Question

On 1 January 2015, Briggs Ltd acquired 100% control of Stratton Ltd for a payment of $4,500,000. The fair values of Stratton Ltds identifiable net

On 1 January 2015, Briggs Ltd acquired 100% control of Stratton Ltd for a payment of $4,500,000. The fair values of Stratton Ltd’s identifiable net assets at that date were represented by the following balances:

Share Capital | $ 3,500,000 |

Asset Revaluation Reserve | 125,000 |

Retained Earnings | 435,000 |

Total Shareholders’ Funds | $ 4,060,000 |

The following transactions occurred during the year ended 31 December 2020:

- Stratton Ltd paid dividends during the year of $200,000, all from post- acquisition profits.

- Sales from Briggs Ltd to Stratton Ltd during the year totalled $485,000. The goods sold had cost Briggs Ltd $330,000. At balance date, 20% of these were still in Stratton Ltd’s inventory.

- The $125,000 loan from Stratton Ltd to Briggs Ltd is at an interest rate of 5%; interest has been fully recorded for the year in each company’s records.

- On 01/07/2020, Stratton Ltd purchased equipment from Briggs Ltd for $85,000. This equipment had originally been purchased by Briggs Ltd on 01/01/2016 for $125,000. Both Stratton and Briggs follow IRD rules in only recording part-year depreciation on purchases; they do not record part-year depreciation prior to disposals.

- Goodwill is assessed as impaired by 12% as at 31/12/2020. Assume this does not qualify for any tax adjustment.

Stratton Ltd depreciates equipment at 15% diminishing value; Briggs Ltd depreciates equipment at 10% straight line. Both normally assume a zero residual value for depreciation of their assets.

Assume a company tax rate of 28%, and round all amounts to whole dollars.

Both companies have a 31 December balance date.

Required:

(a) Prepare the necessary consolidation journal entries, for the Briggs Ltd and Stratton Ltd entity, for the year ending 31/12/2020. Include tax effect entries where appropriate. Remember in this case we assume goodwill does not qualify for a tax adjustment. Round all figures to whole dollars.

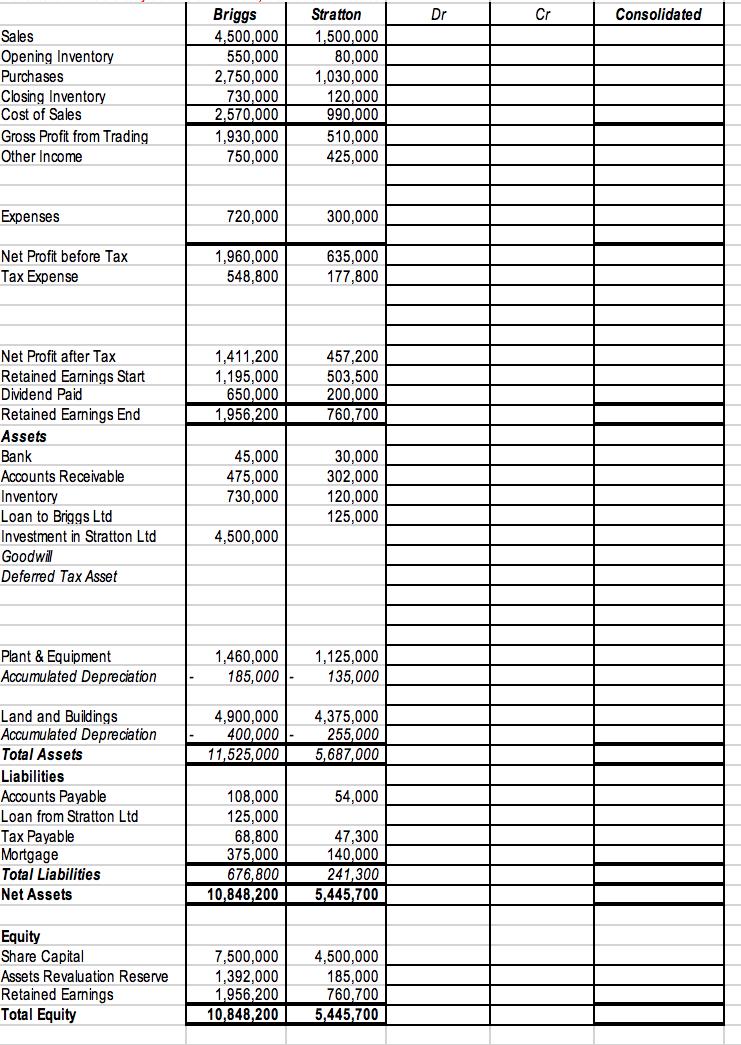

(b) Complete the worksheet for Briggs-Stratton’s consolidated accounts. Use the worksheet provided.

Sales Opening Inventory Purchases Closing Inventory Cost of Sales Gross Profit from Trading Other Income Expenses Net Profit before Tax Tax Expense Net Profit after Tax Retained Earnings Start Dividend Paid Retained Earnings End Assets Bank Accounts Receivable Inventory Loan to Briggs Ltd Investment in Stratton Ltd Goodwill Deferred Tax Asset Plant & Equipment Accumulated Depreciation Land and Buildings Accumulated Depreciation Total Assets Liabilities Accounts Payable Loan from Stratton Ltd Tax Payable Mortgage Total Liabilities Net Assets Equity Share Capital Assets Revaluation Reserve Retained Earnings Total Equity Briggs 4,500,000 550,000 2,750,000 730,000 2,570,000 1,930,000 750,000 720,000 1,960,000 548,800 1,411,200 1,195,000 650,000 1,956,200 45,000 475,000 730,000 4,500,000 1,460,000 185,000- 4,900,000 400,000 11,525,000 108,000 125,000 68,800 375,000 676,80 10,848,200 Stratton 1,500,000 80,000 1,030,000 120,000 990,000 510,000 425,000 300,000 635,000 177,800 457,200 503,500 200,000 760,700 30,000 302,000 120,000 125,000 1,125,000 135,000 4,375,000 255,000 5,687,000 54,000 47,300 140,000 241,300 5,445,700 4,500,000 185,000 760,700 7,500,000 1,392,000 1,956,200 10,848,200 5,445,700 Dr Cr Consolidated

Step by Step Solution

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Briggs Ltd Consolidation Journal Entries 1 January 2020 Share Capital 3500000 Asset Revaluation Reserve 125000 Retained Earnings 435000 Total Shareholders Funds 4060000 1 January 2020 Acquire 100 cont...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started