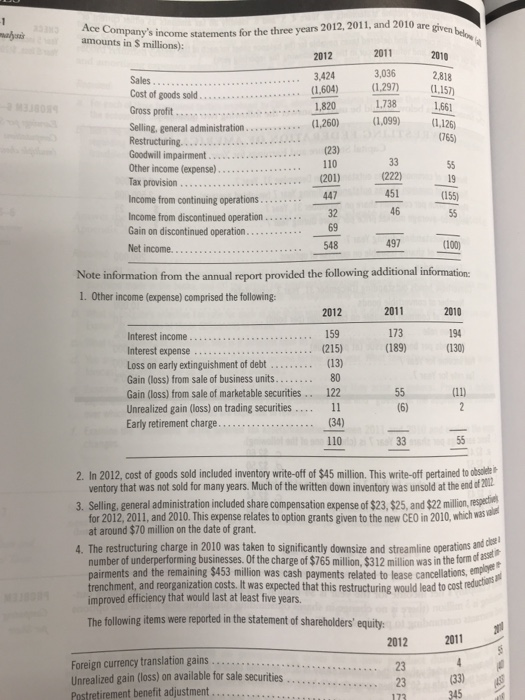

ompany's income statements for the three years 2012, 2011, and 2010 are given amounts in S millions): 2011 3,036 2,818 1,738 (1,099) (1,126) 2012 3,424 Cost of goods sold.. (1.604)(1.297) (.15 1,820 1.788 1,661 Selling, general administration. Restructuring. (23) 110 (201) Other income (expense) Tax provision Income from continuing operations Income from discontinued operation... (222) 451 19 32 Net income... (100) Note information from the annual report provided the following additional information 1. Other income (expense) comprised the following: 2012 159 (215) 2011 173 (189) 2010 194 (130) Interest income Interest expense Loss on early extinguishment of debt ...(13) Gain (loss) from sale of business units...80 Gain (loss) from sale of marketable securities. 122 Unrealized gain (loss) on trading securities....11 Early retirement charge 110 2. In 2012, cost of goods sold included inventory write-off of $45 million. This write-off pertained to obsole 3. Selling, general administration included share compensation expense of $23, $25, and $2 million.respactil 4. The restructuring charge in 2010 was taken to significantly downsize and streamline operations and a ventory that was not sold for many years Much of the written down inventory was unsold at the end for 2012, 2011, and 2010. This expense relates to option grants given to the new CEO in 2010, which was at around $70 million on the date of grant. number of underperforming businesses. Of the charge of $765 million, $312 million was in the form c pairments and the remaining $453 million was cash payments related to lease cancellations, emp trenchment, and reorganization costs. It was expected that this restructuring would lead to cost reductisb improved efficiency that would last at least five years. The following items were reported in the statement of shareholders' equity: 2011 Foreign currency translation gains Unrealized gain (loss) on available for sale securities Postretirement benefit adjustment 2012 23 23 345 ompany's income statements for the three years 2012, 2011, and 2010 are given amounts in S millions): 2011 3,036 2,818 1,738 (1,099) (1,126) 2012 3,424 Cost of goods sold.. (1.604)(1.297) (.15 1,820 1.788 1,661 Selling, general administration. Restructuring. (23) 110 (201) Other income (expense) Tax provision Income from continuing operations Income from discontinued operation... (222) 451 19 32 Net income... (100) Note information from the annual report provided the following additional information 1. Other income (expense) comprised the following: 2012 159 (215) 2011 173 (189) 2010 194 (130) Interest income Interest expense Loss on early extinguishment of debt ...(13) Gain (loss) from sale of business units...80 Gain (loss) from sale of marketable securities. 122 Unrealized gain (loss) on trading securities....11 Early retirement charge 110 2. In 2012, cost of goods sold included inventory write-off of $45 million. This write-off pertained to obsole 3. Selling, general administration included share compensation expense of $23, $25, and $2 million.respactil 4. The restructuring charge in 2010 was taken to significantly downsize and streamline operations and a ventory that was not sold for many years Much of the written down inventory was unsold at the end for 2012, 2011, and 2010. This expense relates to option grants given to the new CEO in 2010, which was at around $70 million on the date of grant. number of underperforming businesses. Of the charge of $765 million, $312 million was in the form c pairments and the remaining $453 million was cash payments related to lease cancellations, emp trenchment, and reorganization costs. It was expected that this restructuring would lead to cost reductisb improved efficiency that would last at least five years. The following items were reported in the statement of shareholders' equity: 2011 Foreign currency translation gains Unrealized gain (loss) on available for sale securities Postretirement benefit adjustment 2012 23 23 345