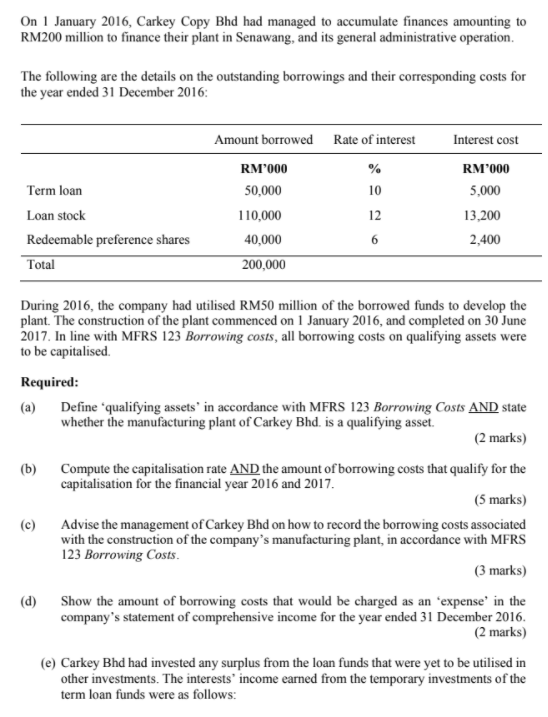

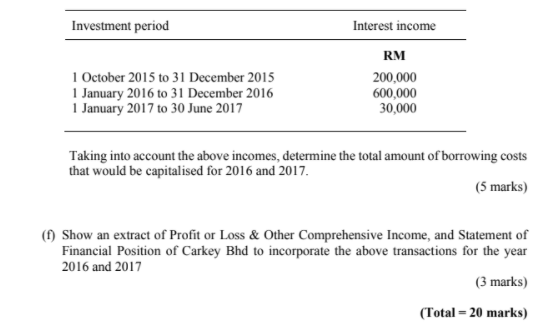

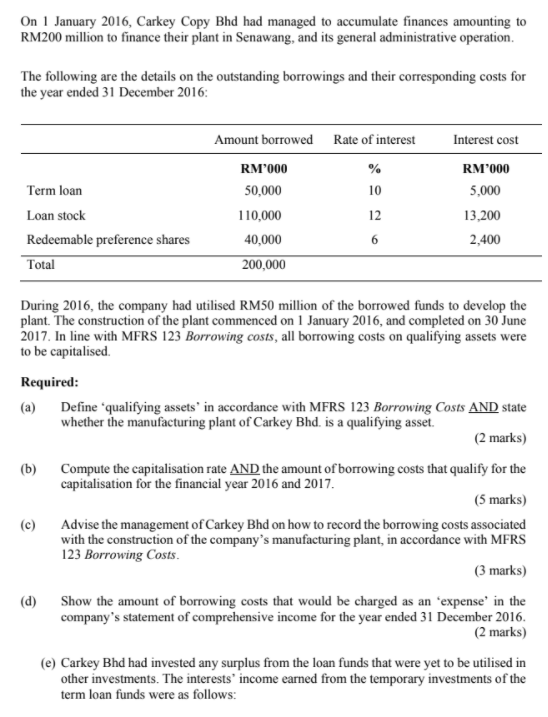

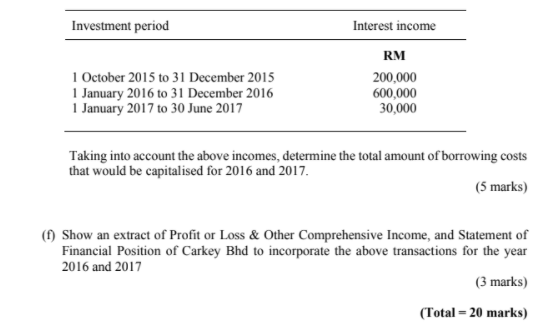

On 1 January 2016, Carkey Copy Bhd had managed to accumulate finances amounting to RM200 million to finance their plant in Senawang, and its general administrative operation. The following are the details on the outstanding borrowings and their corresponding costs for the year ended 31 December 2016: Term loan Loan stock Redeemable preference shares Total Amount borrowed Rate of interest RM'000 50,000 10 110,000 12 40,000 200,000 Interest cost RM'000 5,000 13,200 2,400 6 During 2016, the company had utilised RM50 million of the borrowed funds to develop the plant. The construction of the plant commenced on 1 January 2016, and completed on 30 June 2017. In line with MFRS 123 Borrowing costs, all borrowing costs on qualifying assets were to be capitalised Required: (a) Define qualifying assets in accordance with MFRS 123 Borrowing Costs AND state whether the manufacturing plant of Carkey Bhd. is a qualifying asset. (2 marks) (b) Compute the capitalisation rate AND the amount of borrowing costs that qualify for the capitalisation for the financial year 2016 and 2017. (5 marks) (c) Advise the management of Carkey Bhd on how to record the borrowing costs associated with the construction of the company's manufacturing plant, in accordance with MFRS 123 Borrowing Costs. (3 marks) (d) Show the amount of borrowing costs that would be charged as an expense' in the company's statement of comprehensive income for the year ended 31 December 2016. (2 marks) (e) Carkey Bhd had invested any surplus from the loan funds that were yet to be utilised in other investments. The interests' income earned from the temporary investments of the term loan funds were as follows: Investment period Interest income RM 1 October 2015 to 31 December 2015 1 January 2016 to 31 December 2016 1 January 2017 to 30 June 2017 200,000 600,000 30,000 Taking into account the above incomes, determine the total amount of borrowing costs that would be capitalised for 2016 and 2017. (5 marks) (1) Show an extract of Profit or Loss & Other Comprehensive Income, and Statement of Financial Position of Carkey Bhd to incorporate the above transactions for the year 2016 and 2017 (3 marks) (Total = 20 marks)