Question

On 01/01/2020, the government provided equipment by JD 350,000 to the company as a grant in order to reducing environmental pollution. The company paid

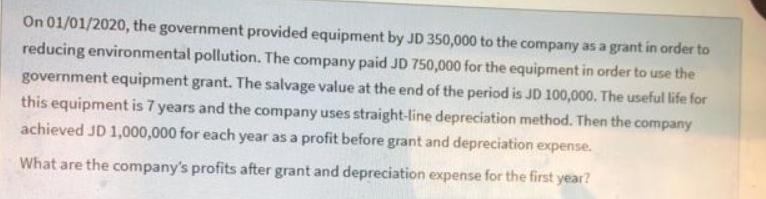

On 01/01/2020, the government provided equipment by JD 350,000 to the company as a grant in order to reducing environmental pollution. The company paid JD 750,000 for the equipment in order to use the government equipment grant. The salvage value at the end of the period is JD 100,000. The useful life for this equipment is 7 years and the company uses straight-line depreciation method. Then the company achieved JD 1,000,000 for each year as a profit before grant and depreciation expense. What are the company's profits after grant and depreciation expense for the first year?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A grant received from the government may be taxable or non taxable depends upon the nature of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Donald Kieso, Jerry Weygandt, Terry Warfield, Nicola Young,

10th Canadian Edition, Volume 1

978-1118735329, 9781118726327, 1118735323, 1118726324, 978-0176509736

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App