Question

On 1 January 2021, Hayden, Inc., purchased 80% of the common stock of Rossi Manufacturing Company for $6,100,000; the value of the noncontrolling interest on

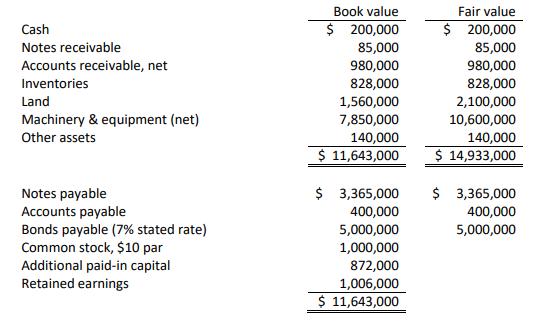

On 1 January 2021, Hayden, Inc., purchased 80% of the common stock of Rossi Manufacturing Company for $6,100,000; the value of the noncontrolling interest on that date was $1,240,000. At the date of purchase the book and fair values of Rossi’s assets and liabilities were as follows:

In addition, the following information is available for this business combination:

In addition, the following information is available for this business combination:

• On 1 January 2022, Hayden purchased $1,500,000 par value of Rossi’s 7% bonds for 102. These bonds mature in six years on 31 December, with interest payable annually on 31 December. All companies use the straight-line method to amortize any discounts or premiums.

• As of the acquisition date, the machinery and equipment had an estimated remaining life of six years. All companies use the straight-line method of depreciation.

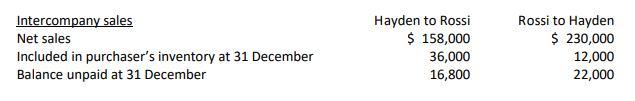

• During 2023, the following intercompany transactions occurred between Hayden and Rossi:

Hayden sells merchandise to Rossi at cost. Rossi sells merchandise to Hayden at regular selling price including a normal gross profit margin of 35%. There were no intercompany sales between the two companies prior to the current year.

Hayden sells merchandise to Rossi at cost. Rossi sells merchandise to Hayden at regular selling price including a normal gross profit margin of 35%. There were no intercompany sales between the two companies prior to the current year.

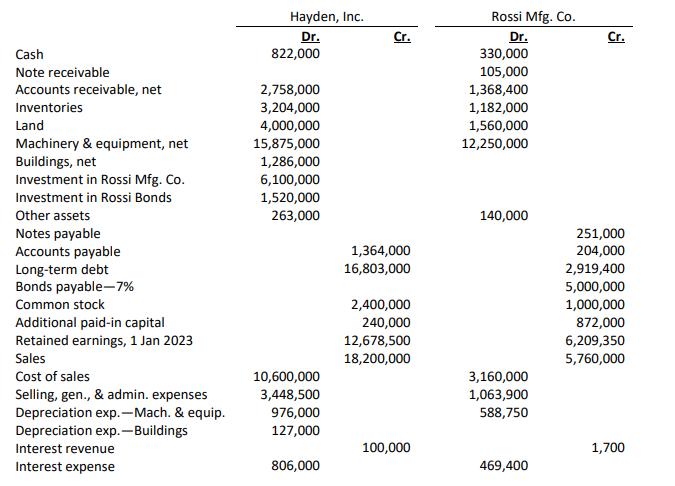

• Adjusted trial balance figures for Hayden and Rossi for 2023 are shown on the following page. Round all computations to the nearest dollar. Ignore income taxes.

Required: Prepare a consolidation worksheet and the appropriate eliminating entries to determine consolidated balances for external financial reporting as of 31 December 2023. You will earn credit for this problem by (1) journalizing the correct consolidating entries, and (2) computing the correct consolidated balances for each line item on the financial statements (including the income to the noncontrolling interest).

Required: Prepare a consolidation worksheet and the appropriate eliminating entries to determine consolidated balances for external financial reporting as of 31 December 2023. You will earn credit for this problem by (1) journalizing the correct consolidating entries, and (2) computing the correct consolidated balances for each line item on the financial statements (including the income to the noncontrolling interest).

Cash Notes receivable Accounts receivable, net Inventories Land Machinery & equipment (net) Other assets Notes payable Accounts payable Bonds payable (7% stated rate) Common stock, $10 par Additional paid-in capital Retained earnings Book value $ 200,000 85,000 980,000 828,000 1,560,000 7,850,000 140,000 $ 11,643,000 $ 3,365,000 400,000 5,000,000 1,000,000 872,000 1,006,000 $ 11,643,000 Fair value $ 200,000 85,000 980,000 828,000 2,100,000 10,600,000 140,000 $ 14,933,000 $ 3,365,000 400,000 5,000,000 Intercompany sales Net sales Included in purchaser s inventory at 31 December Balance unpaid at 31 December Hayden to Rossi $ 158,000 36,000 16,800 Rossi to Hayden $ 230,000 12,000 22,000 Cash Note receivable Accounts receivable, net Inventories Land Machinery & equipment, net Buildings, net Investment in Rossi Mfg. Co. Investment in Rossi Bonds Other assets Notes payable Accounts payable Long-term debt Bonds payable-7% Common stock Additional paid-in capital Retained earnings, 1 Jan 2023 Sales Cost of sales Selling, gen., & admin. expenses Depreciation exp.-Mach. & equip. Depreciation exp.-Buildings Interest revenue Interest expense Hayden, Inc. Dr. 822,000 2,758,000 3,204,000 4,000,000 15,875,000 1,286,000 6,100,000 1,520,000 263,000 10,600,000 3,448,500 976,000 127,000 806,000 Cr. 1,364,000 16,803,000 2,400,000 240,000 12,678,500 18,200,000 100,000 Rossi Mfg.Co. Dr. 330,000 105,000 1,368,400 1,182,000 1,560,000 12,250,000 140,000 3,160,000 1,063,900 588,750 469,400 Cr. 251,000 204,000 2,919,400 5,000,000 1,000,000 872,000 6,209,350 5,760,000 1,700

Step by Step Solution

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Consolidation work sheet Particulars Hyden Inc Rossi Mfg co Eliminations Non controlling interest Co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 1 attachment)

60e4185268752_811811.xlsx

300 KBs Excel File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started