On 1 January 2021, Nobleman plc agreed to buy a luxury property in London for 12 million from Aristocrat plc. Contracts were exchanged in June 2021 and over the six-month period from the agreement to the exchange of the contracts, Londons property prices had significantly risen. Belgravia plc sold an identical property for 15 million.

Nonetheless, in order to honour the gentlemens agreement stipulated with the chief executive of Nobleman plc, the director of Aristocrat plc agreed to exchange contracts at the original price of 12 million.

The legal costs to Nobleman plc of buying the property were 120,000 and the selling costs to Aristocrat plc were 180,000.

Nobleman plc estimates that from the ownership of the property they can derive an annuity of 1 million per year for the following 30 years.

The cost of capital is expected to remain constant at 5%.

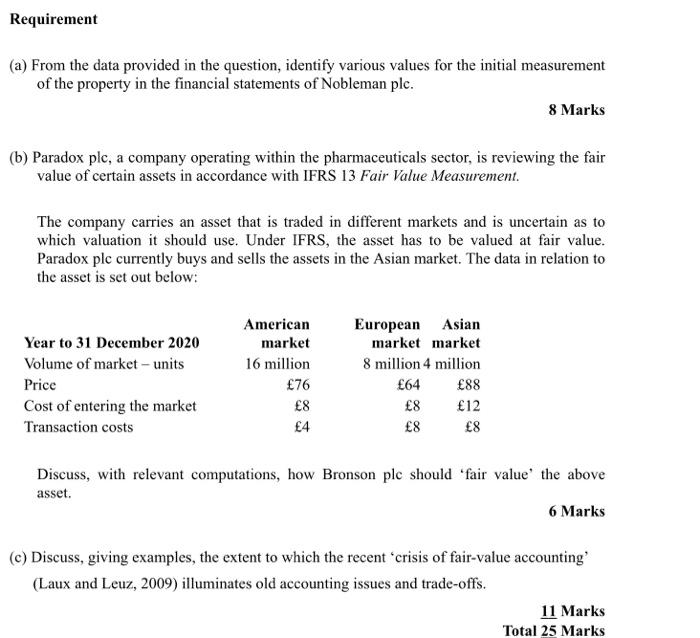

Requirement (a) From the data provided in the question, identify various values for the initial measurement of the property in the financial statements of Nobleman plc. 8 Marks (b) Paradox plc, a company operating within the pharmaceuticals sector, is reviewing the fair value of certain assets in accordance with IFRS 13 Fair Value Measurement. The company carries an asset that is traded in different markets and is uncertain as to which valuation it should use. Under IFRS, the asset has to be valued at fair value. Paradox plc currently buys and sells the assets in the Asian market. The data in relation to the asset is set out below: Year to 31 December 2020 Volume of market - units Price Cost of entering the market Transaction costs American market 16 million 76 8 4 European Asian market market 8 million 4 million 64 88 8 12 8 8 Discuss, with relevant computations, how Bronson plc should 'fair value the above asset. 6 Marks (e) Discuss, giving examples, the extent to which the recent crisis of fair-value accounting (Laux and Leuz, 2009) illuminates old accounting issues and trade-offs. 11 Marks Total 25 Marks Requirement (a) From the data provided in the question, identify various values for the initial measurement of the property in the financial statements of Nobleman plc. 8 Marks (b) Paradox plc, a company operating within the pharmaceuticals sector, is reviewing the fair value of certain assets in accordance with IFRS 13 Fair Value Measurement. The company carries an asset that is traded in different markets and is uncertain as to which valuation it should use. Under IFRS, the asset has to be valued at fair value. Paradox plc currently buys and sells the assets in the Asian market. The data in relation to the asset is set out below: Year to 31 December 2020 Volume of market - units Price Cost of entering the market Transaction costs American market 16 million 76 8 4 European Asian market market 8 million 4 million 64 88 8 12 8 8 Discuss, with relevant computations, how Bronson plc should 'fair value the above asset. 6 Marks (e) Discuss, giving examples, the extent to which the recent crisis of fair-value accounting (Laux and Leuz, 2009) illuminates old accounting issues and trade-offs. 11 Marks Total 25 Marks