Answered step by step

Verified Expert Solution

Question

1 Approved Answer

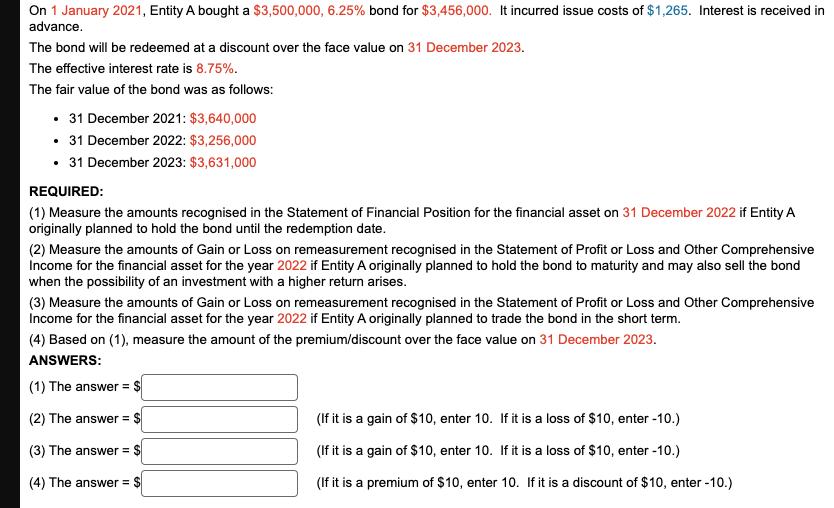

On 1 January 2021, Entity A bought a $3,500,000, 6.25% bond for $3,456,000. It incurred issue costs of $1,265. Interest is received in advance.

On 1 January 2021, Entity A bought a $3,500,000, 6.25% bond for $3,456,000. It incurred issue costs of $1,265. Interest is received in advance. The bond will be redeemed at a discount over the face value on 31 December 2023. The effective interest rate is 8.75%. The fair value of the bond was as follows: . 31 December 2021: $3,640,000 31 December 2022: $3,256,000 31 December 2023: $3,631,000 REQUIRED: (1) Measure the amounts recognised in the Statement of Financial Position for the financial asset on 31 December 2022 if Entity A originally planned to hold the bond until the redemption date. (2) Measure the amounts of Gain or Loss on remeasurement recognised in the Statement of Profit or Loss and Other Comprehensive Income for the financial asset for the year 2022 if Entity A originally planned to hold the bond to maturity and may also sell the bond when the possibility of an investment with a higher return arises. (3) Measure the amounts of Gain or Loss on remeasurement recognised in the Statement of Profit or Loss and Other Comprehensive Income for the financial asset for the year 2022 if Entity A originally planned to trade the bond in the short term. (4) Based on (1), measure the amount of the premium/discount over the face value on 31 December 2023. ANSWERS: (1) The answer= (2) The answer= (3) The answer = $ (4) The answer = $ (If it is a gain of $10, enter 10. If it is a loss of $10, enter -10.) (If it is a gain of $10, enter 10. If it is a loss of $10, enter -10.) (If it is a premium of $10, enter 10. If it is a discount of $10, enter -10.) On 1 January 2021, Entity A bought a $3,500,000, 6.25% bond for $3,456,000. It incurred issue costs of $1,265. Interest is received in advance. The bond will be redeemed at a discount over the face value on 31 December 2023. The effective interest rate is 8.75%. The fair value of the bond was as follows: . 31 December 2021: $3,640,000 31 December 2022: $3,256,000 31 December 2023: $3,631,000 REQUIRED: (1) Measure the amounts recognised in the Statement of Financial Position for the financial asset on 31 December 2022 if Entity A originally planned to hold the bond until the redemption date. (2) Measure the amounts of Gain or Loss on remeasurement recognised in the Statement of Profit or Loss and Other Comprehensive Income for the financial asset for the year 2022 if Entity A originally planned to hold the bond to maturity and may also sell the bond when the possibility of an investment with a higher return arises. (3) Measure the amounts of Gain or Loss on remeasurement recognised in the Statement of Profit or Loss and Other Comprehensive Income for the financial asset for the year 2022 if Entity A originally planned to trade the bond in the short term. (4) Based on (1), measure the amount of the premium/discount over the face value on 31 December 2023. ANSWERS: (1) The answer= (2) The answer= (3) The answer = $ (4) The answer = $ (If it is a gain of $10, enter 10. If it is a loss of $10, enter -10.) (If it is a gain of $10, enter 10. If it is a loss of $10, enter -10.) (If it is a premium of $10, enter 10. If it is a discount of $10, enter -10.)

Step by Step Solution

★★★★★

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

ANSWERS To answer the questions we need to calculate the carrying amount of the bond on December 31 2022 and determine the gain or loss on remeasurement for different scenarios Lets calculate the amou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started