Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ompletion Status: Belle, who has just started her first full-time salary job is determined to have $1 million in her account by the time

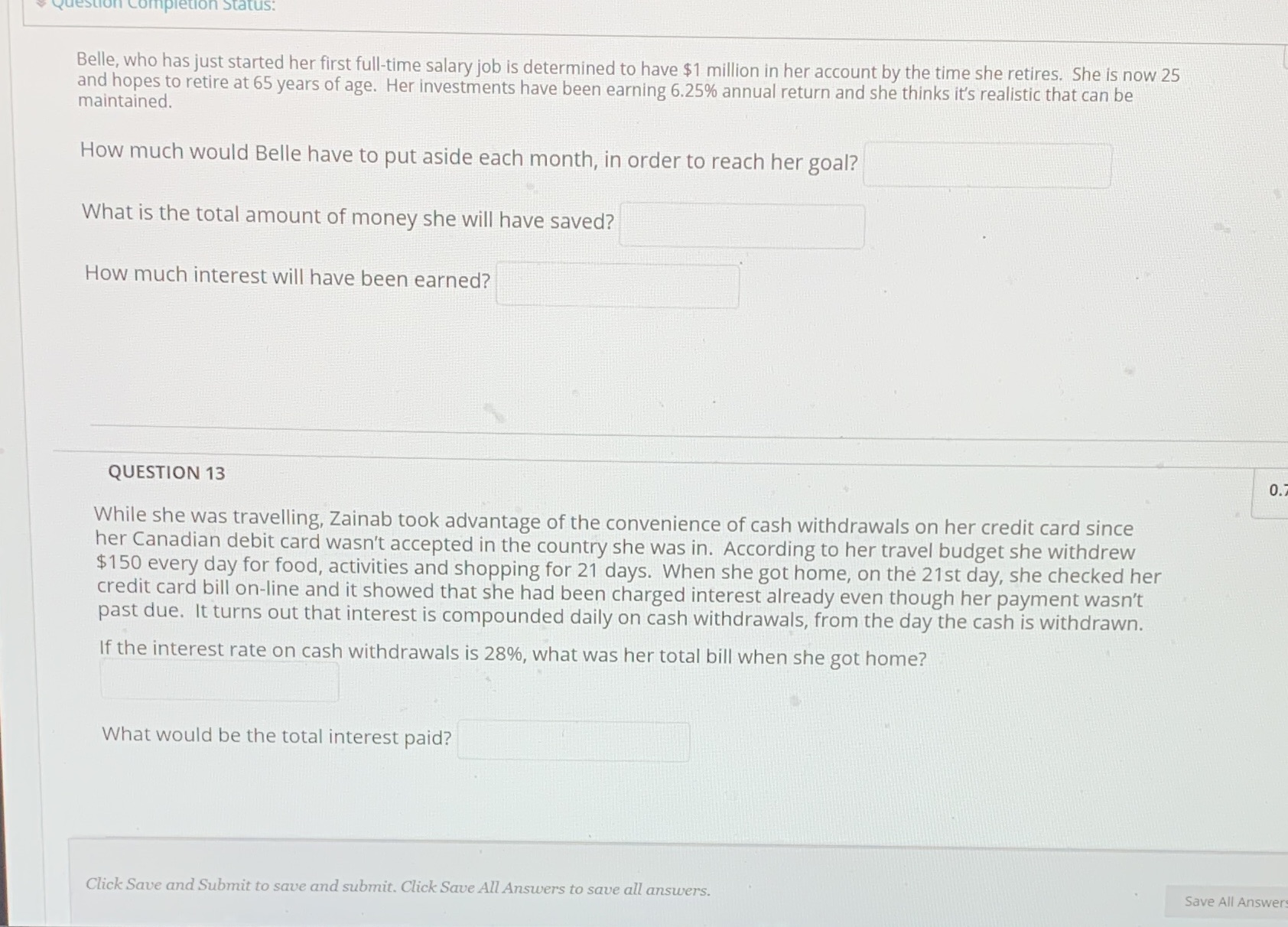

ompletion Status: Belle, who has just started her first full-time salary job is determined to have $1 million in her account by the time she retires. She is now 25 and hopes to retire at 65 years of age. Her investments have been earning 6.25% annual return and she thinks it's realistic that can be maintained. How much would Belle have to put aside each month, in order to reach her goal? What is the total amount of money she will have saved? How much interest will have been earned? QUESTION 13 While she was travelling, Zainab took advantage of the convenience of cash withdrawals on her credit card since her Canadian debit card wasn't accepted in the country she was in. According to her travel budget she withdrew $150 every day for food, activities and shopping for 21 days. When she got home, on the 21st day, she checked her credit card bill on-line and it showed that she had been charged interest already even though her payment wasn't past due. It turns out that interest is compounded daily on cash withdrawals, from the day the cash is withdrawn. If the interest rate on cash withdrawals is 28%, what was her total bill when she got home? What would be the total interest paid? Click Save and Submit to save and submit. Click Save All Answers to save all answers. 0.7 Save All Answers

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started