Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1 January 2020, Grateful Industries Limited (GIL) completed installation of a plant which will be required to be dismantled at the end of

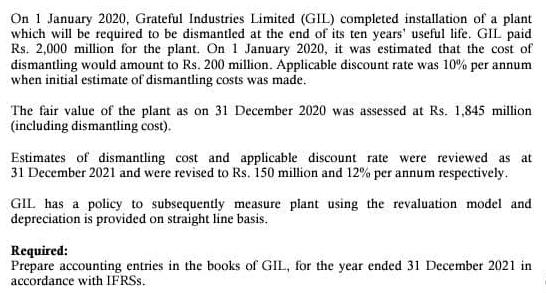

On 1 January 2020, Grateful Industries Limited (GIL) completed installation of a plant which will be required to be dismantled at the end of its ten years' useful life. GIL paid Rs. 2,000 million for the plant. On 1 January 2020, it was estimated that the cost of dismantling would amount to Rs. 200 million. Applicable discount rate was 10% per annum when initial estimate of dismantling costs was made. The fair value of the plant as on 31 December 2020 was assessed at Rs. 1,845 million (including dismantling cost). Estimates of dismantling cost and applicable discount rate were reviewed as at 31 December 2021 and were revised to Rs. 150 million and 12% per annum respectively. GIL has a policy to subsequently measure plant using the revaluation model and depreciation is provided on straight line basis. Required: Prepare accounting entries in the books of GIL, for the year ended 31 December 2021 in accordance with IFRSs.

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To prepare the accounting entries for Grateful Industries Limited GIL for the year ended 31 December 2021 we need to account for several events 1 Depreciation of the plant for the year 2021 2 Revision ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started