Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Omega is an investment advisory firm specializing in pensions for wealthy people located in Geneva. The company has offices in Germany, France and Italy

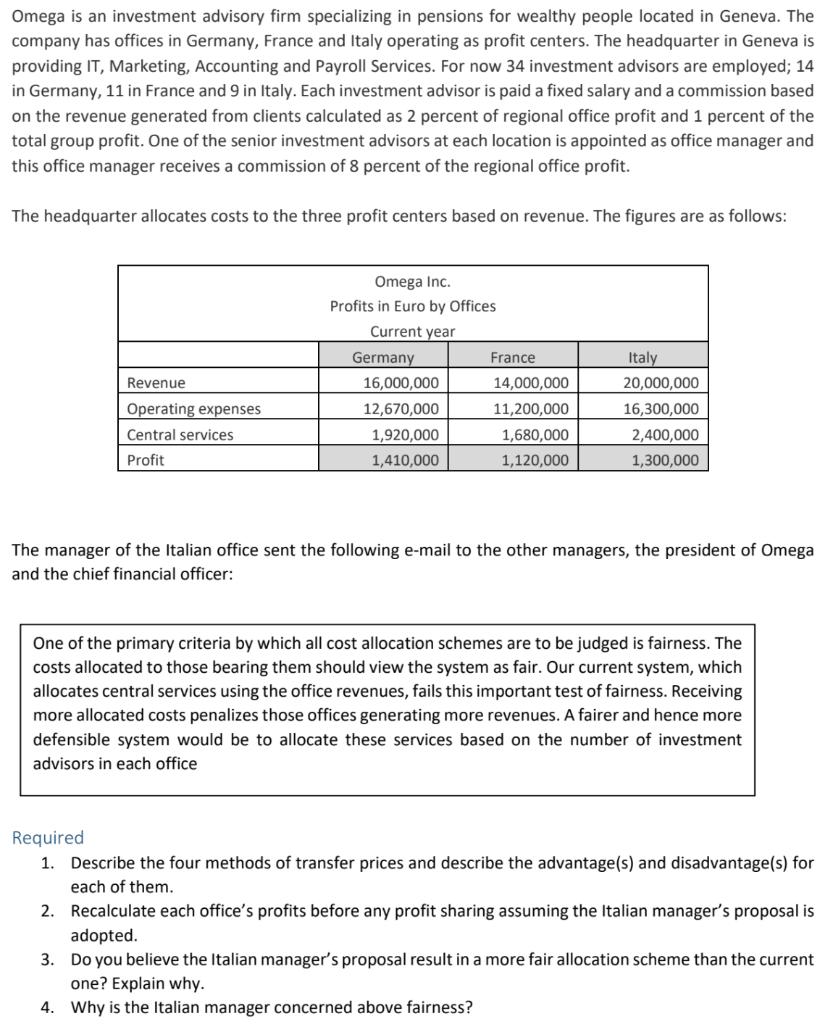

Omega is an investment advisory firm specializing in pensions for wealthy people located in Geneva. The company has offices in Germany, France and Italy operating as profit centers. The headquarter in Geneva is providing IT, Marketing, Accounting and Payroll Services. For now 34 investment advisors are employed; 14 in Germany, 11 in France and 9 in Italy. Each investment advisor is paid a fixed salary and a commission based on the revenue generated from clients calculated as 2 percent of regional office profit and 1 percent of the total group profit. One of the senior investment advisors at each location is appointed as office manager and this office manager receives a commission of 8 percent of the regional office profit. The headquarter allocates costs to the three profit centers based on revenue. The figures are as follows: Omega Inc. Profits in Euro by Offices Current year Germany France Italy Revenue 16,000,000 14,000,000 20,000,000 Operating expenses 12,670,000 11.200.000 16,300,000 Central services 1,920,000 1,680,000 2,400,000 Profit 1,410,000 1,120,000 1,300,000 The manager of the Italian office sent the following e-mail to the other managers, the president of Omega and the chief financial officer: One of the primary criteria by which all cost allocation schemes are to be judged is fairness. The costs allocated to those bearing them should view the system as fair. Our current system, which allocates central services using the office revenues, fails this important test of fairness. Receiving more allocated costs penalizes those offices generating more revenues. A fairer and hence more defensible system would be to allocate these services based on the number of investment advisors in each office Required 1. Describe the four methods of transfer prices and describe the advantage(s) and disadvantage(s) for each of them. 2. Recalculate each office's profits before any profit sharing assuming the Italian manager's proposal is adopted. 3. Do you believe the Italian manager's proposal result in a more fair allocation scheme than the current one? Explain why. 4. Why is the Italian manager concerned above fairness?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1The methods of transfer prices are as follows Traditional transaction methods CUP method R...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started