Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Omar Mohamed, CEO of Memories Company, concluded his meeting with a group of senior managers of the company in November 2021, where they discussed the

Omar Mohamed, CEO of Memories Company, concluded his meeting with a group of senior managers of the company in November 2021, where they discussed the budget plans for the next year, and at its conclusion the following came: I have decided to go ahead and buy the robots - the robot - that we talked about. From next year, I expect it will take most of the year to train workers and organize production processes to take full advantage of the new equipment.

Managers asked many questions. One of them focused on how the company would finance the equipment. Mr. Omar Muhammad Al Mohannadi presented his plan as follows: The robot will cost the facility an amount of 950,000 Qatari riyals. Additional equipment will also be purchased at a value of 50,000 Qatari riyals to operate the robot and that the facility will finance these purchases with a loan of value 1,000,000 Qatari riyals from "Shark Pay" a bank, and I negotiated with her on how to repay the loan as the loan will be repaid on the basis of four equal installments payable on the last day of each quarter at an interest rate of 10%. Interest is also paid every three months. . On the basis of the aforementioned, the meeting was concluded and the budget preparation process commenced.

Memories Company is one of the most important Qatari companies that manufacture metal picture frames. The company manufactures two production lines of tires: a small tire production line called "S", measuring 12 cm x 18 cm, and a large tire production line, called "L", measuring 20 cm x 25 cm. For the manufacture of these frames, primary raw materials are used, which are flexible metal strips of 23 cm x 60 cm, made of glass sheets. Each S tire requires 2 m (2/3 m) of metal tape and L 1 m (1 m).

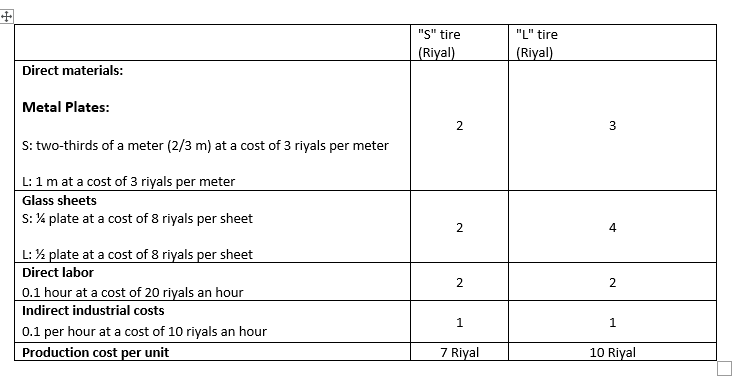

One pane of glass can be used to make four "S" frames or two "L" frames. Other raw materials, such as cardboard, are indirect and insignificant due to the fact that they are inexpensive.

Fatima Al-Zahra, who currently holds the position of the company's accountant, prepares the annual budget for the next year (2022) and collects the following information:

1. Sales in the last quarter of this year are expected to be as follows: 50,000 "S" tires and 40,000 "L" tires. The sales manager expects that over the next two years, sales in each production line will increase by 5,000 units per quarter. A year compared to the previous quarter, for example, it is expected that sales of "S" tires in the first quarter of next year's budget (2021) will be 55,000 units. 2. Based on previous years' sales of Memories Company, it was found that 60% of total sales are account sales, and the rest (40%) are cash sales. The company's experience shows that 80% of the sales on the account are collected during the quarter in which the sales are made, while the remaining 20% is collected in the next quarter, and there are no bad debts.

3. The sale price of a S tire is 10 riyals per unit, and the sale price of a L model is 15 riyals per unit. These prices are fixed and do not change throughout the year. 4. The director of the memories production company tries to make the last-period stock of finished goods at the end of each quarter sufficient to cover 20% of the next quarter's sales. An attempt is also made that the stock of glass panels at the end of each quarter equals 20% of the glass panels requirements for the following quarter. Because the metal bands are purchased locally, the memories company purchases them just in time, so there is hardly any stock at the end of the period.

5. All purchases of direct materials of the Memories Company are on the account. 80% of the purchases of each quarter are paid in cash during the same quarter in which the purchases are made, and the remaining 20% are paid in the next quarter. 6. Indirect materials are purchased for cash as needed. 7. There is no stock of goods in progress. 8. Projected manufacturing costs (in Qatari Riyals) for each product in the budget for the year as follows:

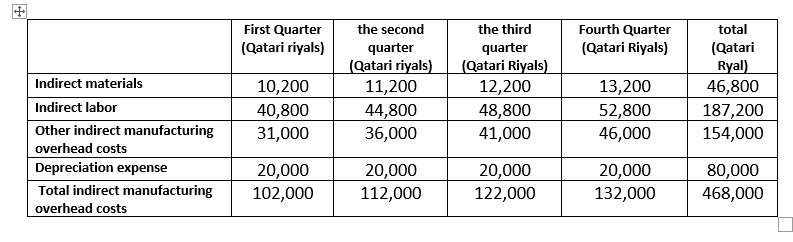

9. The rate of incurring industrial additional costs is 10 Qatari riyals per hour of direct labor. 10. The planned indirect additional industrial costs are as follows:

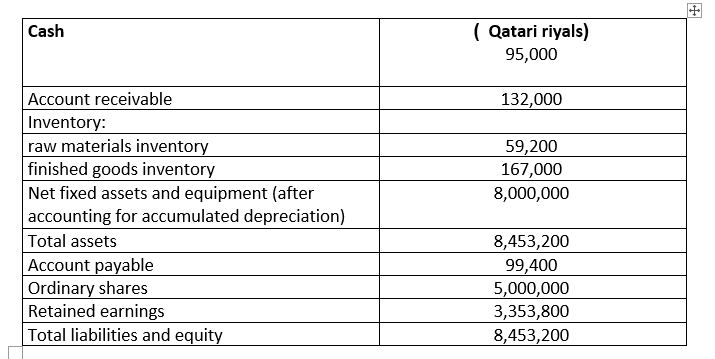

11. The quarterly administrative and selling expenses of the memories company amount to 100,000 riyals, to be paid in cash. 12. Fatima Al Zahraa expects that dividends of 50,000 riyals will be announced and paid in cash every quarter. 13. The planned balance sheet for the Memories Company on December 31 of the current year (2021) is as follows:

Required calculations:

a. Sales budget . B.cash collections budget . C. production budget."S" tire (Riyal) "L" tire (Riyal) Direct materials: Metal Plates: 2 3 S: two-thirds of a meter (2/3 m) at a cost of 3 riyals per meter 2 4 L: 1 m at a cost of 3 riyals per meter Glass sheets S: V plate at a cost of 8 riyals per sheet L: 12 plate at a cost of 8 riyals per sheet Direct labor 0.1 hour at a cost of 20 riyals an hour Indirect industrial costs 0.1 per hour at a cost of 10 riyals an hour Production cost per unit 2 2 1 1 7 Riyal 10 Riyal First Quarter (Qatari riyals) Fourth Quarter (Qatari Riyals) 10,200 40,800 31,000 the second quarter (Qatari riyals) 11,200 44,800 36,000 the third quarter (Qatari Riyals) 12,200 48,800 41,000 13,200 52,800 46,000 total (Qatari Ryal). 46,800 187,200 154,000 Indirect materials Indirect labor Other indirect manufacturing overhead costs Depreciation expense Total indirect manufacturing overhead costs 20,000 102,000 20,000 112,000 20,000 122,000 20,000 132,000 80,000 468,000 Cash ( Qatari riyals) 95,000 132,000 59,200 167,000 8,000,000 Account receivable Inventory: raw materials inventory finished goods inventory Net fixed assets and equipment (after accounting for accumulated depreciation) Total assets Account payable Ordinary shares Retained earnings Total liabilities and equity 8,453,200 99,400 5,000,000 3,353,800 8,453,200 "S" tire (Riyal) "L" tire (Riyal) Direct materials: Metal Plates: 2 3 S: two-thirds of a meter (2/3 m) at a cost of 3 riyals per meter 2 4 L: 1 m at a cost of 3 riyals per meter Glass sheets S: V plate at a cost of 8 riyals per sheet L: 12 plate at a cost of 8 riyals per sheet Direct labor 0.1 hour at a cost of 20 riyals an hour Indirect industrial costs 0.1 per hour at a cost of 10 riyals an hour Production cost per unit 2 2 1 1 7 Riyal 10 Riyal First Quarter (Qatari riyals) Fourth Quarter (Qatari Riyals) 10,200 40,800 31,000 the second quarter (Qatari riyals) 11,200 44,800 36,000 the third quarter (Qatari Riyals) 12,200 48,800 41,000 13,200 52,800 46,000 total (Qatari Ryal). 46,800 187,200 154,000 Indirect materials Indirect labor Other indirect manufacturing overhead costs Depreciation expense Total indirect manufacturing overhead costs 20,000 102,000 20,000 112,000 20,000 122,000 20,000 132,000 80,000 468,000 Cash ( Qatari riyals) 95,000 132,000 59,200 167,000 8,000,000 Account receivable Inventory: raw materials inventory finished goods inventory Net fixed assets and equipment (after accounting for accumulated depreciation) Total assets Account payable Ordinary shares Retained earnings Total liabilities and equity 8,453,200 99,400 5,000,000 3,353,800 8,453,200

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started