Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1 January 2019 Detergent company acquired 75% of Latrine company's equity shares by means of an exchange of 2 shares in Detergent for

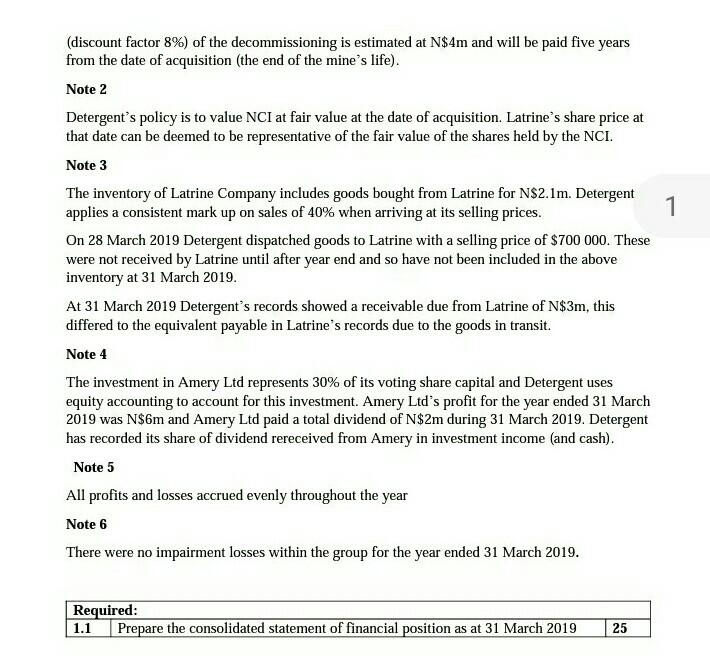

On 1 January 2019 Detergent company acquired 75% of Latrine company's equity shares by means of an exchange of 2 shares in Detergent for every 3 shares acquired in Latrine. On that date, further consideration was also issued to the shareholders of Latrine in the form of $100 8% loan notes for every 100 shares acquired in Latrine. None of the purchase consideration nor the outstanding interest on the loan notes at 31 March 2019 has yet been recorded by Detergent. At date of acquisition the share price of Detergent and Latrine's share is N$3,20 and N$1,80 respectively. The summarized statements of financial position of the two companies as at 31 March 2019 are: N$"000" NS 000" Assets Non-Current assets PPE (note 1) Investment in (Amerson Ltd) (note 4) 75 200 31 500 4 500 79 700 31 500 Current assets 35 300 31 900 Inventory (note 3) Trade receivables bank Total assets Equity and Liabilities Equity Equity shares of $1 each Retained earnings (01 April 2018) (@31 March 2019) 18 800 12 500 600 19 400 14 700 1 200 115 000 63 400 20 000 19 000 50 000 20 000 16 000 8 000 86000 47 000 Non-Current liabilities 8% loan notes Current liabilities Total equity and liabilities 29 000 5 000 24 000 115 000 16 400 Nil 16 400 63 400 The following information is relevant: Note 1 At the date of acquisitionthe fair values of Latrine's assets were equal to their carrying amounts. However Latrine operates amine which requires to be decommissioned in five years' time. No provisions have been made for these decommissioning costs by Latrine. The present value (discount factor 8%) of the decommissioning is estimated at N$4m and will be paid five years from the date of acquisition (the end of the mine's life). Note 2 Detergent's policy is to value NCI at fair value at the date of acquisition. Latrine's share price at that date can be deemed to be representative of the fair value of the shares held by the NCI. Note 3 The inventory of Latrine Company includes goods bought from Latrine for N$2.1m. Detergent applies a consistent mark up on sales of 40% when arriving at its selling prices. 1 On 28 March 2019 Detergent dispatched goods to Latrine with a selling price of $700 000. These were not received by Latrine until after year end and so have not been included in the above inventory at 31 March 2019. At 31 March 2019 Detergent's records showed a receivable due from Latrine of N$3m, this differed to the equivalent payable in Latrine's records due to the goods in transit. Note 4 The investment in Amery Ltd represents 30% of its voting share capital and Detergent uses equity accounting to account for this investment. Amery Ltd's profit for the year ended 31 March 2019 was N$6m and Amery Ltd paid a total dividend of N$2m during 31 March 2019. Detergent has recorded its share of dividend rereceived from Amery in investment income (and cash). Note 5 All profits and losses accrued evenly throughout the year Note 6 There were no impairment losses within the group for the year ended 31 March 2019. Required: Prepare the consolidated statement of financial position as at 31 March 2019 1.1 25

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Consolldated SOFP As at 31 March 2019 S 00 Property Plant ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started