Answered step by step

Verified Expert Solution

Question

1 Approved Answer

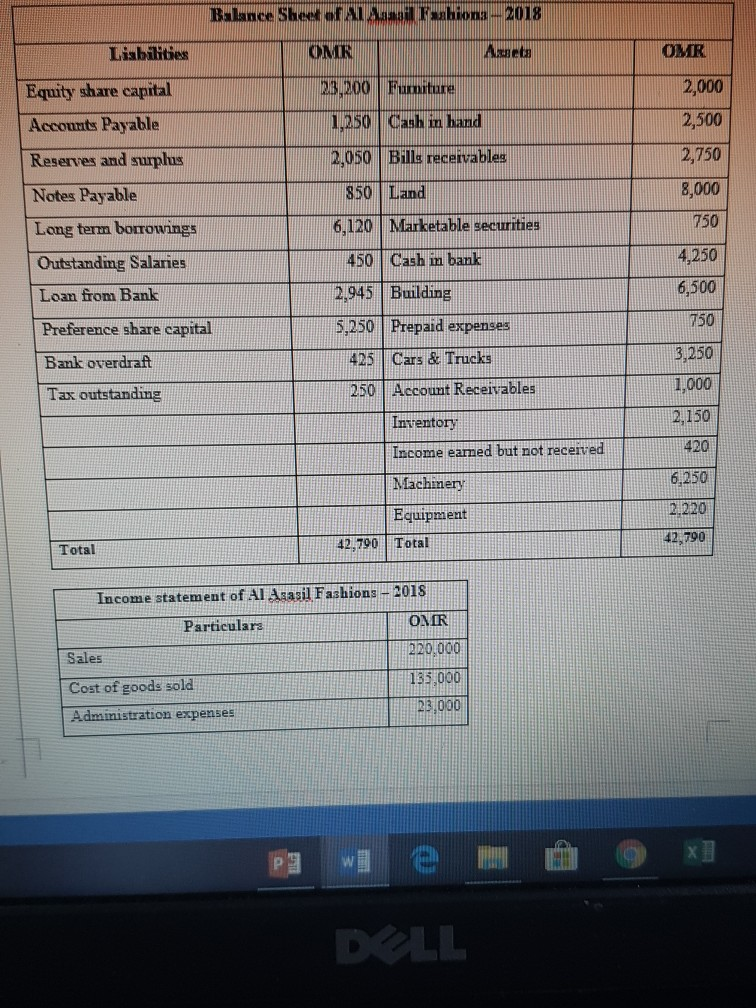

OMR 2,000 2,500 2,750 8,000 750 Balance Sheet of Al Annual Fashions -- 2018 Liabilities OMR Asets Equity share capital 23,200 Fumiture Accounts Payable 1,250

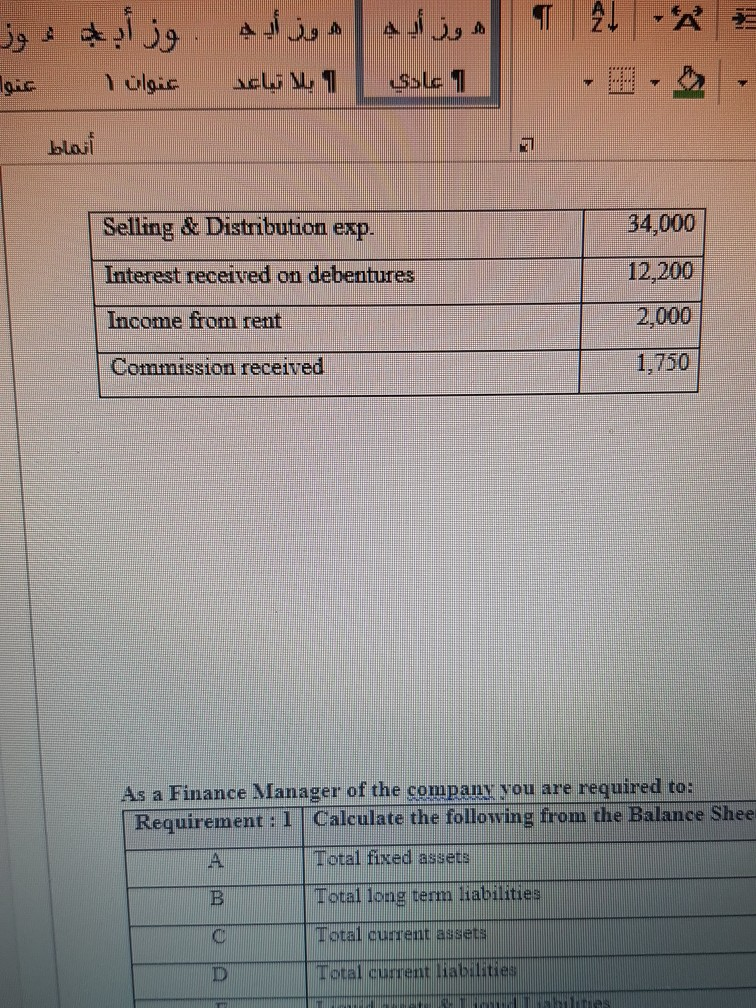

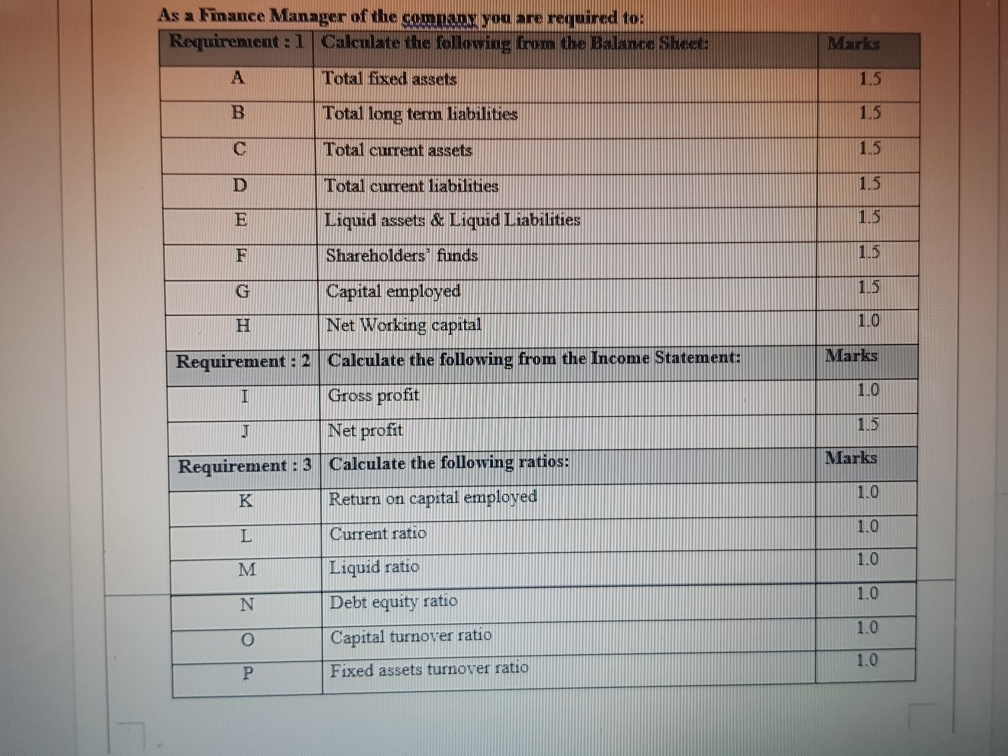

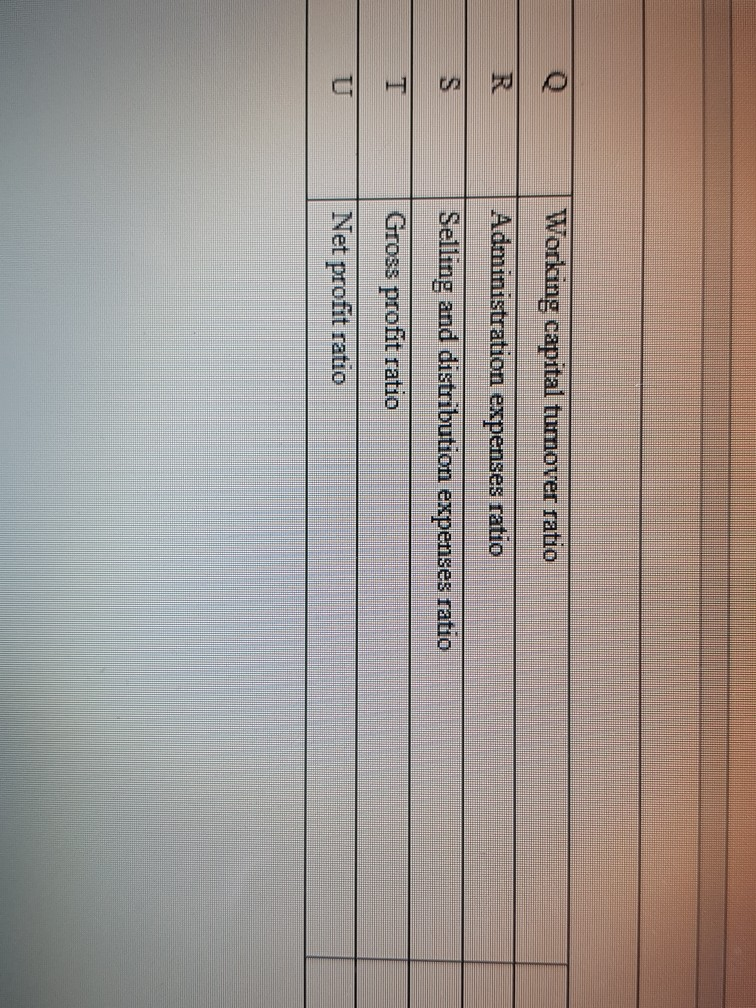

OMR 2,000 2,500 2,750 8,000 750 Balance Sheet of Al Annual Fashions -- 2018 Liabilities OMR Asets Equity share capital 23,200 Fumiture Accounts Payable 1,250 Cash in hand Reserves and surplus 2,050 Bills receivables Notes Payable 850 Land Long term borrowings 6,120 Marketable securities Outstanding Salaries 450 Cash in bank Loan from Bank 2,945 Building Preference share capital 5,250 Prepaid expenses Bank overdraf 425 Cars & Trucks Tax outstanding 250 Account Receivables Inventory Income earned but not received Machinery Equipment 42.790 Total 4,250 6,500 750 3,250 1,000 2,150 420 6,250 2.220 Total 42,790 Income statement of Al Asasil Fashions - 2018 Particular ONIR 220.000 Sales Cost of goods sold Administration expenses 155,000 23,000 p9 DLL . 24 Selling & Distribution exp. Interest received on debentures 34,000 12200 2,000 Income from rent Commission received | 1,750 As a Finance Manager of the company you are required to: LITILIIIIIIII Requirement: 1 Calculate the following from the Balance Shee Total fixed assets Total long tem liabilities Total current assets Total current liabilities As a Finance Manager of the company you are required to: Requirenient : 1 Calculate the following from the Balance She Marks 1.5 1.5 15 1.5 1.0 Marks Total fixed assets Total long term liabilities Total current assets Total current liabilities Liquid assets & Liquid Liabilities Shareholders funds Capital employed Net Working capital Requirement: 2 Calculate the following from the Income Statement: Gross profit Net profit Requirement:3 Calculate the following ratios: Return on capital employed Current ratio Liquid ratio Debt equity ratio Capital turnover ratio Fixed assets turnover ratio 1.0 1.5 Marks 1.0 1.0 1.0 1.0 Workong Capital tumover ratio Administration expenses ratio EST Selling and distribution expenses ratio Gross profit ratio Net profit ratio U

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started