Answered step by step

Verified Expert Solution

Question

1 Approved Answer

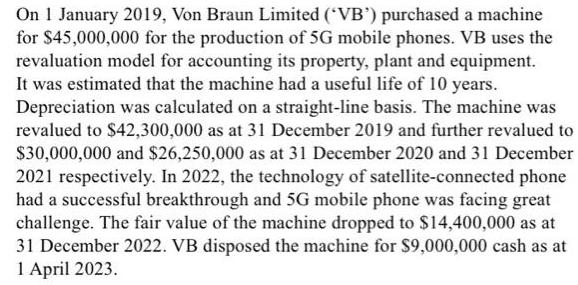

On 1 January 2019, Von Braun Limited (VB') purchased a machine for $45,000,000 for the production of 5G mobile phones. VB uses the revaluation

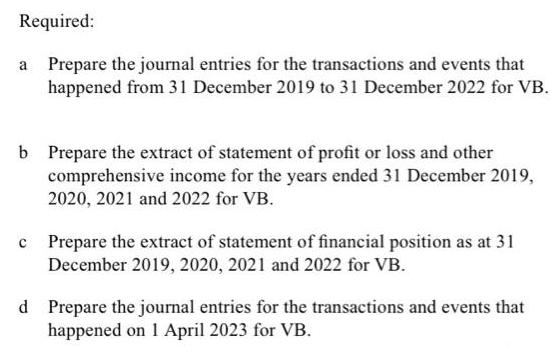

On 1 January 2019, Von Braun Limited (VB') purchased a machine for $45,000,000 for the production of 5G mobile phones. VB uses the revaluation model for accounting its property, plant and equipment. It was estimated that the machine had a useful life of 10 years. Depreciation was calculated on a straight-line basis. The machine was revalued to $42,300,000 as at 31 December 2019 and further revalued to $30,000,000 and $26,250,000 as at 31 December 2020 and 31 December 2021 respectively. In 2022, the technology of satellite-connected phone had a successful breakthrough and 5G mobile phone was facing great challenge. The fair value of the machine dropped to $14,400,000 as at 31 December 2022. VB disposed the machine for $9,000,000 cash as at 1 April 2023. Required: a Prepare the journal entries for the transactions and events that happened from 31 December 2019 to 31 December 2022 for VB. b Prepare the extract of statement of profit or loss and other comprehensive income for the years ended 31 December 2019, 2020, 2021 and 2022 for VB. c Prepare the extract of statement of financial position as at 31 December 2019, 2020, 2021 and 2022 for VB. d Prepare the journal entries for the transactions and events that happened on 1 April 2023 for VB.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Journal entries for transactions and events from 31 December 2019 to 31 December 2022 for VB 1 Revaluation on 31 December 2019 Machine Revaluation R...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started