Answered step by step

Verified Expert Solution

Question

1 Approved Answer

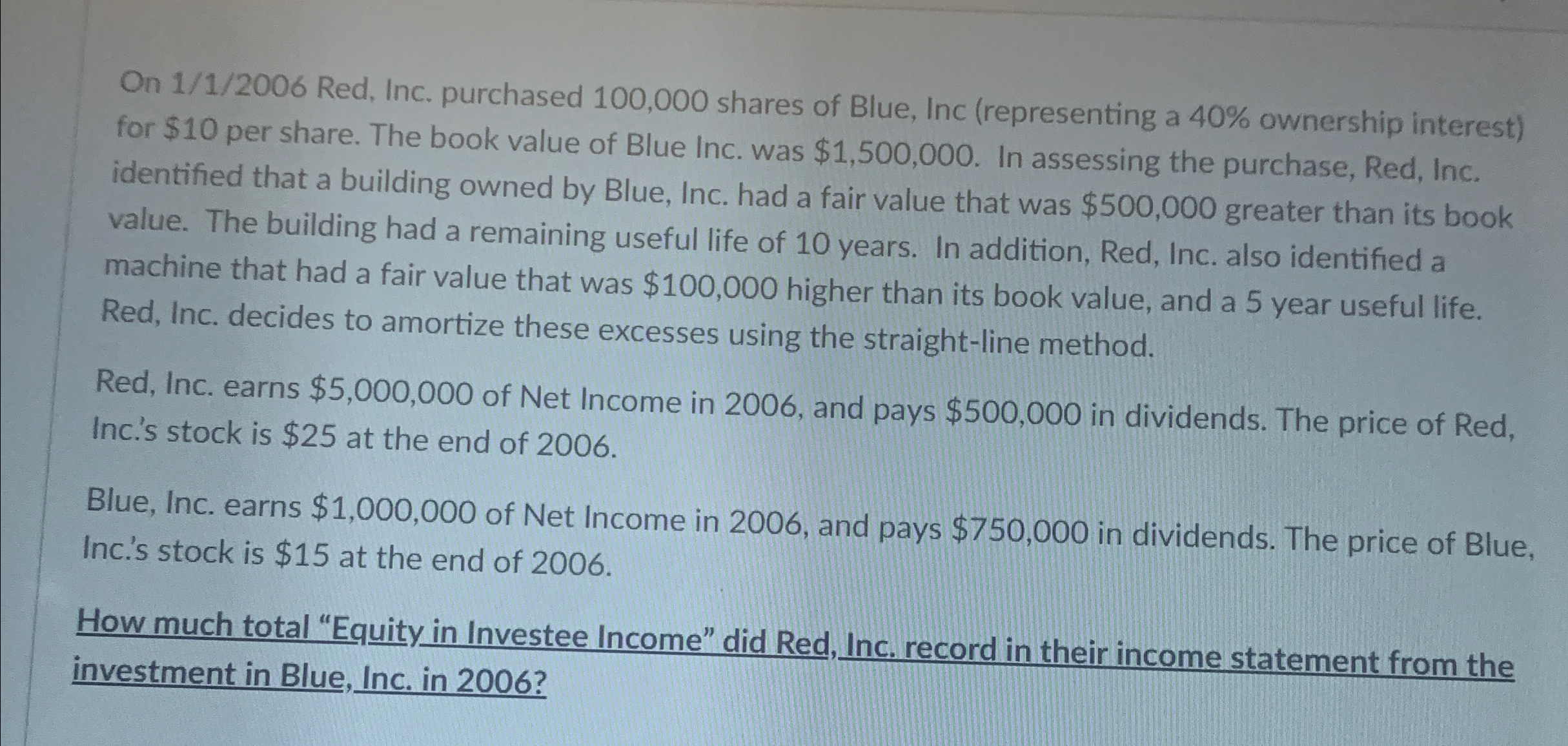

On 1 / 1 / 2 0 0 6 Red, Inc. purchased 1 0 0 , 0 0 0 shares of Blue, Inc ( representing

On Red, Inc. purchased shares of Blue, Inc representing a ownership interest for $ per share. The book value of Blue Inc. was $ In assessing the purchase, Red, Inc. identified that a building owned by Blue, Inc. had a fair value that was $ greater than its book value. The building had a remaining useful life of years. In addition, Red, Inc. also identified a machine that had a fair value that was $ higher than its book value, and a year useful life. Red, Inc. decides to amortize these excesses using the straightline method.

Red, Inc. earns $ of Net Income in and pays $ in dividends. The price of Red, Inc.s stock is $ at the end of

Blue, Inc. earns $ of Net Income in and pays $ in dividends. The price of Blue, Inc.s stock is $ at the end of

How much total "Equity in Investee Income" did Red, Inc. record in their income statement from the investment in Blue, Inc. in

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started