Answered step by step

Verified Expert Solution

Question

1 Approved Answer

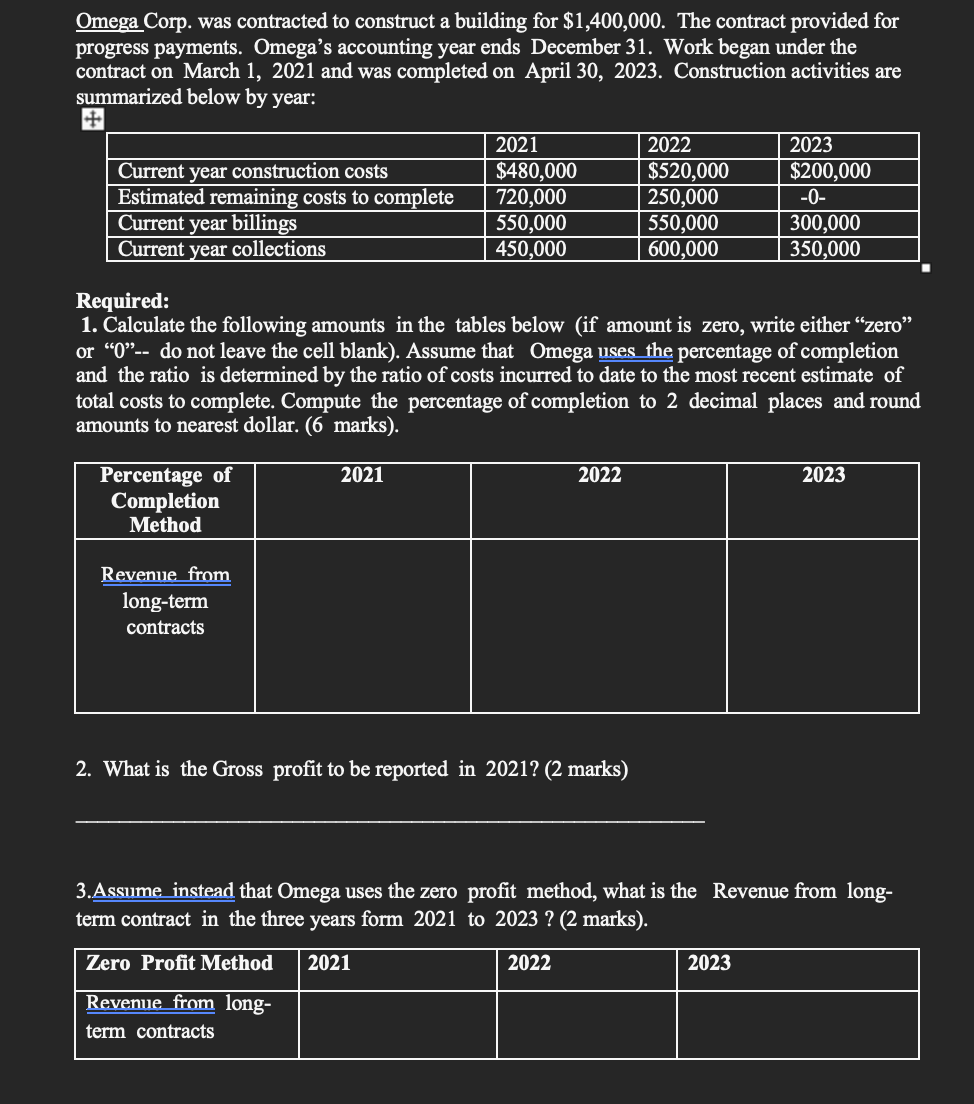

Omega Corp. was contracted to construct a building for $1,400,000. The contract provided for progress payments. Omega's accounting year ends December 31. Work began

Omega Corp. was contracted to construct a building for $1,400,000. The contract provided for progress payments. Omega's accounting year ends December 31. Work began under the contract on March 1, 2021 and was completed on April 30, 2023. Construction activities are summarized below by year: + 2021 2022 2023 Current year construction costs $480,000 $520,000 $200,000 Estimated remaining costs to complete 720,000 250,000 -0- Current year billings 550,000 550,000 300,000 Current year collections 450,000 600,000 350,000 Required: 1. Calculate the following amounts in the tables below (if amount is zero, write either "zero" or "0"-- do not leave the cell blank). Assume that Omega uses the percentage of completion and the ratio is determined by the ratio of costs incurred to date to the most recent estimate of total costs to complete. Compute the percentage of completion to 2 decimal places and round amounts to nearest dollar. (6 marks). Percentage of Completion Method Revenue from long-term contracts 2021 2022 2023 2. What is the Gross profit to be reported in 2021? (2 marks) 3.Assume instead that Omega uses the zero profit method, what is the Revenue from long- term contract in the three years form 2021 to 2023? (2 marks). Zero Profit Method 2021 Revenue from long- term contracts 2022 2023

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started