Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1 January 2018, Blue Bhd acquired 80% interest in Klise Bhd for a cash consideration of RM20 million. On the date of acquisition,

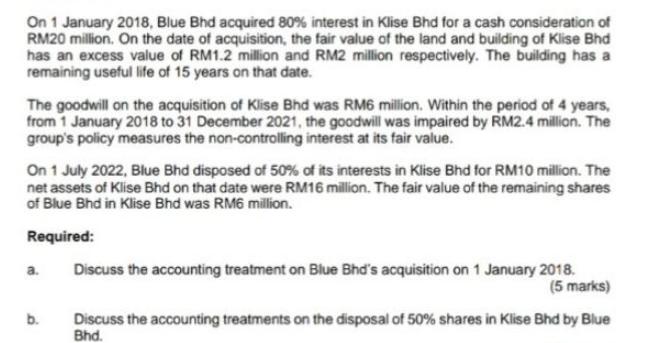

On 1 January 2018, Blue Bhd acquired 80% interest in Klise Bhd for a cash consideration of RM20 million. On the date of acquisition, the fair value of the land and building of Klise Bhd has an excess value of RM1.2 million and RM2 million respectively. The building has a remaining useful life of 15 years on that date. The goodwill on the acquisition of Klise Bhd was RM6 million. Within the period of 4 years, from 1 January 2018 to 31 December 2021, the goodwill was impaired by RM2.4 million. The group's policy measures the non-controlling interest at its fair value. On 1 July 2022, Blue Bhd disposed of 50% of its interests in Klise Bhd for RM10 million. The net assets of Klise Bhd on that date were RM16 million. The fair value of the remaining shares of Blue Bhd in Klise Bhd was RM6 million. Required: a. b. Discuss the accounting treatment on Blue Bhd's acquisition on 1 January 2018. (5 marks) Discuss the accounting treatments on the disposal of 50% shares in Klise Bhd by Blue Bhd.

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a On 1 January 2018 Blue Bhd acquired 80 interest in Klise Bhd for a cash consideration of RM20 mill...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started