Question

Omega Lawn Care Services is a small, family-owned business operating out of Rexdale, Ontario. The company has always charged a flat fee per hundred square

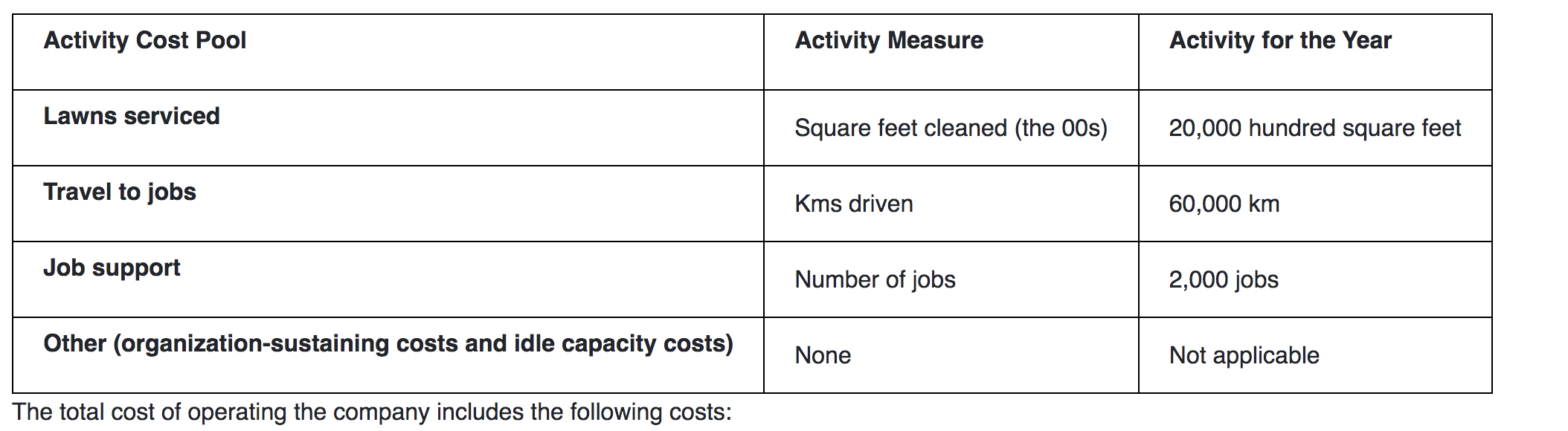

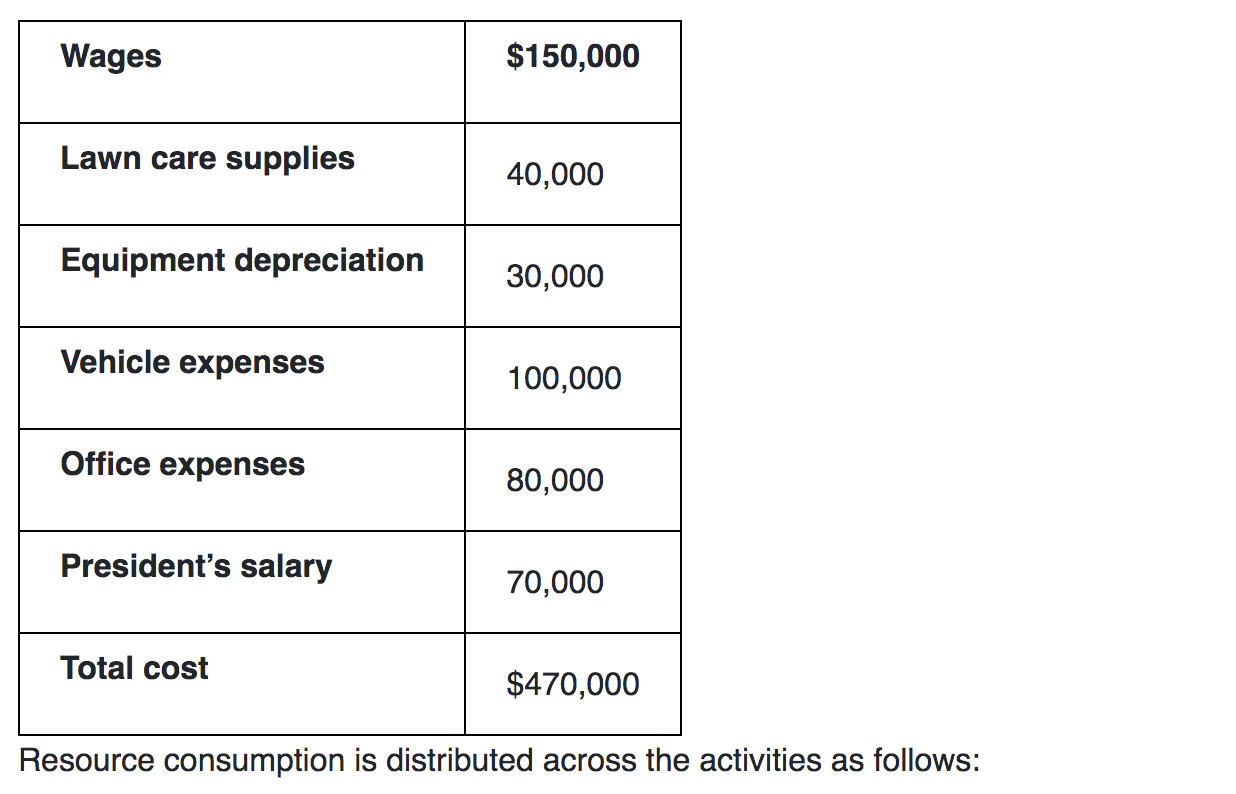

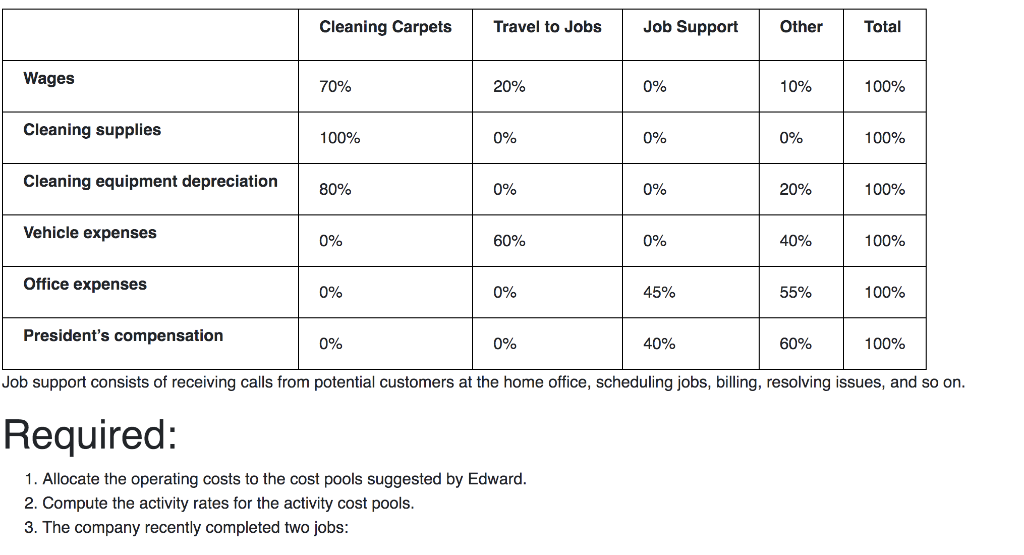

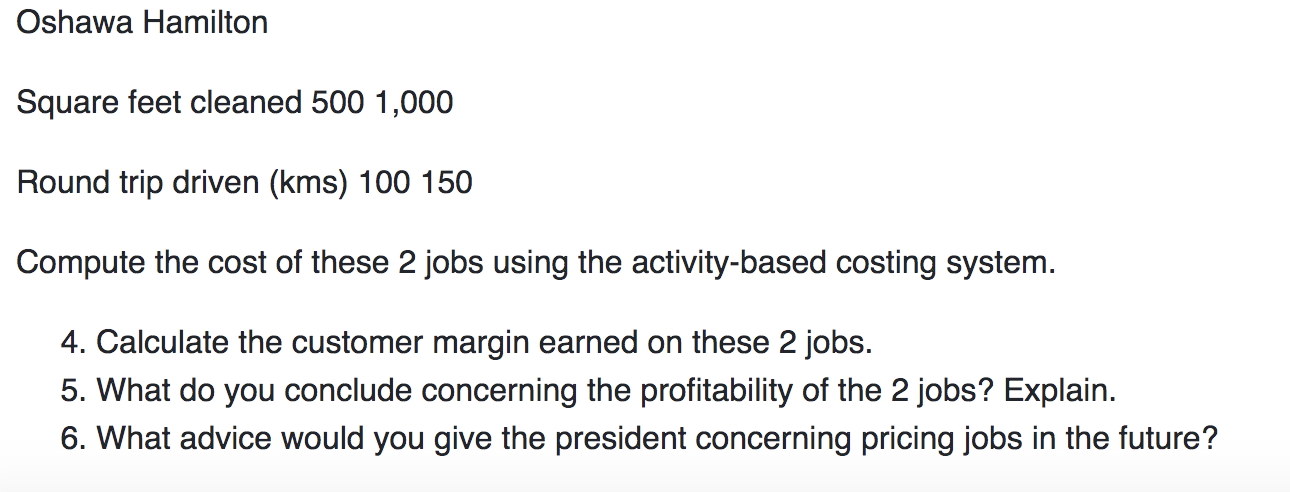

Omega Lawn Care Services is a small, family-owned business operating out of Rexdale, Ontario. The company has always charged a flat fee per hundred square feet of lawn service for its services. The current fee is $30 per hundred square feet. However, there is some question about whether the company is making any money on jobs for some customers, particularly those located in remote areas requiring considerable travel time. The owners son Edward Scott, a recent Accounting graduate has suggested investigating this question using activity-based costing. After some discussion, she designed a simple system consisting of four activity cost pools. The activity cost pools and their activity measures appear below:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started