Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1 January 2014, Daisy Ltd acquired 80% of the ordinary shares of a subsidiary, Grace Org. Grace Org trades in the currency curls.

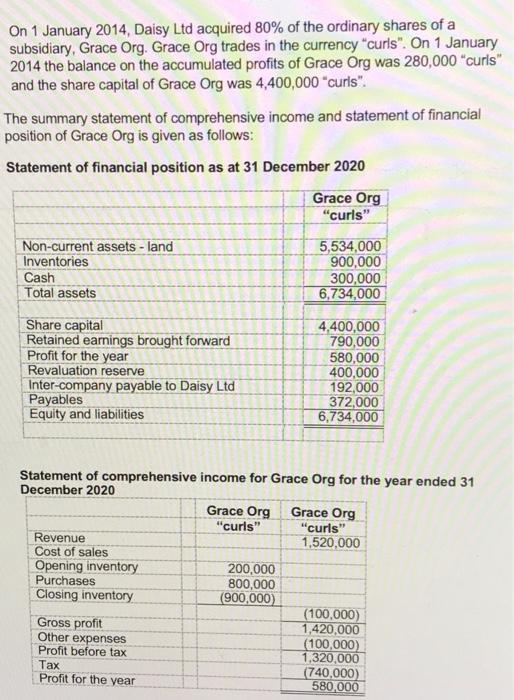

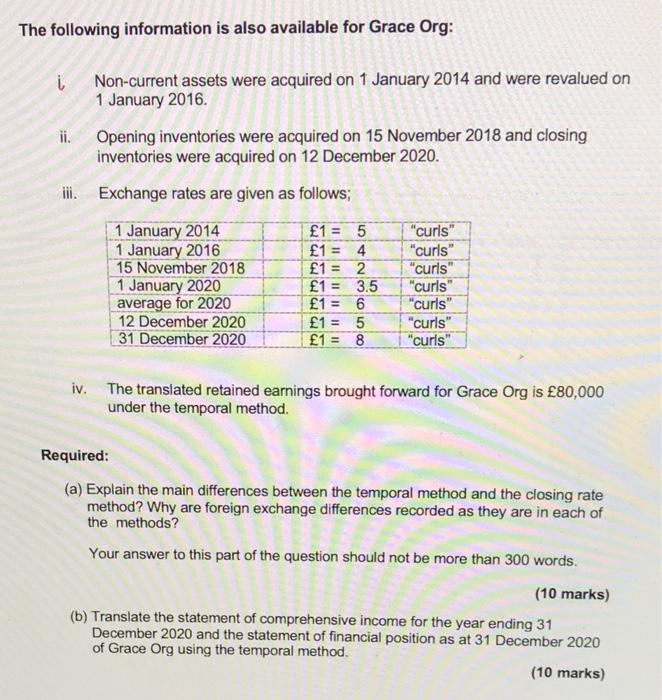

On 1 January 2014, Daisy Ltd acquired 80% of the ordinary shares of a subsidiary, Grace Org. Grace Org trades in the currency "curls". On 1 January 2014 the balance on the accumulated profits of Grace Org was 280,000 "curls" and the share capital of Grace Org was 4,400,000 "curis". The summary statement of comprehensive income and statement of financial position of Grace Org is given as follows: Statement of financial position as at 31 December 2020 Grace Org "curls" Non-current assets - land Inventories Cash Total assets 5,534,000 900,000 300,000 6,734,000 Share capital Retained earnings brought forward Profit for the year Revaluation reserve Inter-company payable to Daisy Ltd Payables Equity and liabilities 4,400,000 790,000 580,000 400,000 192,000 372,000 6,734,000 Statement of comprehensive income for Grace Org for the year ended 31 December 2020 Grace Org Grace Org "curls" 1,520,000 "curls" Revenue Cost of sales Opening inventory Purchases Closing inventory 200,000 800,000 (900,000) Gross profit Other expenses Profit before tax Tax Profit for the year (100,000) 1,420,000 (100,000) 1,320,000 (740,000) 580,000 The following information is also available for Grace Org: Non-current assets were acquired on 1 January 2014 and were revalued on 1 January 2016. Opening inventories were acquired on 15 November 2018 and closing inventories were acquired on 12 December 2020. ii. Exchange rates are given as follows; 1 January 2014 1 January 2016 15 November 2018 1 January 2020 average for 2020 12 December 2020 31 December 2020 "curls" "curls" "curls" "curls" "curls" "curls" "curls" 1 = 5 1 = 4 1 = 1 = 3.5 1 = 6 1 = 5 1 = 8 %3D %3D iv. The translated retained earnings brought forward for Grace Org is 80,000 under the temporal method. Required: (a) Explain the main differences between the temporal method and the closing rate method? Why are foreign exchange differences recorded as they are in each of the methods? Your answer to this part of the question should not be more than 300 words. (10 marks) (b) Translate the statement of comprehensive income for the year ending 31 December 2020 and the statement of financial position as at 31 December 2020 of Grace Org using the temporal method. (10 marks)

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started