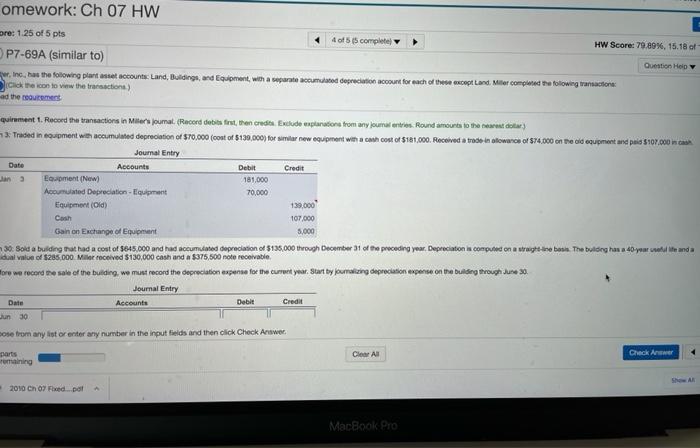

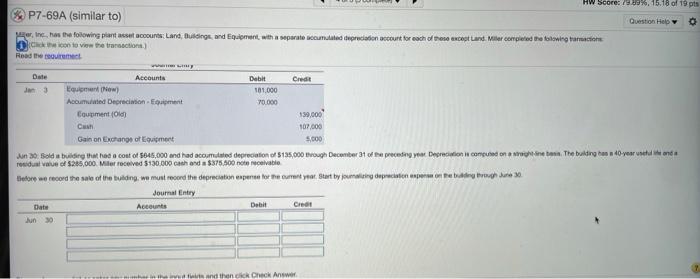

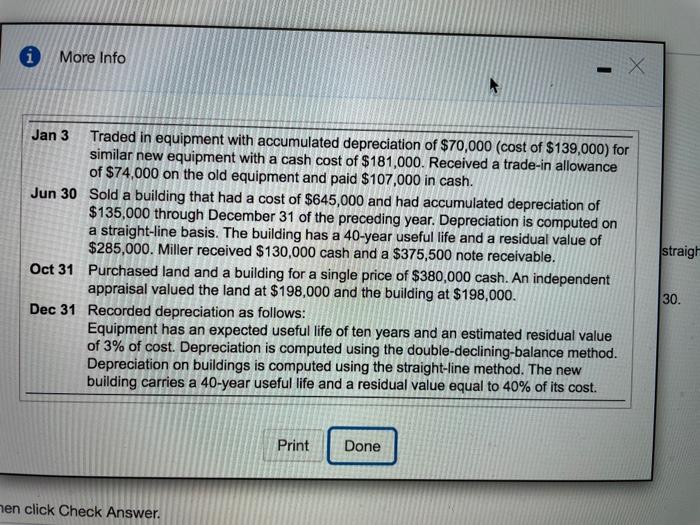

omework: Ch 07 HW are: 1.25 of 5 pts 4 of 15 complete HW Score: 79.89%, 15.18 of P7-69A (similar to) Question Help Inc, has the following plants et accounts: Land, Bulidings, and Equipment, win a separate accumulated depreciation account for each of the except tand. Miter completed the following transaction (Click the icon to view the transactions) ad the reduce quirement. Record the transactions in Miles joumat. (Record debit first, then credit Exclude explanation from any ouma entries Round amounts to the nearest dar) Tried in comment we accumulated depreciation of $70,000 (cout of 6130,000) for similar new equipment with a choo of $181.000. Received a trade len otowance of $74.000 con el cupment and paid $107.000 Journal Entry Date Accounts Debit Credit Jana Epment (New) 181,000 Accumulated Depreciation - Equipment 70.000 Equipment (Old) 139,000 Cash 107.000 Ganon Exchange of Equipment 5,000 Soid a bulding that had a cost of $645.000 and had accumulated Sopreciation of 5135.000 through December 31 of the preceding your. Depreciation in computed on a trought to bean. The building has a 4o you want the and a dan and a $375,500 not fore we record the sale of the building, we must record the depreciation expense for the current year, Start by journalizare depreciation expense on the building through June 20 Journal Entry Dale Accounts Debit Credit Jun 30 ose from any lot or enter any number in the input fields and then click Check Answer Clear All Check remaining ShAR 2010 Ch 07 Faxed pol MacBook Pro HW Score: 0.004.15.18 of 19 pts P7-69A (similar to) Question Hello 0 erine has the following plantaset count: Land, Buildings and Equipment with a post counted depreciation account for each of these exceptand Miler compiled flowing action De to the transactions) Read the Accounts Debit Credit 3 Equipment Now) 101.000 Accumuwied Depreciation 70.000 Coupment 139,000 107.000 Gain on Exchange of comment 5.000 An 20 sold a building the cost of $646.000 and had comdated depreciation 135.000 rough December to preceding your creation compused on rebe. The building to your and residual e of 5205,000. Miler received $130.000 cash and a $375.500 ne vabi there was record the sale of the building, we must record the direction expect for the comentyret. But tymtring depreciation open on the bath Journal Entry Date Accounts un 30 Dahil and then check Answer i More Info - X Jan 3 Traded in equipment with accumulated depreciation of $70,000 (cost of $139,000) for similar new equipment with a cash cost of $181,000. Received a trade-in allowance of $74,000 on the old equipment and paid $107,000 in cash. Jun 30 Sold a building that had a cost of $645,000 and had accumulated depreciation of $135,000 through December 31 of the preceding year. Depreciation is computed on a straight-line basis. The building has a 40-year useful life and a residual value of $285,000. Miller received $130,000 cash and a $375,500 note receivable. Oct 31 Purchased land and a building for a single price of $380,000 cash. An independent appraisal valued the land at $198,000 and the building at $198,000. Dec 31 Recorded depreciation as follows: Equipment has an expected useful life of ten years and an estimated residual value of 3% of cost. Depreciation is computed using the double-declining-balance method. Depreciation on buildings is computed using the straight-line method. The new building carries a 40-year useful life and a residual value equal to 40% of its cost. straigh 30. Print Done men click Check