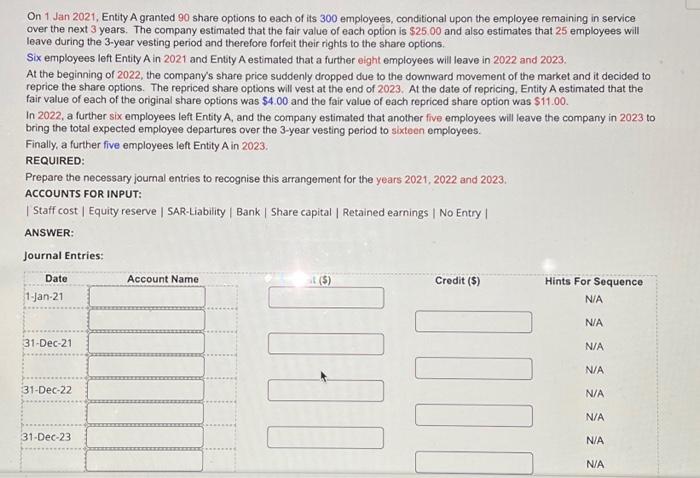

On 1 Jan 2021, Entity A granted 90 share options to each of its 300 employees, conditional upon the employee remaining in service over the next 3 years. The company estimated that the fair value of each option is $25.00 and also estimates that 25 employees will leave during the 3-year vesting period and therefore forfeit their rights to the share options. Six employees left Entity A in 2021 and Entity A estimated that a further eight employees will leave in 2022 and 2023. At the beginning of 2022, the company's share price suddenly dropped due to the downward movement of the market and it decided to reprice the share options. The repriced share options will vest at the end of 2023. At the date of repricing. Entity A estimated that the fair value of each of the original share options was $4.00 and the fair value of each repriced share option was $11.00. In 2022, a further six employees left Entity A, and the company estimated that another five employees will leave the company in 2023 to bring the total expected employee departures over the 3 -year vesting period to sixteen employees. Finally, a further five employees left Entity A in 2023. REQUIRED: Prepare the necessary journal entries to recognise this arrangement for the years 2021, 2022 and 2023. ACCOUNTS FOR INPUT: | Staff cost | Equity reserve | SAR-Liability | Bank | Share capital | Retained earnings | No Entry | ANSWER: On 1 Jan 2021, Entity A granted 90 share options to each of its 300 employees, conditional upon the employee remaining in service over the next 3 years. The company estimated that the fair value of each option is $25.00 and also estimates that 25 employees will leave during the 3-year vesting period and therefore forfeit their rights to the share options. Six employees left Entity A in 2021 and Entity A estimated that a further eight employees will leave in 2022 and 2023. At the beginning of 2022, the company's share price suddenly dropped due to the downward movement of the market and it decided to reprice the share options. The repriced share options will vest at the end of 2023. At the date of repricing. Entity A estimated that the fair value of each of the original share options was $4.00 and the fair value of each repriced share option was $11.00. In 2022, a further six employees left Entity A, and the company estimated that another five employees will leave the company in 2023 to bring the total expected employee departures over the 3 -year vesting period to sixteen employees. Finally, a further five employees left Entity A in 2023. REQUIRED: Prepare the necessary journal entries to recognise this arrangement for the years 2021, 2022 and 2023. ACCOUNTS FOR INPUT: | Staff cost | Equity reserve | SAR-Liability | Bank | Share capital | Retained earnings | No Entry |