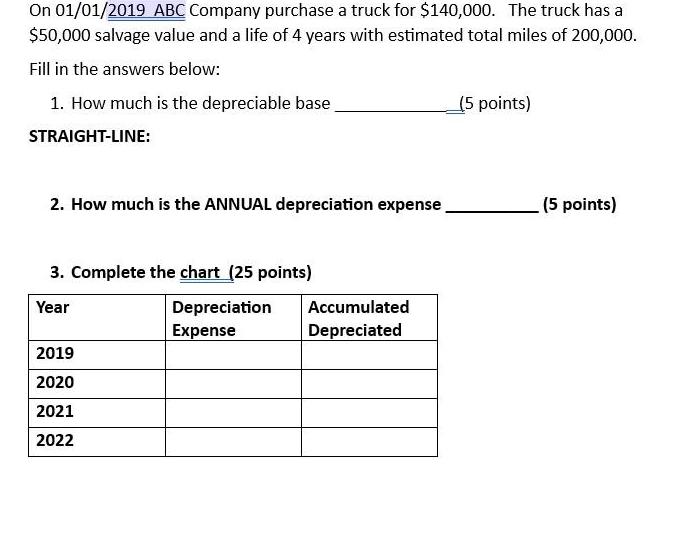

On 01/01/2019 ABC Company purchase a truck for $140,000. The truck has a $50,000 salvage value and a life of 4 years with estimated

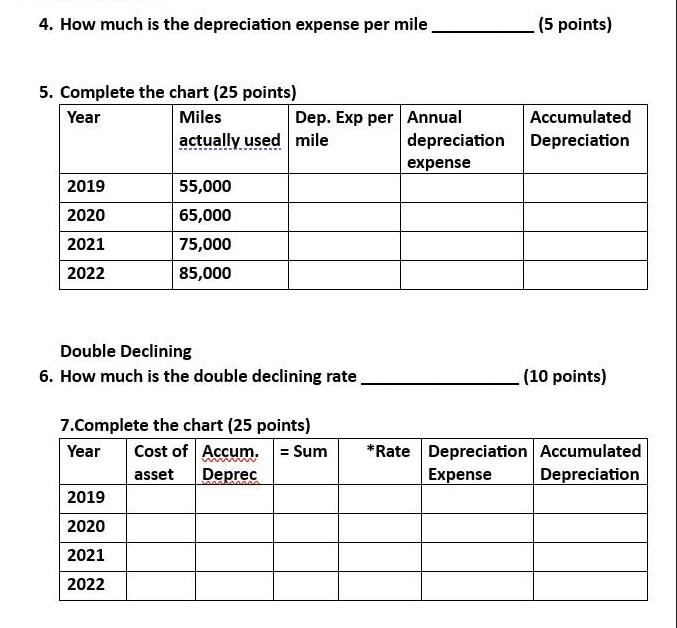

On 01/01/2019 ABC Company purchase a truck for $140,000. The truck has a $50,000 salvage value and a life of 4 years with estimated total miles of 200,000. Fill in the answers below: 1. How much is the depreciable base STRAIGHT-LINE: 2. How much is the ANNUAL depreciation expense 3. Complete the chart (25 points) Year 2019 2020 2021 2022 Depreciation Expense Accumulated Depreciated (5 points) (5 points) 4. How much is the depreciation expense per mile. 5. Complete the chart (25 points) Year Miles actually used mile 2019 2020 2021 2022 55,000 65,000 75,000 85,000 Dep. Exp per Annual Double Declining 6. How much is the double declining rate 2019 2020 2021 2022 7.Complete the chart (25 points) Year Cost of Accum. = Sum asset Deprec (5 points) Accumulated depreciation Depreciation expense (10 points) *Rate Depreciation Accumulated Expense Depreciation

Step by Step Solution

3.27 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

1 The depreciable base is the initial cost of the truck minus the salvage value Depreciable base Ini...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started