Answered step by step

Verified Expert Solution

Question

1 Approved Answer

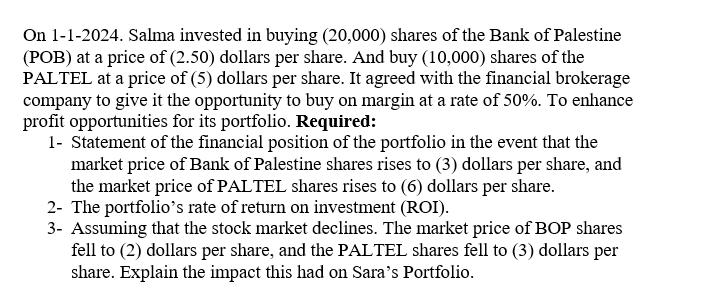

On 1 - 1 - 2 0 2 4 . Salma invested in buying ( 2 0 , 0 0 0 ) shares of the

On Salma invested in buying shares of the Bank of Palestine

POB at a price of dollars per share. And buy shares of the

PALTEL at a price of dollars per share. It agreed with the financial brokerage

company to give it the opportunity to buy on margin at a rate of To enhance

profit opportunities for its portfolio. Required:

Statement of the financial position of the portfolio in the event that the

market price of Bank of Palestine shares rises to dollars per share, and

the market price of PALTEL shares rises to dollars per share.

The portfolio's rate of return on investment ROI

Assuming that the stock market declines. The market price of BOP shares

fell to dollars per share, and the PALTEL shares fell to dollars per

share. Explain the impact this had on Sara's Portfolio.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started