Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1 April 2021 Paradise Ltd, an Australia entity, places an order for US$3.5 million of inventory with Blue Ltd, a US supplier. The

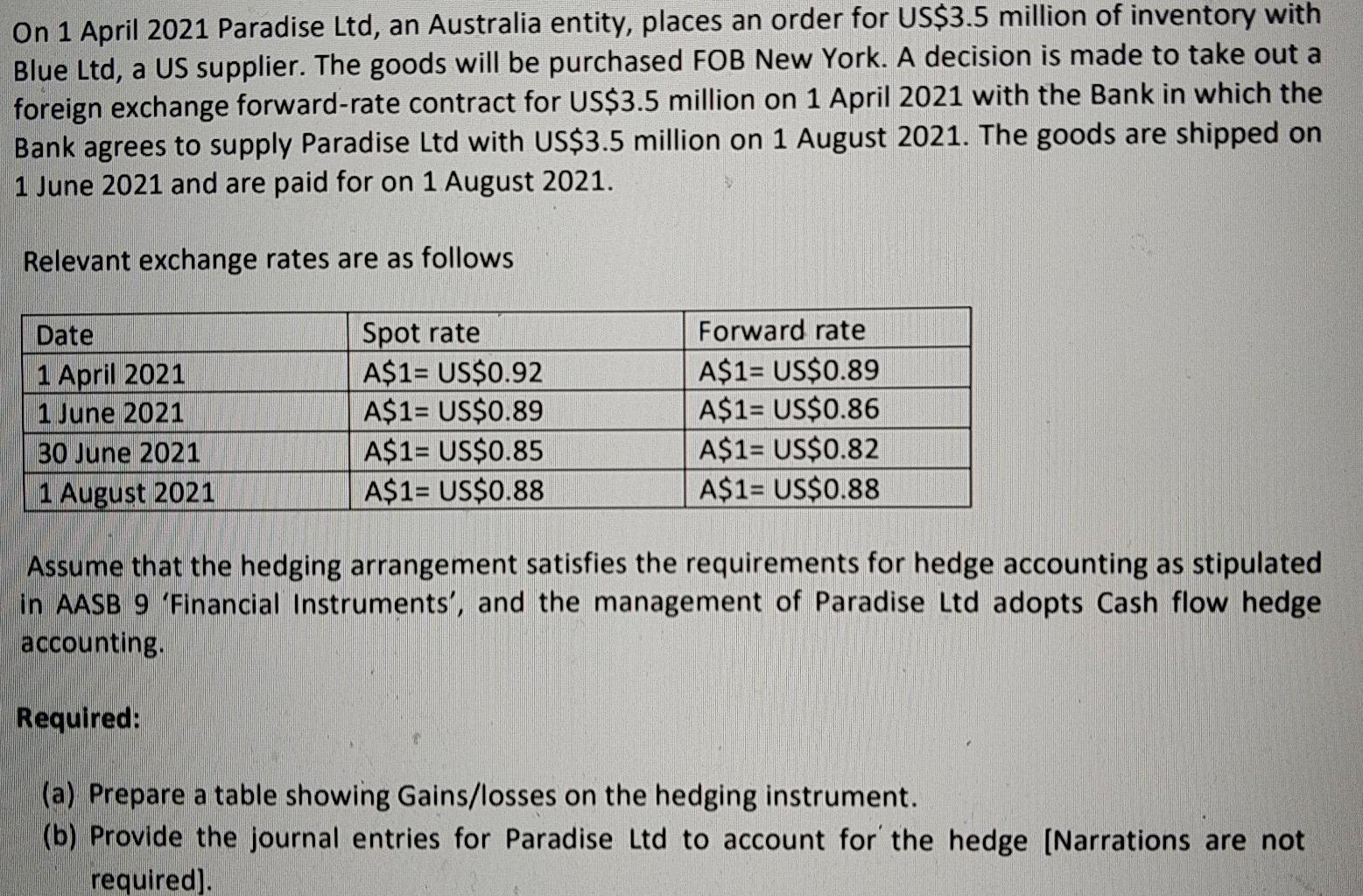

On 1 April 2021 Paradise Ltd, an Australia entity, places an order for US$3.5 million of inventory with Blue Ltd, a US supplier. The goods will be purchased FOB New York. A decision is made to take out a foreign exchange forward-rate contract for US$3.5 million on 1 April 2021 with the Bank in which the Bank agrees to supply Paradise Ltd with US$3.5 million on 1 August 2021. The goods are shipped on 1 June 2021 and are paid for on 1 August 2021. Relevant exchange rates are as follows Spot rate A$1= US$0.92 A$1= US$0.89 A$1= US$0.85 A$1= US$0.88 Date Forward rate 1 April 2021 1 June 2021 30 June 2021 A$1= US$0.89 A$1= US$0.86 A$1= US$0.82 A$1= US$0.88 1 August 2021 Assume that the hedging arrangement satisfies the requirements for hedge accounting as stipulated in AASB 9 'Financial Instruments', and the management of Paradise Ltd adopts Cash flow hedge accounting. Required: (a) Prepare a table showing Gains/losses on the hedging instrument. (b) Provide the journal entries for Paradise Ltd to account for the hedge [Narrations are not required].

Step by Step Solution

★★★★★

3.31 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Solution Step All amount aue in Aus Step 2 a following is the takle showing gain Los...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started