Question

Omega Corp manufactures an intermediate component part, ACC-210 that is widely used in various household electronic products. Operating results, prepared for external reporting purposes, for

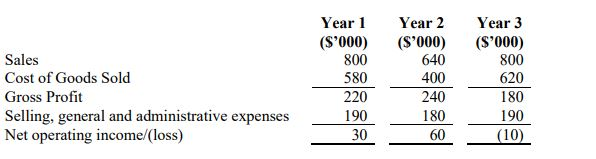

Omega Corp manufactures an intermediate component part, ACC-210 that is widely used in various household electronic products. Operating results, prepared for external reporting purposes, for the first three years of activity were as follows:

With increased competition from lower cost manufacturers, a competitor folded in Year 2, and during the process, offloaded all their remaining stocks on the market. As a result, Omegas sales dropped by 20% during Year 2 even though production increased during the year. Management was caught unawares, and had increased production in view of sales remaining constant at 50,000 units. The increased production was meant to provide the company with a buffer of protection against unexpected spurts in demand.

With the excess stocks carried into Year 3, management decided to cut production, as shown below:

Additional information about the company is given as follows:

Fixed manufacturing overhead costs $480,000

Fixed selling and administrative costs $140,000

Variable costs per unit: Manufacturing cost $2

Selling and administrative cost $1

~The fixed manufacturing overhead costs are applied to units of production on the basis of actual production for the year.

~The company uses a FIFO inventory flow assumption.

Omegas senior management is puzzled why profits doubled in Year 2 when sales declined by 20%, yet a loss was incurred in Year 3 when sales recovered to previous levels.

Prepare a contribution margin format variable costing income statement for each year, and reconcile the variable costing net operating income figures against those reported by the company externally.

Year 1 (S'000) Year 2 (S'000) Year 3 ($'000) 800 640 Sales Cost of Goods Sold Gross Profit Selling, general and administrative expenses Net operating income/loss) Year 1 ('000) 50 50 Year 2 ('000) 60 40 Year 3 (1000) 40 50 Production in units Sales in unitsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started