar Bhd. The opening inventory of Amar Bhd includes goods bought from Omar Bhd of RM 25,000. Amar Bhd paid a net dividend of RM 400,000 which was recognised by Omar Bhd. Omar Bhd charges Amar Bhd for consultancy services of RM 120,000 per annum. The amount paid by Amar Bhd is included in its operating expenses. Given below are the income statements of Omar Bhd and of its subsidiary, Amar Bhd for the year ended 31" December 2020: Omar Bhd Amar Bhd Sales 17,000,000 13,000,000 Cost of sales Gross profit (8,000,000) 9,000,000 (2,000,000) 7,000,000 (6,000,000) 7,000,000 Operating espenses (2,000,000) 5,000,000 Consultancy services to Amar Bhd 120,000 Dividend from Amar Bhd 320,000 7,440,000 5,000,000 Tasation 3,800,000 3,640,000 2,400,000 Profit after tax 2,600,000 Retained profit I" January 2020 Ordinary dividend paid in 2020 15,600,000 2,400,000 1,000,000 400,000 You are required to: a. Prepare Consolidated Statement of Comprehensive Income of Omar Bhd and its subsidiary, Amar Bhd. b. Extract of the Statement of Changes in Equity for the year ended 31 December 2020.

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a In the books of Omar Bhd Consolidated Statement of Comprehensive Income For the financial year ended 31 December 2020 Particulars Note Amount in RM Continuing Operations Sales 1 3000000000 Cost of s...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6361cc3bdb9da_236103.pdf

180 KBs PDF File

6361cc3bdb9da_236103.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started